Trump blocks sale of US tech company to Chinese firm, citing security: BBC

Russia’s Kasperksy Lab’s software banned from US gov’t computers: NY Times

Trump’s outreach to Democrats on tax reform is dividing GOP: Politico

US producer prices in August rise at fastest rate since January: Reuters

Another record high for the US stock market: MarketWatch

Brazil’s main stock market index hits record for 3rd session: RTT

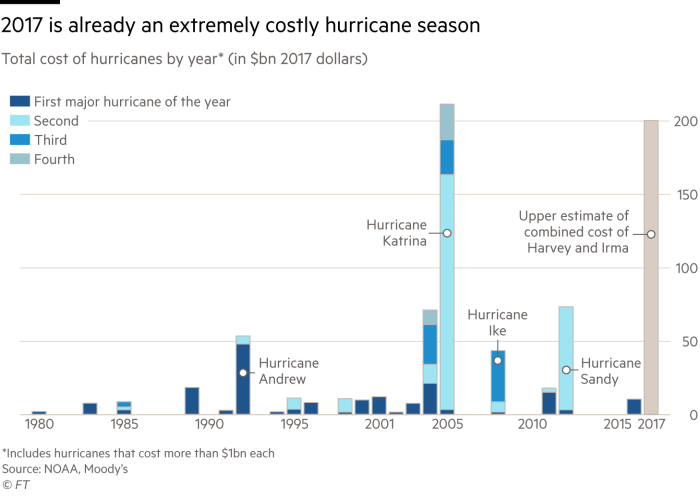

US 2017 hurricane costs to date estimated at highest level since 2005: FT

Annual Growth Rate For US Business Lending Slips To Six-Year Low

The year-over-year growth rate for commercial and industrial loans eased to 1.6% in July, according to last week’s update by the Federal Reserve. The deceleration, the slowest pace since April 2011, looks worrisome in the eyes of some analysts.

Continue reading

Macro Briefing: 13 September 2017

US household incomes increased to record in 2016: WSJ

President Trump: New N. Korea sanctions are only the first step: Reuters

N. Korea vows faster development of nukes after new sanctions: Bloomberg

Global oil market demand set to rise faster than expected: CNBC

US small business optimism edges higher in Aug: MarketWatch

The era of no-retirement age is near: Telegraph

Another record high for US stocks as Treasuries prices fall: FT

Consumer Inflation Data Is Expected To Downplay Rate-Hike Odds

Economists expect that US inflation will remain subdued – below the Federal Reserve’s 2.0% target — in Thursday’s update on consumer prices for August. If the forecast is right, the news will continue to stoke expectations that the central bank will delay the next rate hike into next year.

Continue reading

Macro Briefing: 12 September 2017

Hurricane damage will temporarily slow US economic growth: AP

Irma’s damage expected to be less than forecast: Bloomberg

Consumer inflation outlook for year ahead holds steady at 2.5%: NY Fed

UN Security Council tightens sanctions on North Korea: NY Times

Trump considers more aggressive Iran strategy: Reuters

MSCI All Country World stock index touches record high: Reuters

US stocks (S&P 500) close at record high: Reuters

US Dollar’s Decline Fueled Gains In Foreign Bonds Last Week

The US Dollar Index last week slumped to its lowest level in over two-and-a-half years, boosting returns in foreign bonds. Non-dollar corporate bonds topped the performance list among the major asset classes, based on a set of exchange traded products. Notably, the top-four market performers for last week are offshore fixed-income funds.

Continue reading

Macro Briefing: 11 September 2017

Hurricane Irma will take a bit out of Florida’s economy: CNN Money

Will global warming increase hurricane risk? Bloomberg

Inflation in China rises to fastest pace since Jan: RTT

Will oil rebound to $80/bbl? Fuhgettaboutit: Oil.com

GDPNow’s US Q3 GDP forecast ticks up to 3.0%: Atlanta Fed

NY Fed US Q3 GDP now cast eases to 2.1%: NY Fed

US Dollar Index fell to lowest since Jan 2015 last week: CNBC

US Business Cycle Risk Report Update For Sep. 10, 2017

The Sep. 10 edition of The US Business Cycle Risk Report has been published and emailed to subscribers.

Book Bits | 9 September 2017

● The Myth of Independence: How Congress Governs the Federal Reserve

By Sarah Binder and Mark Spindel

Review via Publishers Weekly

Binder and Spindel have written an extremely thorough study of the Federal Reserve that shows how the institution, while in theory insulated from politics, is in reality anything but. Binder and Spindel persuasively argue that Congress and the Federal Reserve are interdependent entities. By giving the Fed the power to control monetary policy and steer the economy, lawmakers gain their own convenient scapegoat when the economy sours. Likewise, the Fed relies on Congress for political support to implement “unpopular but necessary” policies.

Continue reading

A New Sample Issue: The US Business Cycle Risk Report

Curious about the newsletter? You’re timing is perfect. Here’s a fresh sample of The US Business Cycle Risk Report.

Even better, there’s a weekend bonus: Subscribe for one year by Sunday, Sep. 10, 2017 and you’ll receive 5 additional issues at no extra charge.

For complete subscription information, click here.