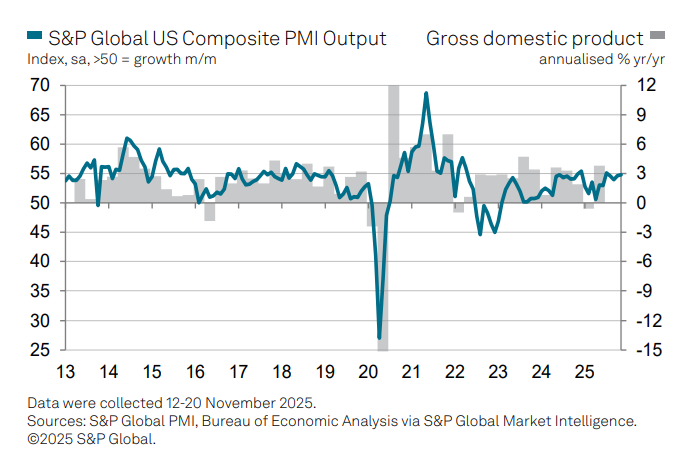

The delayed third-quarter GDP report will, presumably, be published eventually, but it’s ancient history at this point. The focus has turned to an array of data from various sources for October and November. A consensus view is still evolving, but the main takeaway at the moment is that recession risk still appears low so far in Q4.

Category Archives: Uncategorized

Macro Briefing: 24 November 2025

US business activity accelerated for a second successive month in November, according to the US Composite PMI Output Index, a survey-based GDP proxy. “The upturn looks encouragingly broad-based for now, with output rising across both manufacturing and the vast services economy,” said Chris Williamson, chief business economist at S&P Global Market Intelligence. “A marked uplift in business confidence about prospects in the year ahead adds to the good news.”

Book Bits: 22 November 2025

● Company Men: The Invention of Shareholder Value and the Splintering of the American Economy

● Company Men: The Invention of Shareholder Value and the Splintering of the American Economy

Sean Delehanty

Summary via publisher (Chicago U. Press)

How an esoteric economic theory—and its most devout believers—changed the world forever. In the modern economy, stock price is king. The value of a corporation is measured in how it enriches its shareholders, even when doing so subtracts from long-term growth or social good. Greed, in the last half-century of corporate practice, has become very good. Company Men is a sweeping intellectual history of how shareholder value rose from the lesser-known edges of academic theory to the vanguard of corporate practice.

Hiring Rebounded In September, But The Trend Is Still Weakening

The return of the government’s monthly payrolls report delivered some upbeat news yesterday. Non-farm payrolls rose more than forecast in September. The data suggests the US economy ended the third quarter with a modest degree of relative strength. But a closer look at the numbers still points to ongoing weakness, which raises questions about the economy’s strength in the months ahead.

Macro Briefing: 21 November 2025

US payrolls rebounded in September, according to the Labor Department’s delayed report. Nonfarm payrolls rose by 119,000, beating the Bloomberg consensus forecast of 53,000, while August payrolls were revised down to a small contraction of 4,000 from the previously reported gain of 22,000. Job gains continue to be concentrated in a few industries, with healthcare & social assistance, and leisure & hospitality adding 87% of the jobs in September.

Fed’s Mixed Signals From Minutes Raise Doubts About Rate Cuts

Earlier this week we asked: Is Wall Street starting to second-guess the inflation outlook? The Fed’s adding to the suspense — minutes from the Oct. 28–29 policy meeting reveal growing doubts about the case for more rate cuts.

Macro Briefing: 20 November 2025

US economic activity for the third quarter is expected to accelerate, according to the Atlanta Fed’s GDPNow model. Q3 output is expected to rise 4.2% in the July-through-September quarter, modestly above Q2’s strong 3.8% increase. The official report on Q3 should have been published by now, but has been delayed due to the government shutdown.

Hints Of A Weak Jobs Market Ahead Of Thursday’s Payrolls Report

The government has reopened and the task of piecing together the missing economic data points has started. Early clues suggest that hiring slowed in October. Meanwhile, the Labor Department will release its delayed payrolls report for September tomorrow.

Macro Briefing: 19 November 2025

The generation of baby boomers holds more than $85 trillion in assets thanks to economic conditions Gen X, millennials and others would be hard-pressed to replicate. “It’s astonishing how their relative wealth has taken off in the last 30-plus years,” Edward Wolff, an economics professor at New York University, tells The Washington Post. “They started out as among the poorest groups in terms of wealth back in 1983.” In a working paper for the National Bureau of Economic Research, he reviewed the data for 1983-2022, a period when older boomers saw their wealth climb and their younger peers recorded relative declines.

Tech And Utilities Still Lead US Equity Sectors This Year

Stocks in the technology sector, closely followed by utilities, remain the hot hands for the US stock market in 2025, based on a set of ETFs through Monday’s close (Nov. 17).