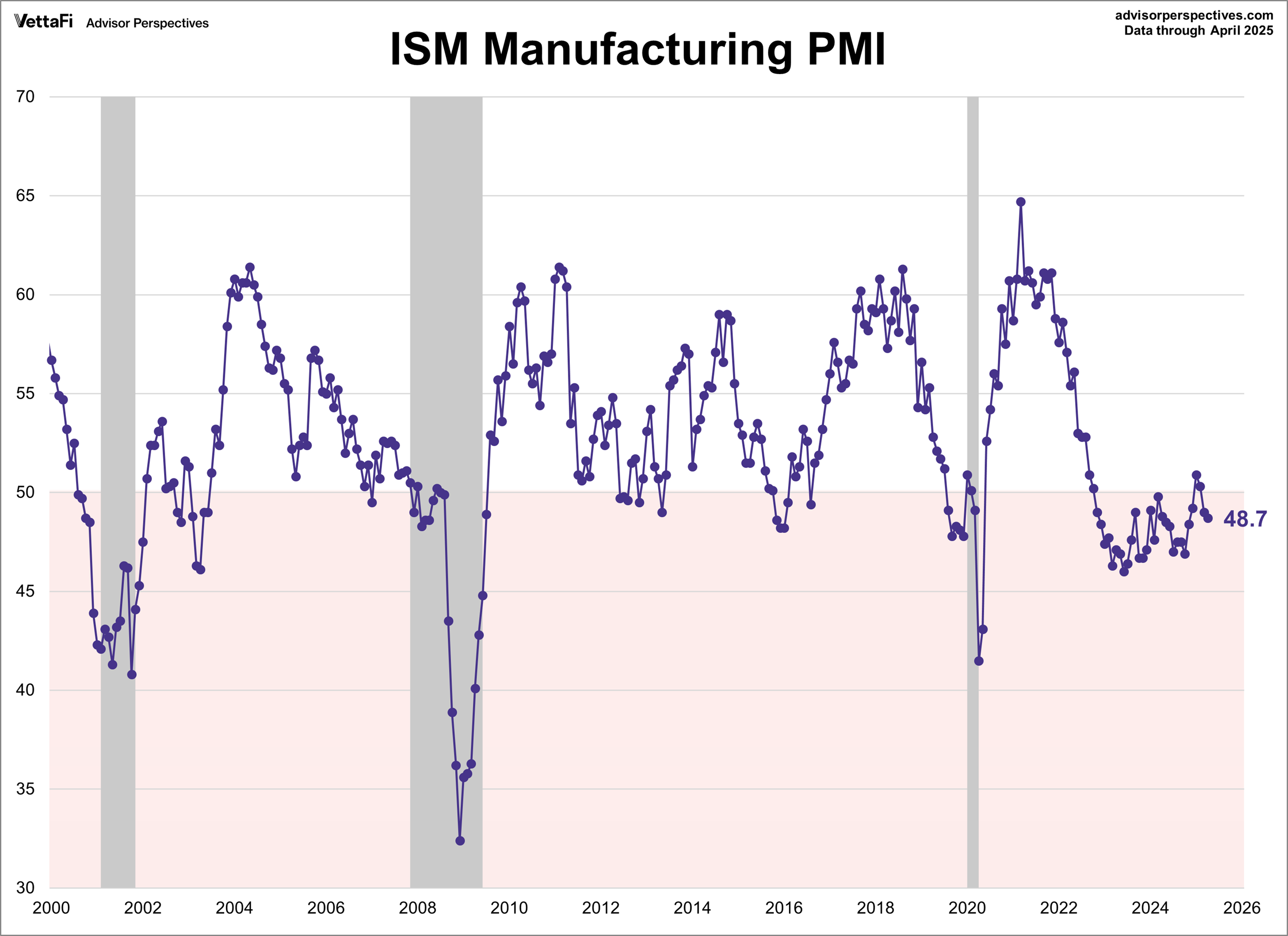

US manufacturing activity contracted for a second month in April, according to the ISM Manufacturing Index, a survey-based profile of the sector. The weak reading indicates that the brief recovery, following a 26-month run of contraction, has faded. “Demand and output weakened while input strengthened further, conditions that are not considered positive for economic growth,” said Institute for Supply Management chair Timothy Fiore said in a press release.

Major Asset Classes | April 2025 | Performance Review

Foreign markets continued to rally in March, leading returns for the major asset classes and extending a bullish trend for foreign assets in 2025, based on a set of ETFs. US stocks, US junk bonds and US property shares, by contrast, continued to lose ground. The big loser in March: commodities, which posted an unusually steep decline.

Macro Briefing: 1 May 2025

US economic activity contracted in the first quarter, according to the government’s preliminary estimate of GDP for the January-through-March period. A key factor in the 0.3% decline was a surge of imports, which subtract from growth for calculating GDP. Imports reduced the headline pace of growth by nearly 5 percentage points, the biggest negative impact on record for this category (since 1947). “Maybe some of this negativity is due to a rush to bring in imports before the tariffs go up, but there is simply no way for policy advisors to sugar-coat this. Growth has simply vanished,” said Chris Rupkey, chief economist at Fwdbonds.

Foreign Equities Continue To Outperform As US Stocks Lag In 2025

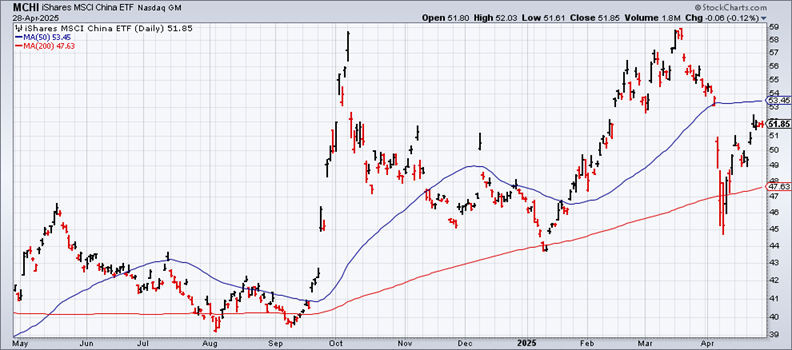

International diversification remains a winning strategy for equities so far this year. Rallies in all the primary regions of the world continue to lead US shares, which are still posting a loss year for 2025, based on a set of ETFs through Tuesday’s close (Apr. 29).

Macro Briefing: 30 April 2025

US job openings fell in March to the lowest level since September. Openings are still above the pre-pandemic level, but the latest slide extends a decline that’s been unfolding since peaking in March 2022.

US Growth Expected To Slow In Tomorrow’s Q1 GDP Report

US economic activity looks set to post a sharply softer rate of growth in Wednesday’s initial estimate of first-quarter GDP, based on the median nowcast for several estimates compiled by CapitalSpectator.com.

Macro Briefing: 29 April 2025

Treasury Secretary Bessent on Monday said Beijing is responsible for reaching a trade agreement with the US. “I believe that it’s up to China to de-escalate, because they sell five times more to us than we sell to them, and so these 120%, 145% tariffs are unsustainable.”

US Stocks And Real Estate Shares Are Still Losers In 2025

In a turbulent year for financial markets, US equities and real estate investment trusts are still bearing the brunt of the selling so far in 2025, based on a set of ETFs through Friday’s close (Apr. 25). By contrast, the rest of the major asset classes are still posting gains year to date.

Macro Briefing: 28 April 2025

US consumer inflation expectations “remain elevated,” according to revised data for this month’s poll published by the Unviersity of Michigan. “Consumers perceived risks to multiple aspects of the economy, in large part due to ongoing uncertainty around trade policy and the potential for a resurgence of inflation looming ahead.” The update also shows consumer sentiment fell for the fourth straight month, tumbling 8% from March.

Book Bits: 26 April 2025

● The Tax-Smart Donor: Optimize Your Lifetime Giving Plan

● The Tax-Smart Donor: Optimize Your Lifetime Giving Plan

Phil DeMuth

Summary via Amazon

Want to make your charitable giving go further? This groundbreaking guide reveals how to maximize the impact of every dollar you donate through strategic tax planning. Rather than making ad hoc charitable gifts, learn how to develop an intentional lifetime giving strategy that leverages the tax code to your advantage. From simple techniques like bunching donations and giving appreciated stock, to advanced strategies involving charitable trusts and retirement accounts, The Tax-Smart Donor shows you how to be a more effective philanthropist at any income level. Whether you’re making annual gifts to your alma mater or planning a major charitable legacy, this essential resource will help you do more good while keeping more of your hard-earned money away from the IRS.