Our trio of proprietary strategies continued to trail their common benchmark last week (through Friday, July 23). The gap ranged from slight to substantial.

Book Bits: 24 July 2021

Romain Felli

Summary via publisher (Verso Books)

The Great Adaptation tells the story of how scientists, governments and corporations have tried to deal with the challenge that climate change poses to capitalism by promoting adaptation to its consequences, rather than combating its causes. Since the 1970s, neoliberal economists and ideologues have used climate change as an argument for creating more “flexibility” in society, for promoting more market-based solutions to environmental and social questions. This book unveils the political economy of this potent movement, showing how some powerful actors are thriving in the face of dangerous climate change and even making a profit out of it.

The ETF Portfolio Strategist: 23 July 2021

* US stocks rebound, ending the week at new high

* Portfolio strategy benchmarks post strong gains for this week’s trading

On The Road… Again

The Capital Spectator will be traveling for the rest of the week, returning with a new Book Bits on Saturday, followed by the normal routine on Monday. Cheers!

Modeling US Stock Market Expected Returns, Part II

Earlier this month I outlined a model for estimating the US stock market’s return in the decade ahead. The post is part of a larger goal is to develop several models and use the average as more reliable forecast, based on the empirical evidence that combining models tends to generate superior results vs. any one model. In addition, the focus on equities is the counterpart to a previous series on estimating “fair value” for the 10-year Treasury yield.

Macro Briefing: 21 July 2021

* World in ‘early stages’ of another Covid-19 wave, says WHO chief

* US life expectancy fell 1.5 years in 2020, biggest drop since WWII

* US economy facing stronger headwinds, including “whiff of stagflation”

* US set to drop opposition to Germany-Russia Nord Stream 2 pipeline

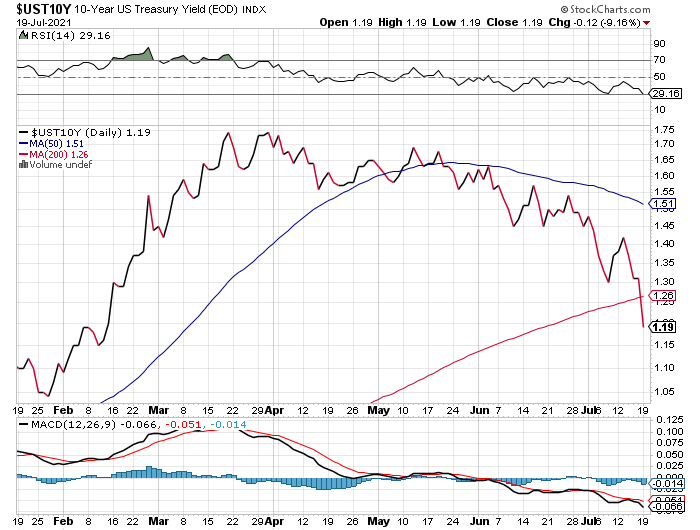

* Monthslong slide in bond yields challenges focus on inflation worries

* Senate leader struggles to keep infrastructure spending bill alive

* Covid slowing recovery for many Southeast Asian economies, says analyst

* US housing starts rose more than expected in June but permits fell again:

Are Markets Done With Inflation Worries?

In case you took a day off yesterday, there’s a new narrative circulating that inflation anxiety is history and worries about slowing economic growth have moved to the fore. Maybe, but there’s no law that says you can’t have both macro risks bubbling, or neither.

Macro Briefing: 20 July 2021

* Biden pushes for more government spending to support the economy

* 90%-plus of people hospitalized with Covid-19 are unvaccinated

* US stock market decline leaves S&P 500 near one-month low at Monday’s close

* Markets appear to be moving beyond inflation worries to concerns about growth

* Spread of Delta variant raises possibility of US 10-year yield falling to 1%

* Can Ireland block global effort to overhaul global tax rules?

* Rising dollar makes emerging markets investors nervous

* NBER declares US covid recession lasted only two months, ended in April 2020

* US 10-year yield continues to sink, falling to 1.19% on Monday:

TIPS and Commodities Led Returns For Asset Classes Last Week

Inflation-indexed Treasuries and commodities were the top performers last week for the major asset classes, based on set of exchange traded funds.

Macro Briefing: 19 July 2021

* Economists expect US economy will slow as stimulus spending fades

* Oil eases after Opec+ agrees to lift production

* Zoom buys Five9 for $15 billion to boost appeal with business clients

* US retail spending was surprisingly strong in June

* Inflation worries weigh on US consumer sentiment in early July

* 10yr-2yr Treasury yield curve narrowed to five-month low on Friday: