● The Last Human Job: The Work of Connecting in a Disconnected World

● The Last Human Job: The Work of Connecting in a Disconnected World

Allison Pugh

Summary via publisher (Princeton U. Press)

With the rapid development of artificial intelligence and labor-saving technologies like self-checkouts and automated factories, the future of work has never been more uncertain, and even jobs requiring high levels of human interaction are no longer safe. The Last Human Job explores the human connections that underlie our work, arguing that what people do for each other in these settings is valuable and worth preserving.

US Q2 GDP Nowcast Eases, But Modest Pickup Over Q1 Is Expected

Recent economic estimates suggest US growth has slowed compared with previous estimates, but today’s revised GDP nowcast for the second quarter still points to a modest pickup in output over Q1.

Macro Briefing: 7 June 2024

* The number of zombie companies (debt-laden firms) in the world has surged

* The US debt problem may be less threatening than it appears

* China exports rise sharply in May amid increasing trade tensions

* ECB cuts interest rates for first time since 2019

* US jobless claims edged higher last week but remain low

* US trade deficit widened in April

* US 10-year Treasury yield stabilizes after 5 days of sharp declines:

Is The US Bond Market Poised For Recovery?

The sharp drop in Treasury yields in recent days has revived chatter that the worst for the bond market may be over. It’s still early to confidently forecast that scenario, but the odds for recovery are looking better these days after a two-year bear market for much of the asset class following the start of Federal Reserve rate hikes in early 2022.

Macro Briefing: 6 June 2024

* Financial distress in commercial real estate continues to rise

* New solar generation capacity installations in US rose to record high in Q1

* Nvidia overtakes Apple to become 2nd largest public firm in US

* US firms trim hiring in May to slowest rise since January, ADP reports

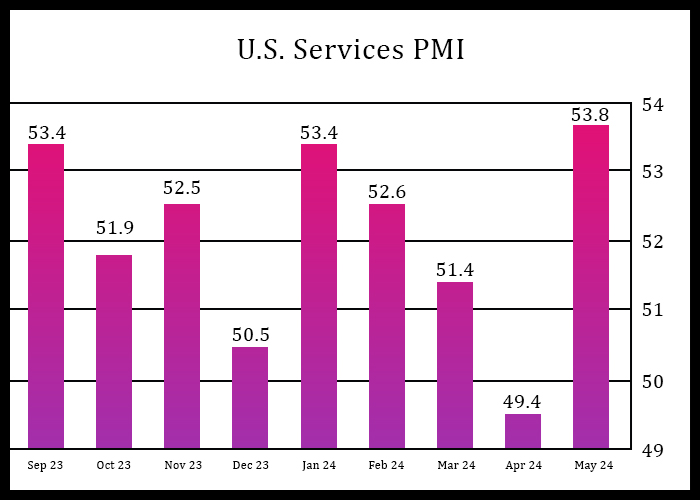

* US ISM Services Index rebounds sharply in May to 9-month high:

Is The Bond Market Rethinking The Outlook For Rate Cuts?

Here we go again. After yesterday’s news that US job openings fell to a three-year low in April, the data fueled the incentive for the bond market to reassess the view that the Federal Reserve will keep interest rates higher for longer.

Macro Briefing: 5 June 2024

* US 10-year Treasury yield drops sharply for fourth straight day

* Eurozone economy grows at fastest rate in a year: PMI survey data

* China services sector grows at fastest pace in 10 months

* US factory orders rose for a third straight month in April

* US job openings fell in April to lowest level in over 3 years:

Total Return Forecasts: Major Asset Classes | 4 June 2024

The performance outlook for the Global Market Index (GMI) ticked higher again in May. For the fourth straight month, GMI’s long-term forecast edged up, rising to an annualized 7.1% pace, which is fractionally above the estimate in the previous month, based on the average of three models (defined below). GMI is an unmanaged benchmark that holds all the major asset classes (except cash), according to market weights via a set of ETF proxies.

Macro Briefing: 4 June 2024

* US Q2 GDP nowcast revised down, again, to +1.8% via Altanta Fed’s model

* Global manufacturing activity improves in May, rising to 22-month high

* Weak US construction spending trend continues in April

* Warren Buffett’s Berkshire Hathaway owns 3% of the US Treasury bill market

* US manufacturing activity contracts for second month in May:

Major Asset Classes | May 2024 | Performance Review

Global markets rebounded sharply in May, with the exception of commodities, based on a set of ETF proxies. Otherwise, gains dominated the major asset classes after April’s widespread pummeling.