The US economic trend looks a bit firmer in the wake of today’s update on personal income and spending for January and revised numbers for last year’s fourth-quarter GDP data. Notably, the year-over-year trend for income and spending kicked higher at the start of 2016. Macro risk is still elevated relative to the broad trend six months ago, especially from a global perspective. But for the moment there’s a modestly stronger tailwind blowing in the published numbers for the US—news that eases fears for assuming that the world’s largest economy is sliding into a new recession.

Personal consumption expenditures (PCE) increased 0.5% in January, the strongest monthly rise in eight months, the Bureau of Economic Analysis reports. Disposable personal income (DPI) also advanced 0.5% last month, the most since last May.

Meanwhile, last year’s Q4 GDP growth rate was revised up to 1.0% from 0.7% previously, the government advises in today’s second round of estimates for the quarterly numbers in last year’s final three months. That’s still a sluggish pace, but the modest improvement—combined with expectations for a considerably stronger gain for this year’s Q1 rate—offers fresh support for thinking that the US macro trend will remain comfortably positive for the near term.

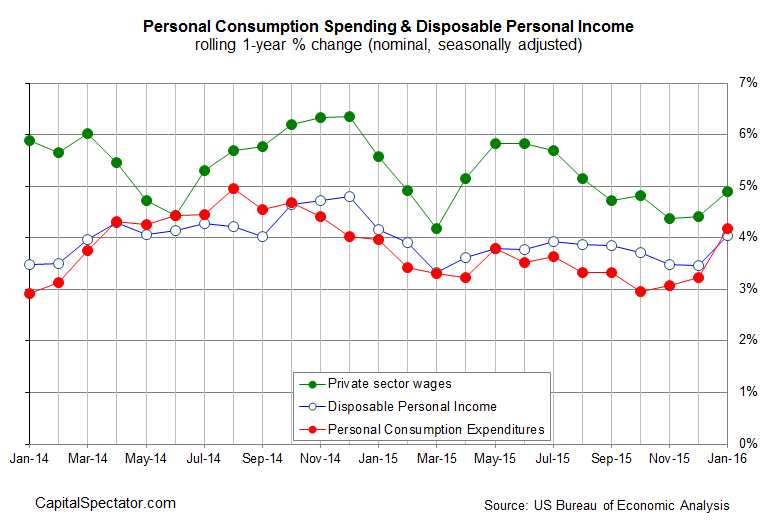

The sight of conspicuously stronger annual increases for income and spending is particularly noteworthy for spinning the numbers with an optimistic edge. After flat-to-lower readings in the annual comparisons since mid-2015, the pop in year-over-year data for January is a welcome change for the better.

Indeed, personal spending and disposable personal income are again growing at 4%-plus rates in annual terms—the best gains in about a year. Private-sector wage growth popped even more, posting a 4.9% increase in January vs. the year-earlier level—the strongest annual gain since last August. Considering that wage growth is the foundation for consumer spending–and the US macro trend generally–it’s hard to interpret today’s update as anything less than a solidly positive development.

The bottom line: the hard data in January all but confirms that recession risk was low to non-existent last month. That’s been the view all along via a broad set of economic indicators, combined with a bit of econometric projection (see last week’s macro profile, for instance). Today’s numbers effectively put to rest the fear that the economy slipped off the edge in January. The jury’s still out on what we’ll find when all the numbers are published for February, as we discussed yesterday in context with this month’s weak survey data for manufacturing and services. But to the extent that a healthy tailwind is productive, it’s still premature to discount forward momentum’s resilience.

Pingback: US Personal Income and Spending Increases in January