Early on in the current run of accelerating inflation there were forecasts that the increase was “transitory.” Then the outlook shifted to estimates that the peak would top out but last longer than previously expected. Now the question is whether inflation’s run higher is on track to continue?

Author Archives: James Picerno

Macro Briefing: 8 February 2022

* Putin hints at possible thaw in Ukraine tensions after meeting France’s Macron

* Biden: Germany’s gas line from Russia won’t operate if Putin invades Ukraine

* Goldman’s head of commodities research says “We’re out of everything”

* Demand rising for dividend stocks amid outlook for slower growth, rising rates

* Hedging on US stocks at highest level in nearly two years

* Oil giant BP reports highest earnings in 8 years as commodity prices surge

* Meta is considering shutting down Facebook and Instagram in Europe

* Baltic Dry Index, a leading economic indicator, is close to lowest level in a year:

Emerging Markets Led Last Week’s Rebound In Global Stocks

Shares in emerging markets rallied for the first time in three weeks, posting the best weekly performance for the major asset classes through Friday’s close (Feb. 7), based on a set of ETFs.

Macro Briefing: 7 February 2022

* German Chancellor Scholz says Russia will pay high price if Ukraine invaded

* Biden to meet with German Chancellor Scholz today in White House

* Germany urged to ‘wake up’ to Ukraine-Russia threat

* French president Macron to meet Putin in effort to avert Ukraine war

* US labor shortages expected to continue through second half of 2022

* Gold has been relatively steady amid recently volatility in US dollar and bonds

* US set to unveil new Asia-Pacific economic strategy to counter China

* Germany’s industrial production declined unexpectedly in December

* Two January estimates of US private payrolls show sharply divergent results:

Book Bits: 5 February 2022

Rupert Russell

Review via Publishers Weekly

Documentary filmmaker and sociologist Russell debuts with a harrowing look at the disastrous consequences of financial speculation. Contending that recent political and social turmoil in Iraq, Ukraine, Venezuela, and other countries has been triggered by irrational price shocks that don’t correspond to actual issues of supply and demand, Russell details how small market movements are amplified and manipulated by hedge fund managers and commodities traders seeking to deliver consistent profits regardless of real-world conditions. Among a plethora of disturbing case studies, Russell describes how oil wealth generated by market speculation fueled corruption and then caused ruinous hyperinflation in Venezuela; explains how artificially low coffee prices, climate change, and agricultural debt led to a surge in migration from Guatemala toward the U.S.; notes that the terrorist organization al-Shabaab drove down cattle prices in Somalia during a 2010–2011 drought in order to compel desperate farmers to join their ranks; and contends that Western governments suspending “the rules of the game” to prop up their economies during the Covid-19 pandemic only underscores how much arbitrary control markets and prices have over the global economy.

Desperately Seeking Yield: 4 February 2022

The inverse relationship between prices and yields, if not quite a blessing, is at least useful. And so it’s been since our last update on trailing yields for the major asset classes via ETF proxies. As prices have fallen, some of the pain is offset by rising trailing yields.

Macro Briefing: 4 February 2022

* Leaders of Russia and China meet at Olympics in Beijing, denounce US pressure

* Global growth in January slowed “notably” in January via PMI survey data

* Bank of England lifted interest rates, again, to fight inflation

* ECB president Lagarde hints at faster policy tightening amid high inflation

* Meta (Facebook) loses $250 billion in market value amid weak earnings results

* Amazon shares soar on strong revenue gain in Q4

* Eurozone retail sales fell more than expected in December

* US jobless claims fell for a second week, hinting at softer Omicron blowback

* Factory orders in US fell 0.4% in December, in line with expectations

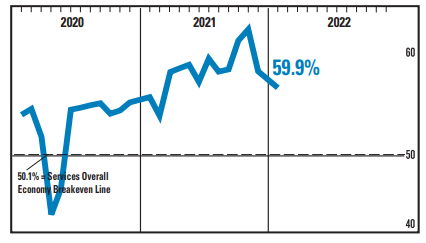

* US ISM Services Index continued to fall in January, reflecting slower growth:

Major Asset Classes | January 2022 | Risk Profile

After a stellar run higher, the Global Market Index’s risk-adjusted performance reversed in January, based on the trailing 3-year Sharpe ratio, a measure of return adjusted by volatility. The downturn was dramatic, but no less expected after the hefty increase in previous months. As noted in last month’s risk profile, “History suggests that upward spikes in GMI’s Sharpe ratio are quickly reversed, which implies that choppy market activity lies ahead.”

Macro Briefing: 3 February 2022

* NATO: Russia stepped up deployments to Ukraine’s northern neighbour Belarus

* Russia condemns US decision to send extra troops to Europe

* Russia’s economy is prepared for more sanctions

* US special forces launch large-scale counterterrorism raid in northwestern Syria

* Eurozone economic growth continued to slow in January via PMI survey data

* High Eurozone inflation will persist, says CEO of Nordea, Denmark-based bank

* Oil giant Shell reports sharp increase in full-year profit

* Tech stocks may face new selling pressure after Facebook profit disappoints

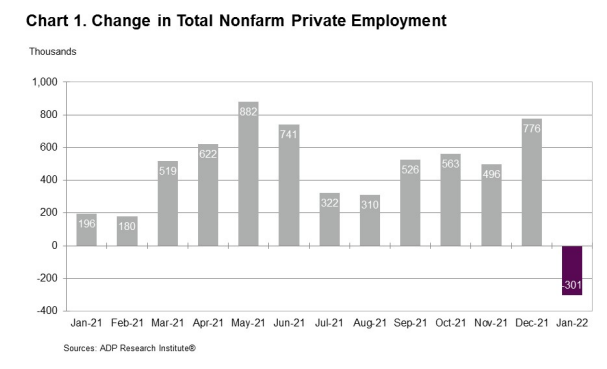

* US companies unexpected reduced employment in January, ADP estimates:

Risk Premia Forecasts: Major Asset Classes | 2 February 2022

The expected risk premium for the Global Market Index (GMI) edged down in January from the previous month’s estimate. Today’s revised 5.9% annualized forecast marks the first dip below the 6.0%-plus mark since October.