● The AI Economy: Work, Wealth and Welfare in the Age of the Robot

By Roger Bootle

Summary via FT

Bootle, chairman of Capital Economics, argues that the economic effects of artificial intelligence may not be as different from those of previous technological transformations as many suppose; that the speed with which the changes occur may not be all that fast; and that, in all probability, piecemeal changes in policy, rather than a radical shift towards universal basic income, are the right response. We need to hear his arguments.

Continue reading

Monthly Archives: November 2019

Off The Charts: Extreme Moves In ETFs — 29 November 2019

Today begins a semi-regular column that focuses on a handful of ETFs that have recently posted extreme changes. The playing field starts with nearly 100 equity funds (US and foreign). For a complete list, see a recent edition of The ETF Portfolio Strategist. The goal: highlighting some of the gains and losses at the outer edge of market action of late, where the odds may be slightly higher for developing quasi-reliable near-term expectations, perhaps for use in adding context to strategic-oriented return estimates. In any case, all the standard caveats still apply and so proceed accordingly.

Macro Briefing | 29 November 2019

Trump restarts talks with Taliban during visit to Afghanistan: The Hill

North Korea fires two short-range missiles in latest provocation: AP

Will US law on Hong Kong derail trade talks with China? Maybe not: NY Times

Is a tight US job market Trump’s ticket to re-election? WSJ

Signs of financial stress are rising in China: Bloomberg

Poll sees UK’s Conservatives set for big win in December election: Reuters

German retail spending tumbled in October: Reuters

Industrial output in Japan fell sharply in October: Nikkei Asian Review

Japan’s retail sales tumble after tax hike: Japan Times

US stock market begins November’s last trading day at record high:

Happy Thanksgiving!

Is The Recent Rebound In Interest Rates Fading?

For much of this year through early September a downside bias in interest rates was conspicuous. The driving force: economic pessimism. The 10-year/3-month yield curve inverted in the spring and for the most part remained below-zero, offering what is widely seen as a recession forecast. But over the last three months the yield curve turned positive and key interest rates rebounded. But economic data doesn’t look any better today vs. the macro profile of three months ago—in fact, the economic trend has weakened slightly. Is that a clue for thinking that interest rates will resume a downward bias in the final month of 2019?

Macro Briefing | 27 November 2019

US opens criminal probe into role of drug companies in opioid crisis: WSJ

China’s economy continues to slow in November: Bloomberg

Pondering the economic iron curtain that’s dividing the world: NY Times

US trade gap narrowed sharply in October: Reuters

Sales of new US homes unexpectedly fell in October: CNBC

Home prices in the US picked up in September: CNBC

Richmond Fed Manufacturing Index turned slighty negative in Nov: RF

US Consumer Confidence Index ticked lower again in November: MW

US Economy Remains On Track To Slow In Fourth Quarter

Tomorrow’s revised GDP data for the third quarter is expected to hold at a 1.9% increase, according to the consensus point forecast via Econoday.com. That’s a moderate gain but it’s may be a bridge too far based on estimates for Q4 via a set of nowcasts compiled by The Capital Spectator.

Macro Briefing | 26 November 2019

Yet another hint of progress in US-China trade-deal talks: Bloomberg

Fed Chairman Powell: strong labor market still has room to run: NY Times

2% inflation remains Fed’s target, says Powell: CNBC

Americans expect to raise their Christmas spending at a strong pace: Gallup

Financial advisers worry they’ll get squeezed in Schwab-TD Ameritrade deal: WSJ

Dallas Fed Mfg Index reflect modest contraction in November: DFed

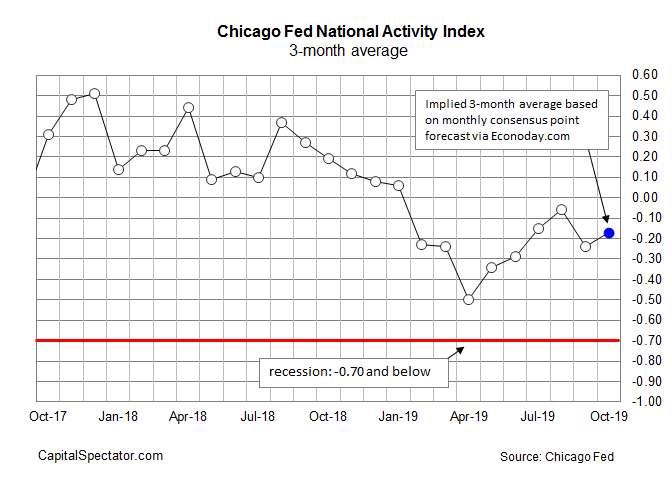

US economic activity continued to slow in October: Chicago Fed

US Bonds, Foreign REITs Were Haven From Selling Last Week

Most of the major asset classes lost ground last week, according to a set of exchange-traded funds. Bucking the downside trend: US investment grade bonds and foreign real estate shares. Otherwise, red ink prevailed in global markets over the five days of trading through November 22.

Macro Briefing | 25 November 2019

US Navy Secretary forced to resign over controversial SEAL case: Reuters

Pro-democracy candidates win big in Hong Kong election: Reuters

German business sentiment improved slightly in November: Bloomberg

Capital spending by S&P 500 companies slows, creating economic headwind: WSJ

Security forum focuses on rising stress weighing on West’s democracies: Politico

US consumers remain upbeat in November: CNBC

KC Fed Manufacturing Index falls again in November: Mstar

US economic growth picked up in November but remains slow: IHS Markit

Slightly firmer slow-growth sign expected in today’s CFNAI (3mo avg) data for Oct: