Nowcasting the business cycle isn’t getting any easier. Despite a firehose of data and an expanding list of analytical techniques, benchmarks and related research at researchers’ disposal, debate persists about the state of the US economy. Yesterday’s release of the Leading Economic Index (LEI) from the Conference Board appears to settle the matter in favor of recession, but real-time analysis isn’t as clear-cut as this indicator suggests.

Macro Briefing: 21 April 2023

* Pentagon prepares to evacuate US embassy staff in Sudan as civil war escalates

* Eurozone economic growth rebounds to 11-month high in April via survey data

* US home sales down 2.4% in March vs. and 22% lower vs. year-ago level

* Mega-cap stocks are leading the recent rally in the equities market

* Money market funds are offering relatively high yields, but there are risks

* US jobless claims edge higher, hint at softening jobs market

* Philly Fed Mfg Index falls to lowest level since pandemic was raging

* US Leading Economic Index fell deeper into the recession zone in March:

Political Calculus, Debt-Ceiling Edition

House Speaker Kevin McCarthy and GOP leaders unveiled a bill that, in theory, temporarily solves the debt-ceiling crisis that’s brewing. In practice, the path ahead is probably no less complicated and risky than it’s been in recent months.

Macro Briefing: 20 April 2023

* House Speaker McCarthy unveils debt-limit plan

* Treasury Sec. Yellen will call for better US-China relations in speech today

* New York Fed president outlines his support for another interest rate hike

* Record temperatures for 2023 are a possibility, climate scientists predict

* Bank of America CEO predicts a mild recession is coming

* Businesses report tougher access to credit, according to Fed’s Beige Book

* Policy-sensitive 2-year Treasury yield rebounds to 5-week high:

Accounting Calculus, Debt-Ceiling Edition

In yesterday’s post I profiled my thinking on the big-picture outlook for estimating the risk associated with the debt-ceiling battle that’s brewing in Washington. To round out this analysis I’m going to dig into some of the details in pursuit of a clearer view on how this potential crisis may unfold.

Macro Briefing: 19 April 2023

* Atlanta Fed’s Bostic: one more rate hike and then a hold ‘for quite some time’

* China’s shrinking population has implications for the global economy

* World’s first tax on imports based on greenhouse gases approved in EU

* About 27% of Americans nearing retirement have no savings

* Meta will conduct another mass round of layoffs at Facebook, Instagram

* Atlanta Fed’s GDPNow model estimates US growth for Q1 was solid 2.5%

* US housing starts pull back in March, close to three-year low:

How Much US Debt-Ceiling Risk Is Lurking?

The answer relies heavily, perhaps completely, on political calculations. In other words, trying to forecast how the tortured path ahead evolves is only a bit easier than trying to grab fish in a barrel.

Macro Briefing: 18 April 2023

* House Speaker McCarthy outlines plan for vote on debt limit and spending cuts

* Hedging interest-rate risk is rare in the banking industry, study finds

* China’s economic growth picks up speed in the first quarter

* Fund managers most underweight stocks since 2009, survey finds

* AI will impact “every product of every company”, predicts Google CEO

* It’s (still) premature to predict US dollar’s demise as world’s reserve currency

* US homebuilder sentiment edges up in April but remains below neutral 50 mark

* NY Fed Mfg Index rebounds in April, marking growth for first time in 5 months:

Stocks In Developed Markets Ex-US Rally For Fourth Straight Week

Is the long-running drought in relative returns for foreign stocks vs. American shares starting to fade? It’s getting easier to consider the possibility as developed-markets equities ex-US continue to rise.

Macro Briefing: 17 April 2023

* US and its allies grapple with how to reduce economic ties with China

* GOP House Speaker McCarthy set to recommend spending cuts on Wall Street

* Democratic senators favor forcing House vote on debt limit increase

* Banks may further tighten lending standards, says Treasury Sec. Yellen

* ECB to lift deposit rate to 3.75% peak in July, survey predicts

* ECB chief says she has ‘huge confidence’ that US won’t default on its debt

* Google reportedly developing AI-powered search engine to fend off rivals

* Big banks report surging revenue and profits for the first quarter

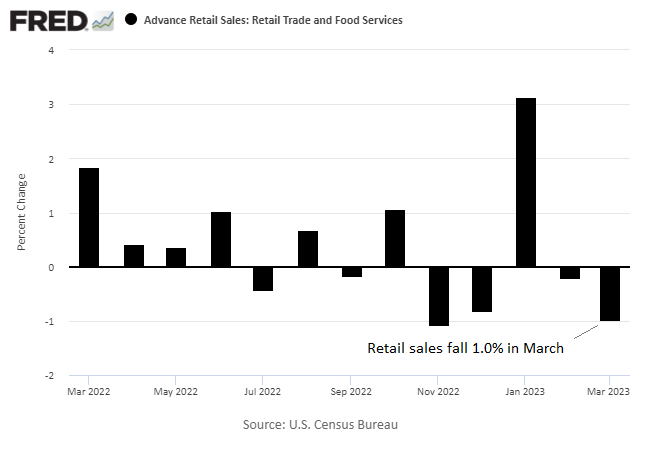

* US retail spending slump deepens in March: