* Some economists now see rate cuts delayed until March 2025,

* Fed’s Beige Book reports steady economic growth but slim progress on inflation

* ‘Insatiable’ AI demand expected to lift Q2 sales for world’s biggest chipmaker

* Climate change bill may reach $38 trillion a year by 2049, study finds

* US dollar’s dominant reserve currency status likely to endure: Morgan Stanley

Higher-For-Longer Risk For Rates Drives Up Treasury Yields

Bowing to recent data, Federal Reserve Chairman Jerome Powell on Tuesday conceded that inflation progress has stalled and the case for rate cuts has weakened. The Treasury market has been effectively making the same case for weeks, but when the top central banker says it out loud the crowd notices.

Macro Briefing: 17 April 2024

* Fed Chair Powell says there’s been a ‘lack of further progress’ on inflation

* US expected to grow at double the rate of G7 peers in 2024, predicts IMF

* Free-market policies are fading around the world, and that worries economists

* US industrial output increased for second month in March

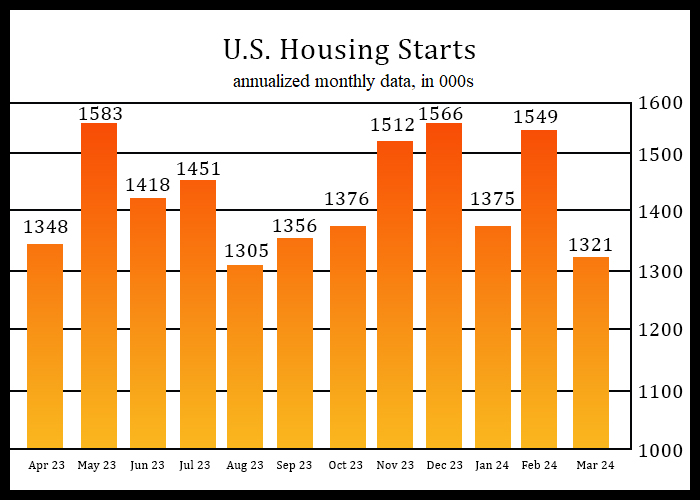

* US housing starts in March fall to slowest pace in seven months:

Where’s The Downside Tipping Point For US Stocks?

Yesterday’s sharp slide in US equities has refocused minds on a hardy perennial: the market can and does go down. Obvious, of course, but easy to overlook when prices are rising virtually non-stop, as they have been for much of the past six months—until now.

