Last month’s review of return correlations highlighted the challenge of finding strong diversification opportunities among the major asset classes for designing and managing portfolios. Does the landscape offer better choices if we expand the opportunity set by adding alternative strategies to the mix?

Continue reading

Macro Briefing: 4 April 2018

US lays out plans for tariffs on 1,300 Chinese goods: CNBC

China vows to retaliate on US tariffs with “measures of equal intensity”: Reuters

Japan ponders upcoming meeting with Trump as trade-war risk rises: Reuters

Trump says he’ll send military to secure US-Mexico border: NY Times

Senior China diplomat offers support N. Korea-S.Korea-US summit: AP

Russia, Iran and Turkey meet to discuss Syria: Reuters

San Francisco Fed President named to lead NY Fed: Politico

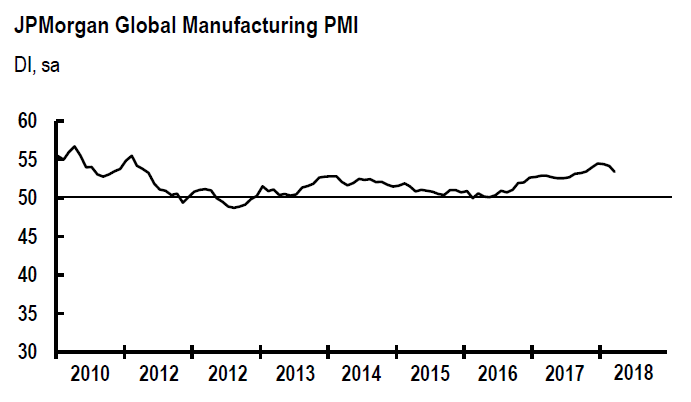

Global mfg growth slows to five-month low in March: IHS Markit

Does The Stock Market’s Slide Signal Regime Shift?

This much is clear: the sharp decline in the S&P 500 yesterday (April 2) confirms that the downside bias in the first three months of the year has spilled over into the second quarter. It’s also obvious that the latest market stumble has inspired a new round of warnings from analysts.

Continue reading

Macro Briefing: 3 April 2018

Wall Street falls sharply amid tech and trade-war concerns: Reuters

Korea expert recommends cancelling Trump-Kim meeting: CNBC

US ISM Mfg Index edged down to still-strong 59.3 for March: MarketWatch

US Mfg PMI rose to 3-year high in March: IHS Markit

Construction spending in US posted a weak 0.1% gain in February: Reuters

Eurozone mfg sentiment still positive in Mar, but eased to 8-month low: IHS Markit

German retail spending fell for third month in February: Reuters

Fed funds futures predicting no change in rates at FOMC meeting in May: CME

US visitor visas fall 13% over past year: Politico

Major Asset Classes | March 2018 | Performance Review

The major asset classes delivered mixed performances in March. Stocks in the US and foreign markets fell while US real estate investment trusts (REITs) and foreign inflation-linked government bonds posted the strongest gains.

Continue reading

Macro Briefing: 2 April 2018

China imposes tariffs on a range of US goods: Wall St Journal

Trump: US may leave NAFTA unless Mexico tightens border security: Bloomberg

Israel faces new military and political challenges after deadly clash in Gaza: WSJ

Deadly clashes erupt in Kashmir between Indian army and militants: BBC

Tariff war threatens US farm economy, a Trump stronghold: NY Times

Guidelines for estimating which countries are at risk in a trade war: ETF Trends

Sentiment in China’s mfg sector dips to 4-mo low in March: IHS Markit

Tech firms brace for new European Union privacy law: The Hill

US stock market’s Q1 close is near lowest level for quarter: MarketWatch

Book Bits | 31 March 2018

● Advice and Dissent: Why America Suffers When Economics and Politics Collide

By Alan Blinder

Interview with author via MarketPlace.org

When it comes to fiscal policy, it might seem like politicians and economists would work in lockstep. But in many cases, the politics come first — and that tends to lead to policies with not-so-sound data backing it up. And according to Princeton economics professor Alan Blinder, the fault might lie with economists as much as it does with politicians. In his new book, “Advice and Dissent: Why America Suffers When Politics and Economics Collide,” Blinder sets out to explore the troubled relationship between politicians and economists — and offer some solutions. Marketplace host Kai Ryssdal spoke with Blinder about his book.

Continue reading

Research Review | 30 March 2018 | Portfolio Analysis

Factor Momentum

Robert D. Arnott (Research Affiliates), et al.

January 31, 2018

Past industry returns predict the cross section of industry returns, and this predictability is at its strongest at the one-month horizon (Moskowitz and Grinblatt 1999). We show that the cross section of factor returns shares this property, and that industry momentum stems from factor momentum. Factor momentum is transmitted into the cross section of industry returns via variation in industries’ factor loadings. Momentum in industry-neutral factors spans industry momentum; factor momentum is therefore not a by-product of industry momentum. Factor momentum is a pervasive property of all factors; we show that factor momentum can be captured by trading almost any set of factors. Factor momentum does not resolve the puzzle of momentum in individual stock returns; it significantly deepens this puzzle.

Continue reading

Macro Briefing: 30 March 2018

Russia orders 60 US diplomats out of country: Reuters

US consumer spending growth lagged income rise for 2nd month: Bloomberg

Consumer Sentiment Index for US advances to highest level since 2004: CNBC

Jobless claims in US fall to lowest level since 1973: MarketWatch

Sentiment reading for the Chicago PMI decreases to 12-mo low: Chicago PMI

Global mergers and acquisitions rise to record high in Q1: Reuters

VIX Index shows US equity market’s volatility nearly doubles in Q1: Bloomberg

Recent slide in big tech stocks has disproportionate effect on broad market: WSJ

10-Year/2-Year Treasury Yield Spread Falls Below 50 Basis Points

Two Federal Reserve officials have recently dismissed it. But a research note published this month by the San Francisco Fed paper advises that the yield curve is still a relevant economic signal for monitoring the business cycle. The disparate views within the central bank arise as the yield difference between the 10-year and 2-year rates continue to plumb new post-recession lows.

Continue reading