The mixed news on inflation earlier this week didn’t help, but neither did sticky inflation news derail expectations that the Federal Reserve will start cutting interest rates in June. Yet uncertainty about the timing is creeping higher, as a confluence of factors muddy the outlook.

Macro Briefing: 14 March 2024

* Wall Street forecasters are playing catch-up with strong US economy

* House passes bill that will force either ban or sale of Tik Tok

* New data reaffirms that US is world’s leading oil producer

* Global oil demand expected to cool vs. 2023, predicts IEA

* Demand for mortgages rebounds as 30-year fixed rate dips below 7%

* US gasoline benchmark price rises to six-month high:

10-Year US Treasury Yield ‘Fair Value’ Estimate: 13 March 2024

The US 10-year Treasury yield continues to trade well above a ‘fair value’ estimate, based on the average of three models maintained by CapitalSpectator.com. The market premium continues to suggest that the benchmark rate’s upside potential is constrained, but at the same time recent history suggests a relatively quick decline toward fair value still faces long odds, arguably due to behavioral and other factors.

Macro Briefing: 13 March 2024

* It’s official: Biden and Trump secure delegates for November rematch

* US stock market (S&P 500) hits new record high despite stick inflation data

* House of Representatives will vote on Tik Tok ban today

* Higher-for-longer world for rates may be likely, but perhaps that’s OK

* Sticky inflation data take a bite out of bond and real estate ETFs

* Consumer spending in US rebounded in February via credit card data

* US consumer inflation posts mixed results for February:

Small Cap And Value Stocks Lag In This Year’s Rally

Shares of small companies and value stocks have had a tough time keeping up with the broad market in recent years, and the headwind for these risk factors is still blowing so far in 2024.

Macro Briefing: 12 March 2024

* US is world’s largest oil producer, again–leading output for sixth straight year

* JPMorgan CEO Jamie Dimon urges Fed to delay rate cuts

* Haiti’s prime minister resigns amid increasing violence

* Will China’s surging exports trigger a backlash in the West?

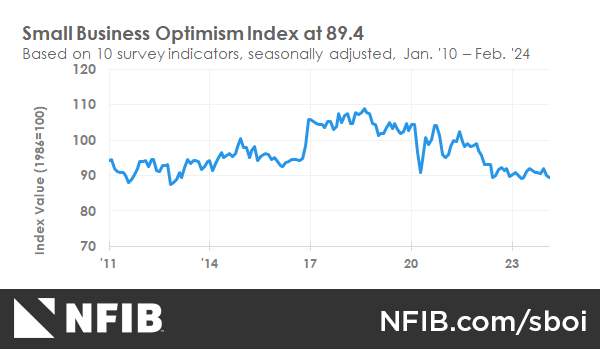

* US Small Business Optimism Index ticks down to 10-month low in February:

Is The US Labor Market As Strong As It Appears?

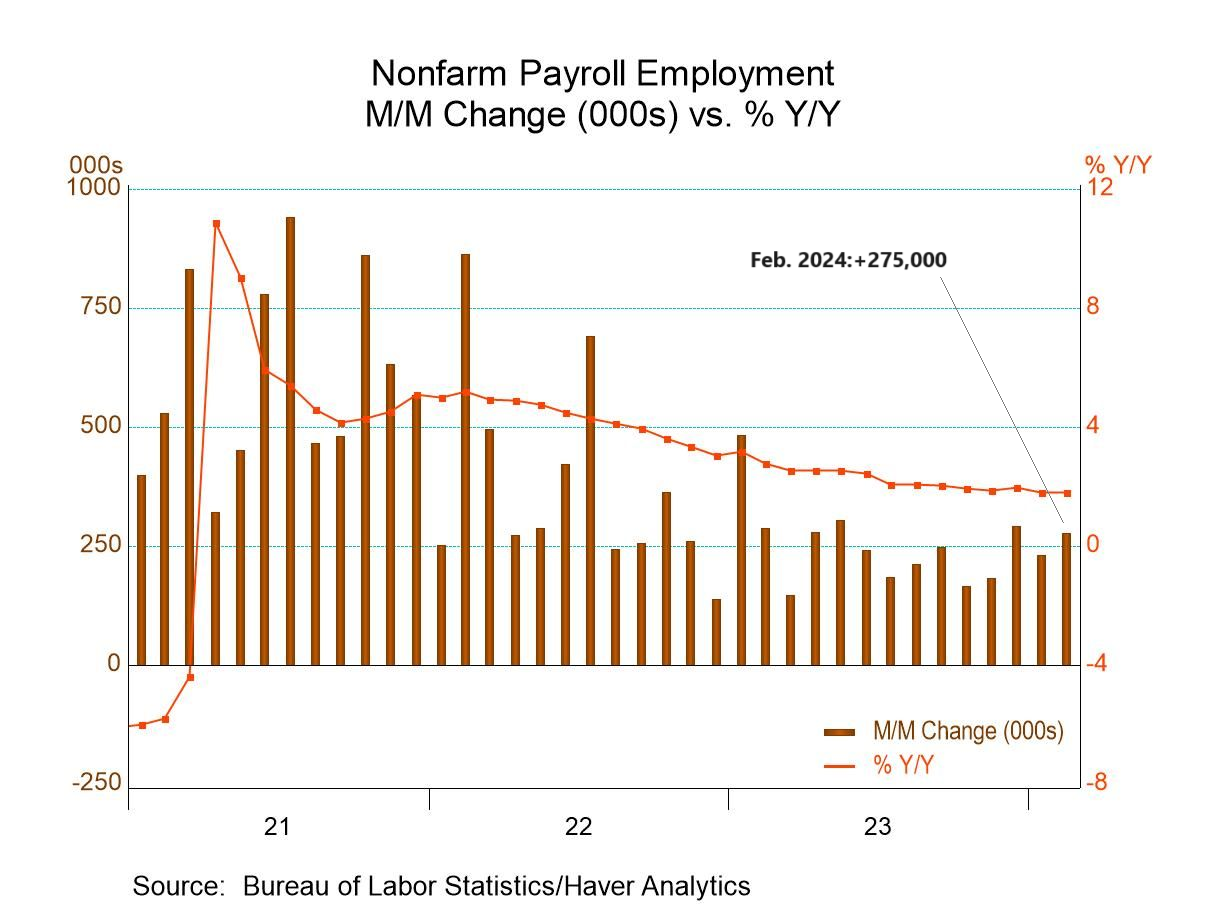

Friday’s payrolls data for February dispatched another upside surprise, reaffirming the now-consensus view that recession risk is low for the US economy. Hiring rose 275,000 last month, beating expectations — well above the consensus forecast for around 200,000.

Macro Briefing: 11 March 2024

* Strong US growth prompts investors to buy a broader set of stocks

* China’s housing minister: troubled real-estate developers should go bankrupt

* China consumer inflation rises for first time in six months

* Japan avoids technical recession after Q4 economic data revised up

* Bank of Japan expected to scrap world’s last negative interest rate experiment

* Gold prices steady on Monday after hitting record highs last week

* US nonfarm payrolls increase 275,000 in February, beating expectations:

Book Bits: 9 March 2024

● Work, Retire, Repeat: The Uncertainty of Retirement in the New Economy

● Work, Retire, Repeat: The Uncertainty of Retirement in the New Economy

Teresa Ghilarducci

Summary via publisher (U. of Chicago Press)

Many argue that the solution to the financial straits of American retirement is simple: people need to just work longer. Yet this call to work longer is misleading in a multitude of ways, including its endangering of the health of workers and its discrimination against people who work in lower-wage occupations. In Work, Retire, Repeat, Teresa Ghilarducci tells the stories of elders locked into jobs—not because they love to work but because they must. But this doesn’t need to be the reality. Work, Retire, Repeat shows how relatively low-cost changes to how we finance and manage retirement will allow people to truly choose how they spend their golden years.

Research Review | 8 March 2024 | Combination Model Forecasting

Market Risk Premium Expectation: Combining Option Theory with Traditional Predictors

Hong Liu (Washington University in St. Louis), et al.

December 2022

In general, the slackness between the Martin lower bound (solely based on option prices) and the market risk premium depends on economic state variables. Empirically, we find that combining information from option prices and economic state variables yields forecasts of the market risk premium with greater out-of-sample performance compared to forecasts using option prices alone or economic state variables alone. Additionally, these combination-based forecasts can significantly increase investors’ utility by improving their portfolios’ Sharpe ratios. Our findings suggest the importance of combining information from option prices and economic state variables.