Macro Briefing: 16 April 2024

* Another round of Fed rate hikes is possible, advise UBS strategists

* China’s economy grew faster than expected in Q1, but…

* New home prices in China fall at fastest rate since 2015

* NY Fed Mfg Index continues to indicate contraction in April

* US home builder sentiment steady at modest growth level in April

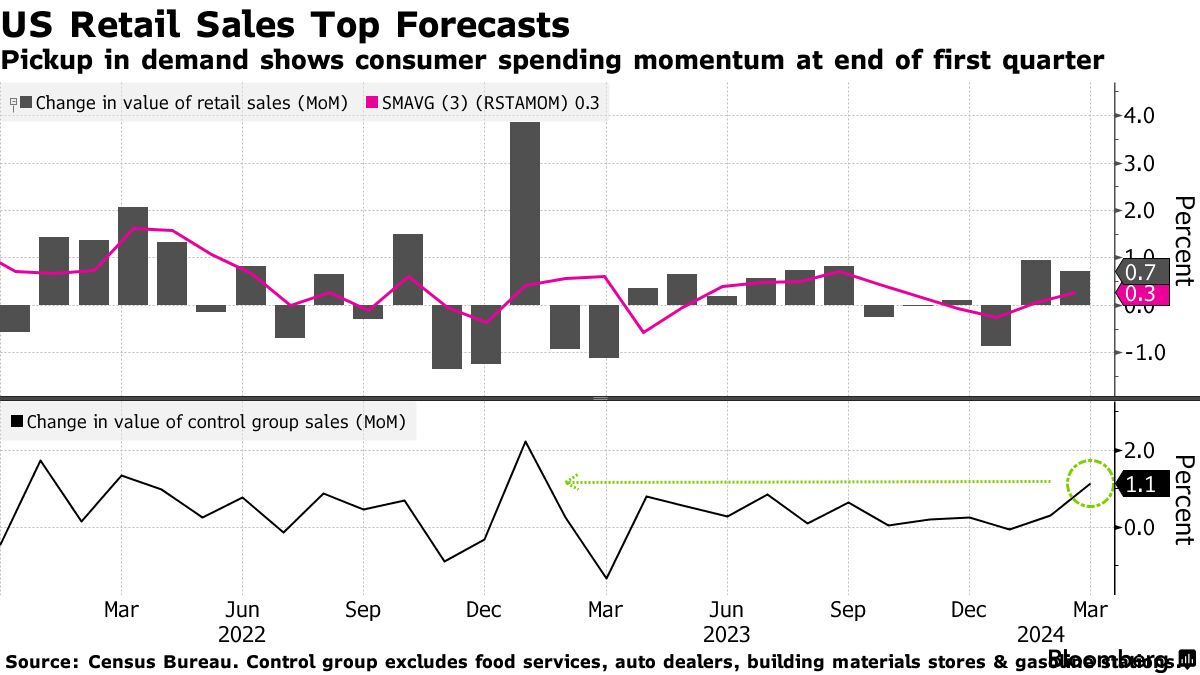

* US retail sales rose more than forecast in March:

Rate Cuts Off The Table For Near Term Outlook: Futures Market

In the wake of last week’s hotter-than-expected consumer inflation data for March, the implied forecast via Fed funds futures indicates that interest-rate cuts are unlikely in the months ahead.

Continue readingMacro Briefing: 15 April 2024

* Israel considers how to respond to Iranian missile attack

* Economists lift US growth forecasts in new Wall Street Journal survey

* German Chancellor Scholz in China to focus on tense economic ties

* US 10-year yield approaching 4.6% in early Monday trading

* Tesla laying off more than 10% of workforce after lackluster sales results

* US consumer sentiment “moved sideways for the fourth straight month” in April:

Book Bits: 13 April 2024

● Slow Burn: The Hidden Costs of a Warming World

Robert Jisung Park

Review via International Monetary Fund

As the world warms, anxiety over the effects continues to rise. A survey conducted by the United Nations found two-thirds of the global population believe that climate change is a global emergency. Fears abound on the risks of triggering tipping points in the climate system, such as the melting of ice sheets or the release of underground methane. But alongside future risks of climate catastrophe, there are also slow-burning effects already being felt around the globe. In Slow Burn: The Hidden Costs of a Warming World, environmental and labor economist R. Jisung Park documents these effects, from the expected, like worsening inequality, to the unexpected, such as declining productivity and economic growth.

Research Review | 12 April 2024 | Equity Risk Premium

Macroeconomic Announcement Premium

Hengjie Ai (University of Wisconsin-Madison), et al.

November 2023

The paper reviews the evidence on the macroeconomic announcement premium and its implications on equilibrium asset pricing models. Empirically, a large fraction of the equity market risk premium is realized on a small number of trading days with significant macroeconomic announcements. We review the literature that demonstrates that the existence of the macroeconomic announcement premium implies that investors’ preferences must satisfy generalized risk sensitivity. We show how this conclusion generalizes to environments with heterogeneous investors and demonstrate how incorporating generalized risk sensitivity affects economic analysis in dynamic setups with uncertainty.

Macro Briefing: 12 April 2024

* Biden urged to ban imports of Chinese-made electric cars to US

* IMF chief warns central banks against cutting interest rates too soon

* Gold rallies above $2400/oz.

* China’s exports fell sharply in March in US dollar terms

* US jobless claims fell last week, holding near multi-decade low

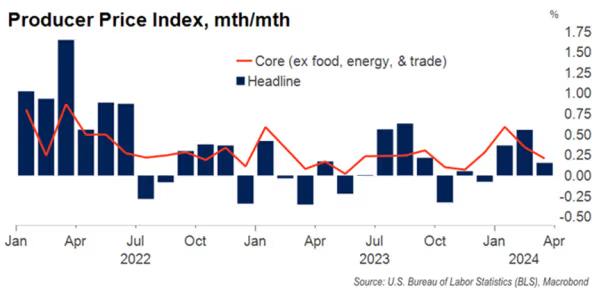

* US producer price inflation rises less than expected in March: