The US Treasury 10-year yield continues to look elevated relative to CapitalSpectator.com’s “fair-value” estimate, which is based on the average of three models. That’s no assurance that the market will trim the benchmark yield, but current conditions still suggest that the odds appear skewed to a neutral/downside outlook for this rate.

Macro Briefing: 15 December 2022

* Biden announces efforts to promote trade between US and Africa

* Markets appear more optimistic on inflation outlook vs. Fed’s expectations

* Fed Chairman Powell on rate hikes: “We still have some ways to go”

* China Covid spike predates ending zero-tolerance policy, says WHO director

* China retail sales fall sharply, more than expected in November

* Atlanta Fed business inflation expectations fall ‘significantly’ to 3.1%”

* US import prices slide for fifth straight month in November

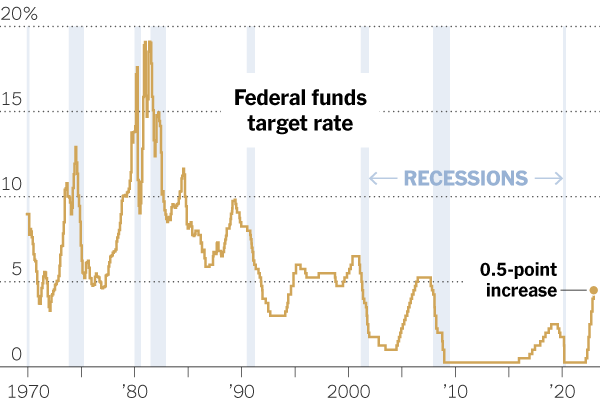

* Federal Reserve slows rate hikes, lifting target rate by 1/2 point:

Dividend Yield Is 2022’s Upside Outlier For Equity Factor Returns

The US equity market has been clawing back some of its losses recently, but reviewing results through a factor-risk lens shows dividend yield leading the field with the only positive performance for 2022, based on a set of ETF proxies.

Macro Briefing: 14 December 2022

* Fed expected to slow rate hikes in today’s policy announcement

* Biden’s Africa summit begins with goal of resetting relations

* Will the $60 price cap on Russian oil disrupt Putin’s economic strategy?

* FTX founder Sam Bankman-Fried charged with criminal fraud, conspiracy

* Quant strategies on track to post a strong run for 2022 results

* Eurozone industrial output falls more than expected in October

* UK inflation pulls back from 41-year high in November

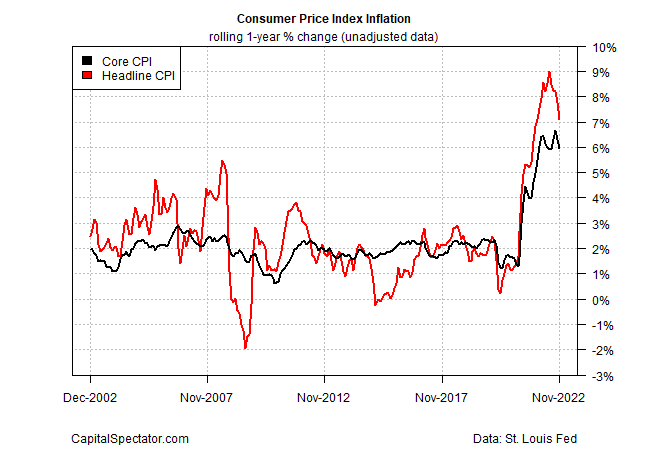

* US consumer inflation eased again in November, rising less than forecast:

How Long And How Far Will The Fed Lift Interest Rates?

The answer, of course, depends on how soon inflation shows convincing signs of behaving. There are hints that we’re now in the early phase of post-peak inflation. Today’s update on consumer price inflation for November will be a reality check, which in turn will factor into the Federal Reserve’s monetary policy decision at tomorrow’s FOMC meeting announcement. Meantime, markets are cautiously optimistic that inflation has peaked, but the outlook beyond this binary view remains murky at best.

Macro Briefing: 13 December 2022

* FTX founder Sam Bankman-Fried arrested in Bahamas

* Binance, world’s largest crypto exchange, halts withdrawals of stablecoin USDC

* China challenges US chip curbs at WTO, charging ‘trade protectionism’

* India and China troops clash at disputed mountain border

* European Union plans to tax imports based on greenhouse gas emissions

* China delays closely watched economic policy meeting due to Covid spike

* Keystone pipeline leak is now biggest oil spill in US since 2010

* US consumers lower 1-year inflation expectations via NY Fed survey

* German investor sentiment continues to recover in December

* US 10yr Treasury yield trades near recent highs ahead of Fed meeting:

Inflation And Growth Worries Weighed On Markets Last Week

Nearly all components of the major asset classes fell last week, based on a set of proxy ETFs. Real estate shares ex-US were the exception.

Macro Briefing: 12 December 2022

* Slowing growth now tops inflation as main concern for markets

* Treasury Sec. Yellen is “hopeful” that inflation has peaked

* Breakthrough reported in fusion energy by US scientists

* World will get more power from solar vs. coal in 3 years, IEA predicts

* This week’s Fed meeting will be closely watched for signals on rates outlook

* China scraps virus-tracking app as part of dismantling of zero-Covid policy

* China announces first delivery of its new domestically produced passenger jet

* Investors are increasingly inclined to expect a soft landing for US economy

* US consumer sentiment rises in December but remains near historical lows:

Book Bits: 10 December 2022

● Principles for Navigating Big Debt Crises

Ray Dalio

Summary via publisher (Avid Reader Press/Simon & Schuster)

Ray Dalio, the legendary investor and #1 New York Times bestselling author of Principles—whose books have sold more than five million copies worldwide—shares his unique template for how debt crises work and principles for dealing with them well. This template allowed his firm, Bridgewater Associates, to anticipate 2008’s events and navigate them well while others struggled badly. As he explained in his #1 New York Times bestseller Principles, Ray Dalio believes that most everything happens over and over again through time so that by studying patterns one can understand the cause-effect relationships behind events and develop principles for dealing with them well. In this three-part research series, he does just that for big debt crises and shares his template in the hopes of reducing the chances of big debt crises happening and helping them be better managed in the future.

Research Review | 9 Dec 2022 | Valuation Analysis

Preference for dividends and stock returns around the world

Allaudeen Hameed (National University of Singapore), et al.

November 2022

We find strong international evidence favoring dividend payout as a salient stock characteristic affecting expected stock returns. We find that dividend-paying stocks outperform non-payers by 0.54% per month in 44 countries, adjusting for exposures to global and regional risk factors. The majority of the dividend premium is earned during the ex-dividend months. The dividend premium is higher following bad market states and co-varies across countries. Dividend payers’ outperformance is stronger in countries with poor governance but is unrelated to local tax rates on dividends. The evidence emphasizes the importance of (time-varying) preference for dividends in driving average stock returns and global return comovement.