The August 1 tariffs deadline that will raise prices for US imports is approaching, but market sentiment remains unaffected, based on set of proxy ETFs through Friday’s close (July 18). Following the April tariff tantrum, when markets tanked, prices have rebounded and the risk-on posture looks no worse for wear with less than two weeks to go for implementing new US tariffs.

Monthly Archives: July 2025

Macro Briefing: 21 July 2025

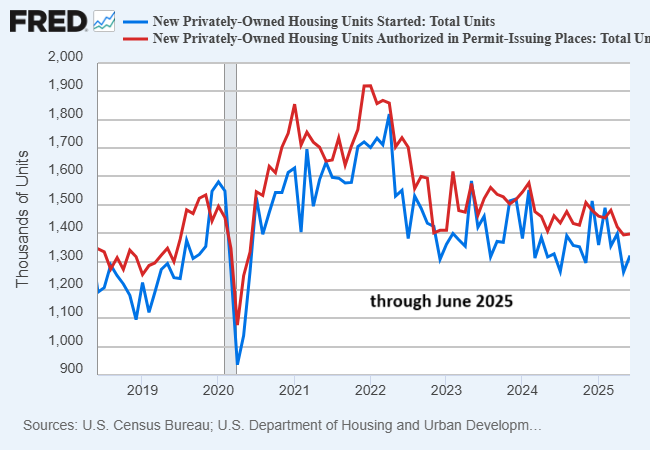

US housing starts rebound in June after dropping to 5-year low, but the downside bias in recent years remains intact. “Everywhere builders look there are reasons to delay or scrap projects,” said Christopher Rupkey, chief economist at FWDBONDS. “The nation’s housing market outlook has never looked this troublesome. This could actually end quite badly for the economy.”

Book Bits: 19 July 2025

● A Field Guide to Responsible Investing: Asset Management in the Age of Polycrises

● A Field Guide to Responsible Investing: Asset Management in the Age of Polycrises

Amy O’Brien

Summary via publisher (Palgrave Macmillan)

For years, responsible investing has been a bewildering precinct in asset management. To many, the idea of aligning your values with your investment portfolio seemed naive. Slowly and steadily, responsible investing morphed from a movement into an industry on course to command $50 trillion in assets by 2025— a third of the capital at work in the markets. And yet responsible investing has remained as difficult to traverse as ever. It’s drawn fire from critics who’ve branded the approach “woke capitalism” whilst more “responsible” generations of investors are poised to marshal trillions of assets of their own into the business – we are at an inflection point.

Moderate Rebound Still Expected For US Economy In Q2 GDP Data

The government’s second-quarter GDP report scheduled for later this month is still on track to post a moderate recovery in output, based on the median estimate for a set of nowcasts compiled by CapitalSpectator.com.

Macro Briefing: 18 July 2025

US retail sales rebounded in June after two straight monthly declines. “Don’t count the American consumer out yet,” Heather Long, chief economist at Navy Federal Credit Union, wrote in commentary. “There’s still a lot of trepidation about tariffs and likely price hikes, but consumers are willing to buy if they feel they can get a good deal.”

Industrials Holding On To Lead As Top Equity Sector In 2025

In a volatile year for stocks, as tariffs and other factors roil expectations and keep investors on edge, industrial stocks are the market darlings since the April rebound.

Macro Briefing: 17 July 2025

US producer price inflation unexpectedly cooled in June. Wholesale prices were unchanged in June, marking a contrast with firmer consumer prices for analyzing if tariffs will boost inflation in the months ahead.

10-Year US Treasury Yield ‘Fair Value’ Estimate: 16 July 2025

The market premium for the US Treasury yield edged lower in June, based on analysis using a “fair value” estimate. But with inflation showing signs of heating up due to tariffs, economic conditions don’t look particularly conducive for an ongoing decline in the market premium for the near term.

Macro Briefing: 16 July 2025

US consumer inflation’s 1-year pace picked up in June. The consumer price index rose 2.7% at the headline level vs. the year-ago level, up from 2.4% in May, according to the Bureau of Labor Statistics — the highest increase since February. Citing tariffs as a factor, “Inflation is going kick into a much higher gear in coming months,” said Mark Zandi, chief economist at Moody’s. “We are on the leading edge of that now, but it will become clearly evident in the months ahead.” Omair Sharif, founder and president of Inflation Insights, wrote in a note to clients: The higher inflation data “showed that tariffs are beginning to bite.”

The Everything Rally In 2025 Rolls On

Judging by the headlines, there’s a lot to worry about. But if markets are anxious it’s not obvious in the year-to-date results for the major asset classes, which are posting across-the-board gains in 2025 via a set of ETFs through Monday’s close (Jan. 14).