● MoneyZen: The Secret to Finding Your “Enough”

Manisha Thakor

Q&A with author via CNBC

Q: What is the “never enough” mindset?

A: I define the “never enough” mindset as a feeling that no matter how many accomplishments you achieve or how much praise you receive, it just feels like it’s never enough. And you feel almost compelled in a subliminal, toxic way to keep chasing after these things. No matter how many of them you receive, it just doesn’t seem to quench the need.

10-Year US Treasury Yield ‘Fair Value’ Estimate: 11 August 2023

The 10-year Treasury yield continues to trade at a level well above CapitalSpectator.com’s fair-value estimate, but the gap suggests that further increases in the benchmark rate are facing stronger headwinds.

Macro Briefing: 11 August 2023

* Biden says China’s economic woes are a “ticking time bomb”

* One of China’s largest property developers warns of a hefty loss

* Britain’s economy grew more than expected in Q2

* Record hot ocean temps could turbocharge hurricanes, NOAA scientists warn

* US jobless claims rise to 5-week high but not enough to raise concern

* US headline consumer inflation picks up as core CPI holds steady in July:

Foreign Bonds Lead US Fixed Income So Far In 2023

The global rise in interest rates may be peaking, a view that’s helped lift most corners of foreign bond markets year to date, based on a set of ETFs through yesterday’s close (Aug. 9).

Macro Briefing: 10 August 2023

* Biden issues executive order to steer some US investments away from China

* China rebukes Biden’s executive order that limits US investment in technology

* Downturn in world trade fuels concern of increasingly fractured global economy

* Central banks need to keep rates at roughly 5%, veteran economist predicts

* Average US mortgage rate rises to 7.02% — highest in almost 21 years

* Five bearish arguments that, so far, “haven’t worked”

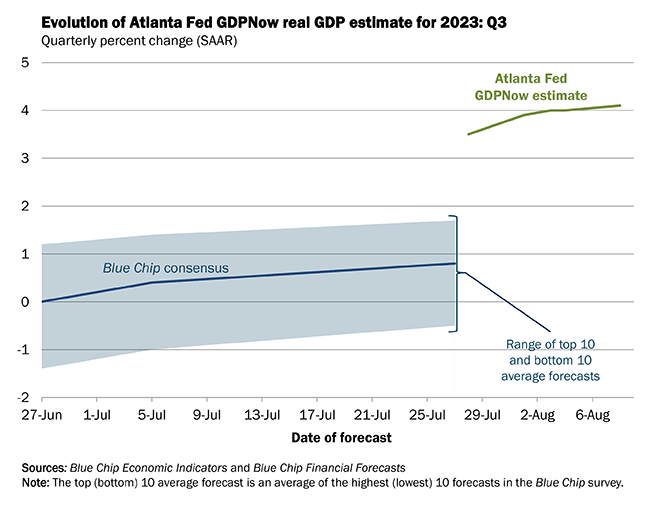

* US Q3 GDP nowcast revised up to strong 4.1% via Atlanta Fed’s GDPNow model:

Markets Continue To Signal A Risk-On Bias Prevails

The recent rally in risk assets has confounded some analysts, but right or wrong the revival in animal spirits still has momentum, based on several proxies of market behavior via ETF pairs through yesterday’s close (Aug. 8).

Macro Briefing: 9 August 2023

* US set to ban some private-equity and venture-capital investments in China

* Moody’s says it may cut credit ratings for six big US banks

* Economists expect another month of slowing inflation in July

* S&P will end ranking companies’ environmental, social and governance risks

* US trade deficit narrows in June via pullback in imports

* China consumer inflation turns negative in July for first time since 2020:

Markets See End Of Rate Hikes As Fed Officials Suggest Otherwise

Investors continue to price in high odds that the Federal Reserve interest-rate hikes are history after last month’s ¼-point increase. But the latest comments by several central bank officials tell a different story. Adding to the uncertainty: mixed expectations for Thursday’s release (Aug. 10) of July data on US consumer inflation.

Macro Briefing: 8 August 2023

* China exports drop the most in over 3 years in July

* NY Fed president expects interest rates will remain restrictive for some time

* World reaches crucial global warming threshold in July for temperature

* Climate change may threaten credit ratings for countries, study finds

* Moody’s cut credit ratings for several small to mid-sized US banks

* New lending by mortgage REITs falls sharply

* US small business confidence edges up to eight-month high in July:

US Stocks Still Lead Global Markets In 2023 By Wide Margin

Markets around the world took a hit last week, but American shares are still the clear performance leader for the major asset classes year to date, based on a set of ETFs through Friday’s close (Aug. 4).