President Donald Trump will leave the White House on Jan. 20, perhaps sooner if growing efforts to unseat him in the remaining days of his presidency come to fruition. Whatever happens over the next two weeks, the economic and social forces that helped elect Trump aren’t going away. In fact, there’s a distinct possibility that those forces will strengthen and broaden in the months and years ahead. In turn, political and economic uncertainty may increase, in ways that have yet to be fully understood or recognized.

Macro Briefing: 8 January 2021

* Trump says he will prepare for Biden administration to take power

* Democrats moving toward second Trump impeachment

* Calls increase for Trump’s resignation after Capitol chaos

* US foes eye opportunity to exploit US political chaos

* US envoy to UN to visit Taiwan, a trip that will anger China

* Sharp slowdown expected for today’s December US payrolls report

* US trade deficit reached a 14-year high in November

* Tesla’s Elon Musk becomes world’s richest person

* Eurozone unemployment unexpectedly ticked down to 8.3% in November

* US ISM Services PMI edged up in Dec, reflecting solid rate of expansion

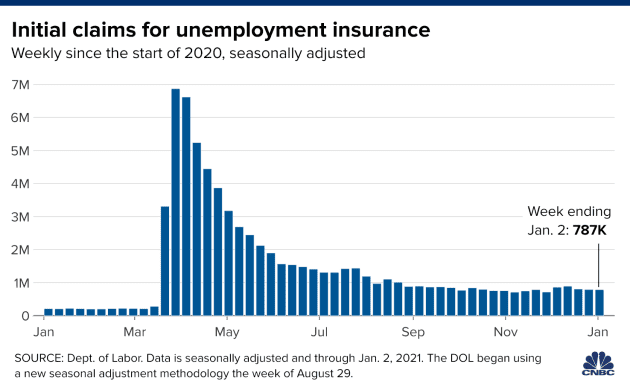

* US jobless claims remained unusually high last week

US Firms Cut Jobs In December, Clouding Economic Outlook

The assault of the US Capitol on Wednesday failed, allowing Congress to certify Joe Biden’s election victory after a harrowing day in Washington. But the challenges for the US economy endure.

Macro Briefing: 7 January 2021

* Congress certifies Biden’s election win after assault of US Capitol

* Trump pledges ‘orderly’ transition after riot on Capitol Hill

* Democrats capture Georgia’s Senate seats and win control of US Senate

* US unprepared for genetic variations of the coronavirus, experts warn

* Global economic expansion remained ‘solid’ at 2020’s close, survey data shows

* Eurozone economic confidence strengthened in December

* 10-year Treasury yield rose 1% in November

* US services sector growth slips to slowest pace in three months in December

* US private payrolls declined in Dec — first monthly setback since April:

Is A Weak US Dollar A Key Macro Theme For 2021?

The world’s reserve currency has been weakening since May and recent trending behavior suggests the slide has room to run and so it’s time for a short recap of the implications and the outlook for what could be a major driver of investment results in 2021.

Macro Briefing: 6 January 2021

* Democrats appear to win Georgia runoff elections and take control of Senate

* Congress expected to certify Biden’s win today

* VP Pence isn’t expected to try to block Biden’s election certification today

* Trump bars transactions with eight Chinese phone apps

* Second US stimulus payments has reached 2/3 of households’ bank accounts

* Hong Kong police arrest 53 pro-democracy lawmakers and activists

* Bitcoin tops $35,000–another record high

* GMO’s Jeremy Grantham warns of ‘epic bubble risk’

* US Treasury 10-year yield reaches 1% in overnight trading–highest since March

* China services sector expanded at slower pace in December via survey data

* US manufacturing activity accelerated to 2-1/2-year high in December:

Risk Premia Forecasts: Major Asset Classes | 5 January 2021

The expected risk premium for the Global Market Index (GMI) for the long run continued to tick higher in December. Today’s revised estimate rose to an annualized 5.5%, based on current data. That’s up from last month’s 5.3% projection. These forecasts represent long-run outlooks for the index’s performance over the “risk-free” rate via a risk-based model (details below).

Macro Briefing: 5 January 2021

* US Senate control hangs in the balance in today’s Georgia runoff election

* South Korea tanker diverted to Iran by Iranian Revolutionary Guard troops

* Chicago Fed president: monetary policy will be accomodative ‘for a long time’

* NYSE halts delisting of Chinese telecom companies

* Retail, jobless data suggest German economy remains resilient during pandemic

* UK recession threat deepens as new pandemic lockdown unfolds

* Global mfg growth held near decade highs in Dec, according to PMI survey data

* US construction spending rose to record high in November

* US mfg recovery from pandemic endured in December via PMI survey data:

Major Asset Classes | December 2020 | Performance Review

The year just passed left deep scars on humanity and the global economy, but there were few signs of trouble in the 2020 returns for the major asset classes. With the exception of broadly defined commodities and US and foreign property shares, global markets posted solid gains last year.

Continue reading

Macro Briefing: 4 January 2021

* Trump, in phone call, urges Georgia officials to overturn election results

* US officials consider half doses of vaccine to accelerate rollout

* Economists expect rough Q4 data for US followed by 2021 rebound

* Pelosi re-elected as House Speaker

* Survey: US political divide is biggest risk on world stage in 2021

* Smaller cryptocurrencies are rising after Bitcoin’s surge

* Eurozone manufacturing growth strengthened in December

* UK Manufacturing PMI rose to 3-year high in December

* US Treasury inflation forecasts start 2021 trading at two-year-plus highs: