* Federal Reserve expected to raise interest rates again at today’s policy meeting

* Rate hikes should be put on pause after this week, says former Fed vice chair

* Regional US bank shares drop sharply despite rescue of First Republic

* House Democrats unveil plan to force vote on lifting US debt limit

* Leaders of top AI companies to meet at White House today

* Gold price rebounds above $2000 an ounce

* US factory orders recovered in March, boosted by aircraft bookings

* US job openings fell again in March, contracting at a deeper annual rate:

Total Return Forecasts: Major Asset Classes | 2 May 2023

The expected long-run return for the Global Market Index (GMI) ticked down to a 5.9% annualized pace in April, fractionally lower vs. last month’s estimate. The forecast, based on the average estimate for three models (defined below), is near the lower range for realized performance in recent history, based on a rolling 10-year return.

Macro Briefing: 2 May 2023

* US government could run out of cash by early June, advise Yellen and CBO

* IMF lifts growth outlook for Asia, citing China recovery

* Eurozone manufacturing activity falls in April–first decline since January

* Eurozone annual inflation in April ticks up for first time in six months

* Actively-run ETFs are a small niche but growing rapidly

* US construction spending rose in March, first gain in four months

* US ISM Mfg Index edges higher, which suggests sector recession is easing:

Major Asset Classes | April 2023 | Performance Review

Most of the major asset classes continued to rebound in April, led by property shares ex-US, based on a set of ETF proxies. The downside outliers: foreign government bonds in developed markets, stocks in emerging markets and commodities.

Macro Briefing: 1 May 2023

* JPMorgan acquires failed First Republic Bank

* Fed report finds fault with its oversight in collapse of Silicon Valley Bank

* China manufacturing unexpectedly contracted in April

* South Korea’s exports fell for seventh straight month in April

* Hefty churn in jobs expected in next 5 years, economic report predicts

* Charlie Munger sees trouble ahead for US commercial property market

* US consumer spending was flat in March, reflecting slowing economy

* Fed’s preferred inflation metric slows in April, but just barely:

Book Bits: 29 April 2023

● These Are the Plunderers: How Private Equity Runs―and Wrecks―America

Gretchen Morgenson and Joshua Rosner

Review via Business Insider

According to the authors, private equity firms “buy companies and load them with debt while bleeding them of assets and profits,” only to, within a few years, “sell these same companies off to new owners … at a substantial gain.”

On its face, the idea that one could regularly flip unprofitable businesses drained of productive assets for spectacular gains just doesn’t make sense. Sure, you could find a few anecdotes in which an aggressive private equity firm successfully foisted an overleveraged company it had subjected to excessive cost-cutting onto an unsuspecting buyer. But is this credible as a strategy for deploying trillions of dollars of capital? No way.

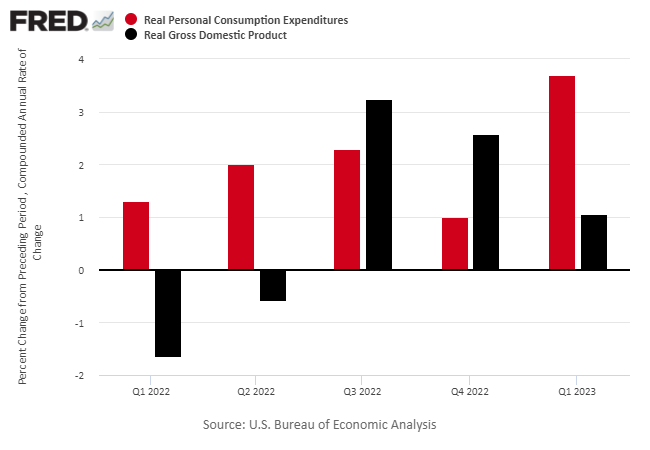

US Growth Is Slowing, But Recession Doesn’t Appear Imminent

The US economy expanded at a much slower rate than expected in the first quarter, a prelude to recession, according to some forecasters. It would naïve to rule out the possibility in the current climate, but there’s also a case for expecting the economy to muddle onward with a sluggish expansion.

Macro Briefing: 28 April 2023

* US officials working with private sector to rescue First Republic Bank

* Eurozone economy continued to stagnate in Q1

* China raises pressure on foreign companies, posing new risks for Western firms

* Pending US home sales fell in March, first decline since November

* US jobless claims fell last week, staying low despite softer economic growth

* US growth slows more than expected in Q1 as consumer spending ramps up:

Tech And Communications Still Lead US Equity Sectors In 2023

There’s no shortage of things to worry about in the months ahead, but you wouldn’t know by reviewing year-to-date returns for the leading equity sectors. Tech and communications services are still red-hot this year, leaving the rest of the field – the stock market overall – in the dust, based on a set of ETFs through yesterday’s close (Apr. 26).

Macro Briefing: 27 April 2023

* House Republicans pass debt-ceiling and spending-cuts plan, but…

* The GOP debt-ceiling bill is expected to be dead on arrival in the Senate

* Weak tax collections suggest US may default on its debt as soon as early June

* US and S. Korea unveil landmark deal to counter N. Korean nuclear threat.

* The risk from ‘shadow banks’ has increased in wake of SVB collapse

* US durable goods orders rebound sharply but business investment falls again

* Atlanta Fed’s GDPNow model sharply downgrades Q1 growth estimate: