* Fed leaves rates unchanged but expects cuts later this year

* Fed Chairman Powell doesn’t appear worried about recent sticky inflation data

* New CBO estimates still project hefty runup in US debt in years ahead

* Eurozone economy close to stabilizing in March via PMI survey data

* As mortgage rates decline, US housing supply is starting to rebound

* Private equity firm Apollo offers to buy Paramount film and TV studios

* Micron shares soar as AI-driven earnings report impresses investors

* US 10-year Treasury yield continues to ease after Fed leaves rates unchanged:

Profiling A ‘Real Assets’ Portfolio During The Recent Inflation Surge

The sharp runup in US inflation in 2021-2022 revived the idea that a so-called real assets portfolio is crucial for asset allocation strategies. But with the peaking of inflation in mid-2022, the outlook has turned murky for a dedicated focus on assets that are expected to benefit from higher pricing pressure.

Macro Briefing: 20 March 2024

* Federal Reserve expected to leave rates unchanged at today’s policy meeting

* Economists continue ponder why high rates haven’ caused US recession

* US dollar strengthens after Bank of Japan ends policy of negative rates

* Rate cut for Europe on the table for June, says ECB President Lagarde

* UK inflation in February eases to slowest pace in nearly 2-1/2 years

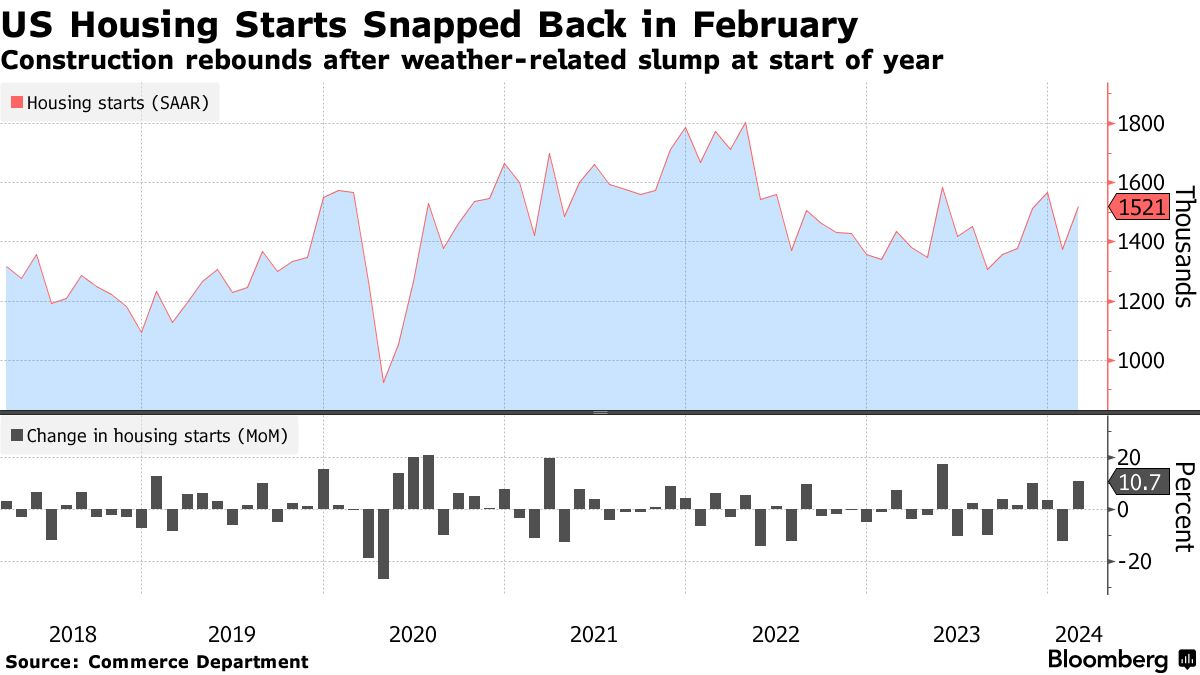

* US housing starts rebounded in February–biggest rise since May:

Expectations For June Rate Cut Continue To Fade

Analysts are debating if last week’s sticky inflation news is the death knell for a June cut in interest rates by the Federal Reserve. This much is clear: the recent run of news isn’t encouraging for anticipating that a dovish turn for monetary policy is imminent.

Macro Briefing: 19 March 2024

* Japan’s central bank lifts interest rates for first time since 2007

* Federal court temporarily halts SEC’s new climate-disclosure rules

* Nvidia announces new generation of artificial intelligence chips

* Google and Apple reportedly discussing use of Gemini’s generative AI in iPhones

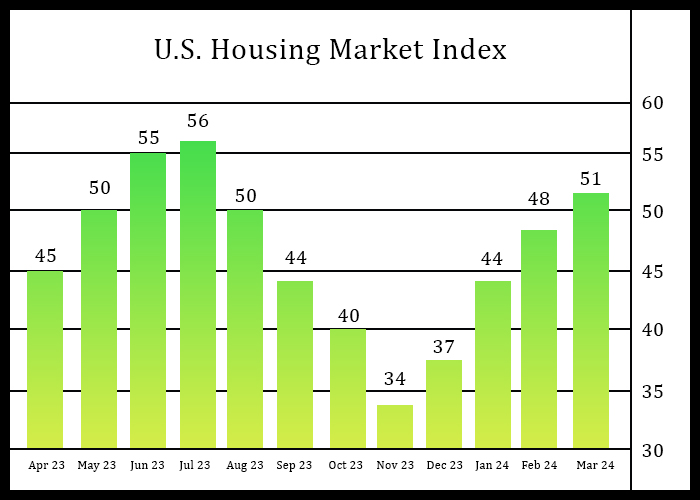

* US homebuilder sentiment rises to 8-month high in March:

Commodities Overtake US Stocks As Performance Leader In 2024

It had to end eventually. Whether last week’s shift in the pole position endures is something else entirely. But for the moment, US equities are no longer leading the horse race for the major asset classes year to date, based on a set of proxy ETFs through Friday’s close (Mar. 15).

Macro Briefing: 18 March 2024

* Fed will to keep rates higher for longer, economists advise in poll, but…

* BIS chief predicts rate cuts are still likely this year

* Another potential partial-government shutdown lurks, again, on Friday

* China reports firmer economic data in retail and industrial sectors, but…

* The ailing property market in China shows is still struggling

* Working in old age isn’t as effective as it seems for the retirement crisis

* US retail spending leveling off as consumers pull back:

Book Bits: 16 March 2024

● The Price is Wrong: Why Capitalism Won’t Save the Planet

● The Price is Wrong: Why Capitalism Won’t Save the Planet

Brett Christophers

Review via Financial Times

Why is it so difficult to wean renewable energy off public support? While higher interest rates and steel prices clearly haven’t helped, Christophers argues we’ve missed the answer for a structural reason: we are looking at the wrong measure. It isn’t just relative power prices that determine how many wind or solar parks get built; more important is how profitable entrepreneurs think these investments will be. And here’s the rub: the anticipated returns are unappealing. On average, renewable projects earn just 5 to 8 per cent on their equity, Christophers reports, compared to more than 15 per cent for oil and gas.

US Economic Growth Still Expected To Slow In Q1 GDP Report

A new round of nowcasts continue to estimate that US economic activity will downshift in next month’s release of first-quarter GDP data. Today’s revised estimate is based on the median for a set of nowcasts compiled by CapitalSpectator.com.

Macro Briefing: 15 March 2024

* A key source of US economic strength: workers don’t fear layoffs

* Commercial real estate woes weigh on cities’ finances

* Copper price surges amid concerns over supply risk

* Retail sales in US rebound in February after January’s steep decline

* US jobless claims remain low for week through Mar. 9

* US producer price inflation is hotter than expected for February: