US companies added a relatively soft 135,000 workers in September, a hefty slide from the 228,000 advance in the previous month, according to this morning’s release of the ADP Employment Report. Looking at the last data point in a vacuum suggests there’s trouble brewing for the economy. But the year-over-year trend suggests otherwise, which is encouraging. All the more so when you consider that the temporary effects of two hurricanes probably played a role in last month’s slowdown in hiring.

Continue reading

Laws, Sausage, And Risk Premia Forecasts

Bismark Bismarck may have been misquoted when he reportedly said “laws are like sausages, it is better not to see them being made.” Whoever is the source, the observation applies to estimating expected returns. The end result is forever in high demand, but the details for generating the numbers can get messy.

Continue reading

Macro Briefing: 4 October 2017

US auto sales in September: best month so far in 2017: Detroit News

Major US stock indexes climb further into record territory: MarketWatch

Warren Buffett and BlackRock’s Larry Fink criticize Trump’s tax plan: Reuters

Spain’s Catalonia problem continues to deteriorate: Reuters

GDPNow estimate for Q3 GDP growth picks up to 2.7%: Atlanta Fed

Wall Street economists expect Q3 GDP growth of 2.6%: CNBC

Is the high CAPE level for US stocks a reason to worry? Maybe not: Bloomberg

Risk Premia Forecasts: Major Asset Classes | 3 October 2017

The expected risk premium for the Global Market Index (GMI) increased again in September. GMI, an unmanaged, market-value weighted portfolio of the major asset classes, is currently projected to earn an annualized 6.7% (over the “risk-free” rate) in the long run. The estimate marks a sharp gain of 70 basis points over the August forecast.

Continue reading

Macro Briefing: 3 October 2017

Key US stock indexes, including S&P 500, close at record highs: MarketWatch

Five tailwinds could keep stock-market rally humming: Bloomberg

10-year Treasury yield rises to 2.34%–highest since mid-July: StockCharts

Hurricanes expected to temporarily weigh on Friday’s jobs report: Bloomberg

The next Fed chair? Trump leaning toward replacing Yellen: Quartz

US ISM Mfg Index rises to 13-year high in September: Reuters

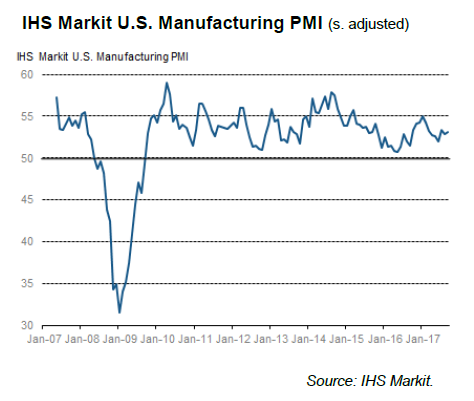

US Mfg PMI, however, still signals moderate growth for Sep: IHS Markit

Tragedy In Vegas

The carnage in Las Vegas last night is reportedly the deadliest mass shooting in US history. The current count: at least 50 dead and more than 400 wounded from the shooter. It’s a heartbreaking story, but one with some uplifting points of light during the struggle to survive — and to save others — amid a madman’s hail of bullets. No doubt we’ll learn of many acts of bravery and heroism as this story unfolds. Meantime, here’s one moving example via Reuters that stands out as a reminder that disaster has a habit of clarifying what’s genuinely important:

Mike McGarry, a 53-year-old financial adviser from Philadelphia, was at the concert when he heard hundreds of shots ring out.

“It was crazy – I laid on top of the kids. They’re 20. I‘m 53. I lived a good life,” McGarry said. The back of his shirt bore footmarks, after people ran over him in the panicked crowd.

Major Asset Classes | September 2017 | Performance Review

Stock markets in the developed world delivered the leading performances for the major asset classes in September. The rest of the field posted a mix of modest gains and losses last month. The biggest setback unfolded in foreign government bonds in developed markets.

Continue reading

Macro Briefing: 2 October 2017

Gunman kills at least 20, wounds 100 at Las Vegas concert: NY Times

Catalonia may be set to declare independence from Spain: Bloomberg

Euro falls against US dollar on Spain’s Catalonia worries: Reuters

US consumer spending growth slows to a crawl in August: Reuters

Consumer sentiment remained elevated in September: UoM

Chicago PMI rises sharply in September to three-month high: ISM-Chicago

US Business Cycle Risk Report: Update For Oct. 1, 2017

The Oct. 1 edition of The US Business Cycle Risk Report has been published and emailed to subscribers.

Book Bits | 30 September 2017

● Americana: A 400-Year History of American Capitalism

By Bhu Srinivasan

Review via The Economist

Bhu Srinivasan’s new book, “Americana”, is a delightful tour through the businesses and industries that turned America into the biggest economy in the world. Not only is the book written in a light and informative style, it is cleverly constructed. Each chapter has a theme—tobacco, cotton, steam, oil, bootlegging, mobile telephones and so on—and these themes are organised to lead the reader through a chronological history of the American economy.

Continue reading