In mid-December, CapitalSpectator.com mused: “Are Commodities A Compelling Contrarian Trade For 2024?” The answer so far this year continues to be “yes,” as a rally for prices of raw materials continues to bubble after a rough 2023 in this corner of global markets.

Macro Briefing: 4 April 2024

* US Treasury Sec. Yellen says US may consider new tariffs on China

* Atlanta Fed’s Bostic now sees only one rate cut this year

* Global economic recovery is driving a strong commodities rally in 2024

* Eurozone economic activity begins to recover via PMI survey data

* US services sector growth slows further in March via ISM Services Index, and…

* ISM Services data also indicate price pressures are easing

* US private-sector hiring improves for second month in March: ADP

New Questions Emerge On Prospects For A June Rate Cut

Forecasts that the Federal Reserve will start cutting interest rates in June took another hit after Monday’s relatively firm manufacturing-survey data for March. Markets are still pricing in moderate odds that easing will start at the end of the second quarter, but the incoming data is providing more support for again pushing the date for a dovish policy pivot further down the road.

Macro Briefing: 3 April 2024

* Taiwan hit by strongest earthquake in 25 years

* Fed officials still expect rate cuts, but not anytime soon

* Global manufacturing growth strengthens in March via PMI survey

* China manufacturing growth posts strongest pace in 13 months: PMI survey

* Eurozone inflation unexpectedly cools to 2.4% in March

* Tesla’s sales fall, a sign that’s its share of EV market is slipping

* US factory orders rebound sharply in February after two monthly declines

* US job openings edge higher, staying in relatively elevated terrain:

Total Return Forecasts: Major Asset Classes | 2 April 2024

The long-run performance estimate for the Global Market Index (GMI) ticked up again in March vs. the previous month. Today’s revised forecast (based on three models defined below) indicates a 6.9% annualized return for the unmanaged benchmark, which holds all the major asset classes (except cash), according to market weights via a set of ETF proxies.

Macro Briefing: 2 April 2024

* Gold prices reach a new record high on Monday

* Housing is the Fed’s main inflation challenge lately

* Expectations for European stock are far too low, advises JP Morgan analyst

* US construction spending falls for second straight month in February

* Eurozone manufacturing activity continued contracting in March: PMI survey

* ISM Mfg Index in March indicates slight expansion–first increase in 16 months:

Major Asset Classes | March 2024 | Performance Review

The rally in global assets broadened in March, lifting nearly every slice of the major asset classes. The downside outlier: bonds in emerging markets. Otherwise, last month delivered a clean sweep of gains, based on a set of ETFs.

Macro Briefing: 1 April 2024

* Inflation remains sticky in US and Europe, creating challenges for central banks

* China factory activity in March is strongest in 13 months via survey

* Gold trades at new record high on Monday

* Bitcoin and S&P 500 are first quarter’s big winners

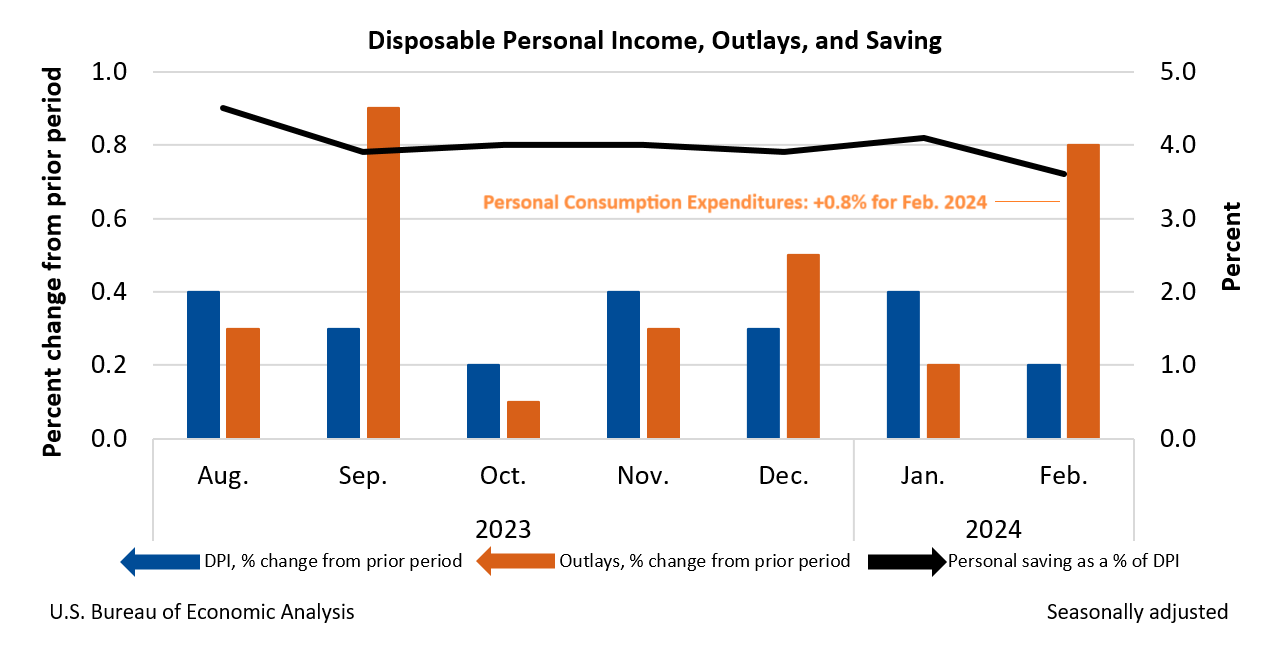

* Fed’s favored inflation gauge ticked up to 2.5% in February

* US consumer spending rebounds sharply in February:

Book Bits: 30 March 2024

● Enough: Why It’s Time to Abolish the Super-Rich

Luke Hildyard

Summary via publisher (Pluto Press)

The story is all too familiar. The global economy generates immense fortunes for a super-rich elite. Yet at the same time pay stagnates for ordinary workers, food banks proliferate and public services collapse around us. In Enough, Luke Hildyard argues that far from being the hard-working and productive entrepreneurs that they claim to be, the super-rich are an extractive, parasitic force sucking up a vastly disproportionate share of society’s resources – making the rest of us all poorer as a result.