Stocks in emerging markets blasted out of the gate for the start of 2018, once again posting the strongest monthly gain for the major asset classes. Overall, most markets advanced in January, with three exceptions: US real estate trusts (REITs), which suffered the biggest loss last month, along with modest declines in US investment-grade bonds and inflation-indexed Treasuries.

Continue reading

Macro Briefing: 1 February 2018

Feud between Trump and FBI erupts into open battle: WaPo

White House seeks big cut in clean energy funding at Energy Dept: The Hill

Former Fed Chair Greenspan warns of bubbles in stocks and bonds: Bloomberg

Fed leaves rates unchange; expects higher inflation in 2018: Reuters

ADP: US private payrolls rose 234k in Dec, sharply above expectations: CNBC

Pending home sales rise 0.5%, the most since March: MarketWatch

Chicago PMI eased in Jan, pulling back from 9-year high: MarketWatch

US Employment Cost Index posts solid rise in 2017’s Q4: Reuters

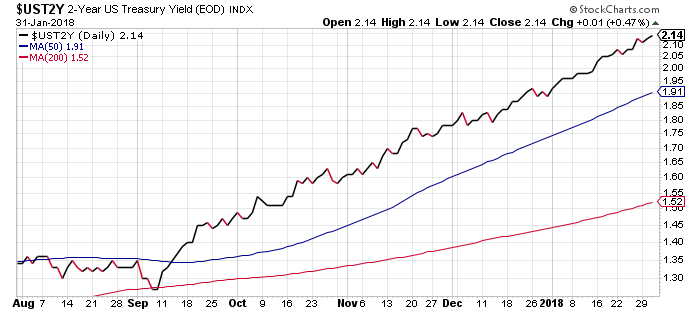

2-year Treasury yield’s bull streak continues, rising to 2.14%, a new 10yr high:

ADP: US Payrolls Post Healthy Rise In January

Corporate payrolls increased by a robust 234,000 in January, according to this morning’s ADP Employment Report. The gain is slightly below December’s 242,000, although both numbers point to a solid rate of expansion in the labor market. Taking today’s update at face value points to a better-than-expected advance in Friday’s official employment report that’s due from the Labor Department. The mystery is why the government’s data to date has been trailing ADP’s estimates by a comparatively wide margin. Will the upcoming report from Washington close the gap? Or has the ADP data been overestimating the strength of the economy’s record on minting new jobs?

Continue reading

The Capital Spectator Named A Top Economics & Finance Blog

Focus Economics, a consultancy that specializes in slicing, dicing and otherwise aggregating forecasts from various sources, rolled out its annual short list of “top blogs” in economics and finance for 2018 and The Capital Spectator made the grade. It’s a high honor, considering the prestigious roster of sites — 101 in all — that we’re rubbing shoulders with. Happy reading!

Is The Momentum Factor Relevant For Bonds?

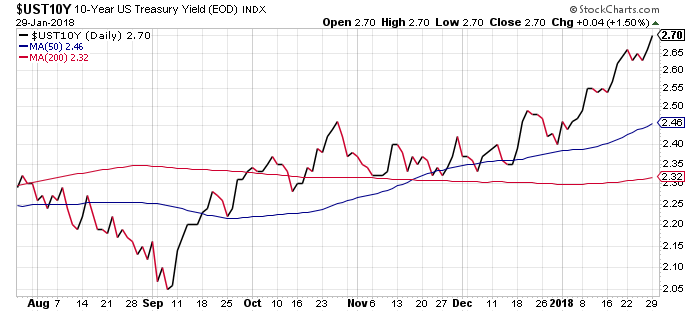

The question has gone viral lately, courtesy of the recent rise in interest rates. The benchmark 10-year Treasury yield, for instance, edged up to 2.73% yesterday, the highest in nearly four years. The 2-year rate’s ascent has been even stronger, rising to a 10-year high on Tuesday.

Continue reading

Macro Briefing: 31 January 2018

Trump links presidency to US prosperity in State of the Union speech: Bloomberg

Five key takeaways in Trump’s State of the Union speech: The Hill

Fed on track to leave rates unchanged in Yellen’s last meeting as chair: Reuters

N. Korea expected to parade missiles ahead of Winter Olympics in S. Korea: CNN

Is Amazon’s entry into healthcare space a step to reordering industry? Bloomberg

US Consumer Confidence Index rises in Dec, close to 18-year high: CNBC

Case-Shiller index: US home prices rise 6.2% in Nov vs year-ago level: USA Today

Should int’l investors show more respect (fear) for forex risk? The Economist

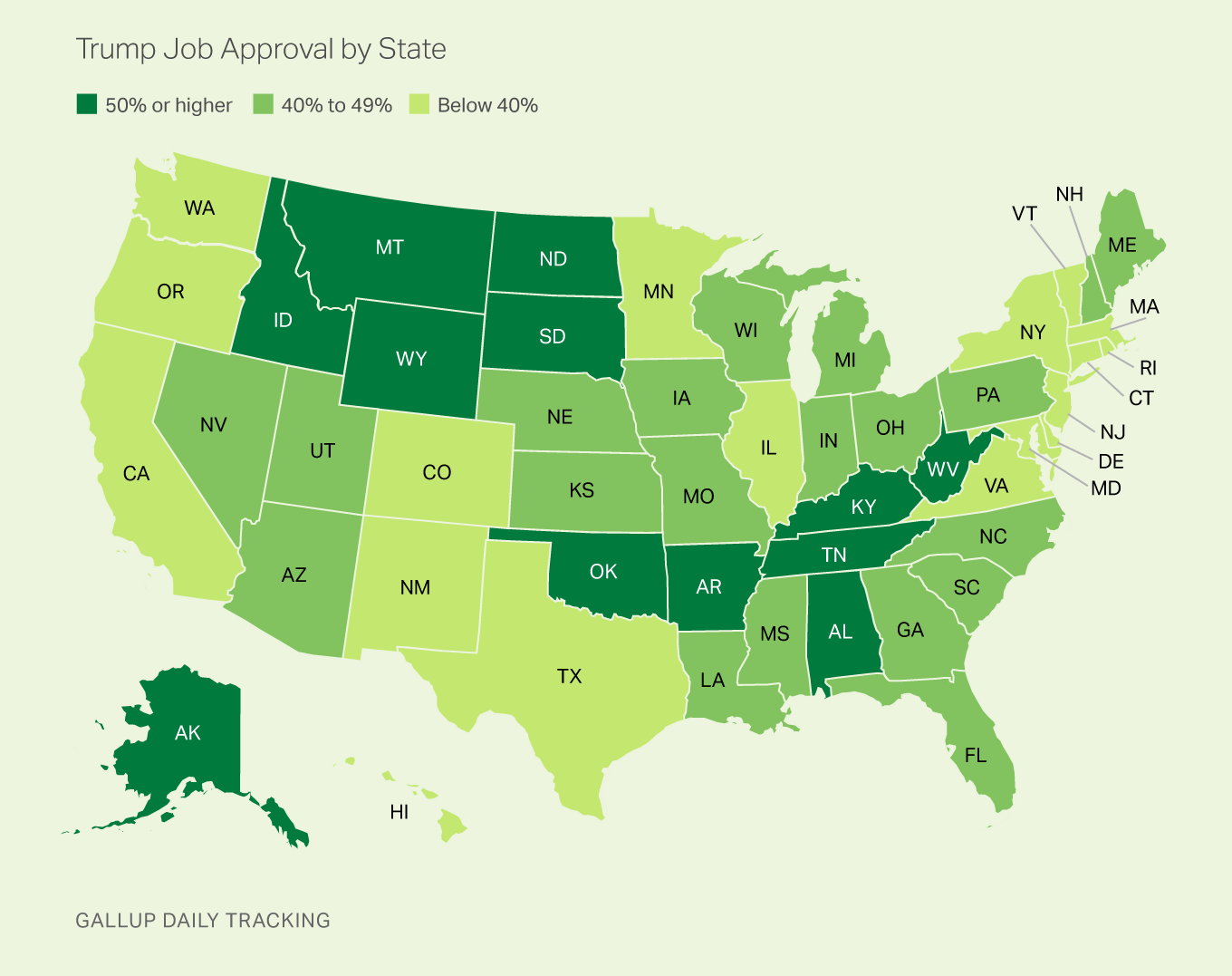

Trump’s approval by state — West Virginia leads, Vermont lags: Gallup

Will Economic Data Support The Recent Rise In The 10-Year Yield?

The benchmark 10-year rate yesterday (Jan. 30) jumped to 2.70% for the first time since 2014, based on daily data via Treasury.gov. One of the catalysts is firmer expectations for higher inflation. A weaker dollar is a factor too. Whatever the reason, the technical profile for the 10-year rate has recently shifted to an upside posture, signaling that the trend will continue.

Continue reading

Macro Briefing: 30 January 2018

Washington think-tank projects US budget deficit above $1 trillion in 2019: Reuters

CIA director says Russia may meddle in this fall’s US mid-term elections: BBC

Eurozone GDP increased by a solid 0.6% in 2017’s fourth quarter: Bloomberg

What’s on the agenda for Trump’s state of the union speech tonight? USA Today

US consumer spending up 0.4% in Dec as savings rate drops to 12yr low: Reuters

Japan retail spending rises 0.9% in Dec, beating expectatins: RTT

Dallas Fed mfg production index eases in Jan after reaching 11yr high: Dallas Fed

Obamacare reduced financial distress for young adults: Philly Fed

Rising Treasury yields pose a risk for stocks: Bloomberg

10-year Treasury yield reaches 2.7% for first time since 2014: MarketWatch

All The Major Asset Classes Scored Gains Last Week

It was a clean sweep. Every one of the major asset classes posted an increase last week, based on a set of exchange-traded products. The gains, a sign of heightened optimism, mark the first across-the-board advances on a calendar-week basis since last November.

Continue reading

Macro Briefing: 29 January 2018

Trump faces deadline on implementing Russia sanctions: Politico

Israel’s Netanyahu in Moscow for talks on Syria with Putin: Reuters

Trump admin. considering nationalizing portion of US mobile network: Axios

Shale oil boom boosts US leverage in economics and diplomacy: NY Times

2017:Q4 increasaes 2.6%, slowest rise since since Q1: MarketWatch

US durable goods orders rose 2.9% in Dec, the most in six months: Bloomberg

How much longer will rising consumer confidence lift the US economy? NY Times

US merchandise-trade deficit widens to biggest gap since 2008: Bloomberg

UK GDP growth beats expectations in Q4 with 0.5% increase: RTT

For first time in nearly a decade, all the major economies expanding: NY Times