Welcome to the New Year — and the sequel to last week’s first installment of notable titles that appeared in The Capital Spectator’s weekly Book Bits column in 2020. Happy reading!

The ETF Portfolio Strategist: 1 Jan 2021

In this issue:

- Stock In Asia Ex-Japan Shine In 2020

- Beta Risk Provided Strong Tailwinds For Portfolio Strategies In 2020

- A Red-Hot Year For Our Managed Volatility Strategy But Minimum Vol Stumbled

Asia Ex-Japan Equities Led 2020 Returns: If you held a healthy share of equities across Asia excluding Japan in your investment strategy last year, congratulate yourself. This slice of global asset classes not only posted the strongest return this week; Asia ex-Japan also outperformed the rest of the field for our list of proxy ETFs representing the major asset classes on a global basis.

This Concludes Our Broadcasting Year…

The Capital Spectator has left the building. So long to 2020, and good riddance. We’ll be back in the new year, starting with Best of Book Bits 2020: Part II on Saturday, Jan 2, followed by the resumption of the usual routine on Monday, January 4. Meantime, best wishes to our readers for 2021! Our model-free

The Capital Spectator has left the building. So long to 2020, and good riddance. We’ll be back in the new year, starting with Best of Book Bits 2020: Part II on Saturday, Jan 2, followed by the resumption of the usual routine on Monday, January 4. Meantime, best wishes to our readers for 2021! Our model-free forecast assumption: relief is coming.

Correlations For Return Volatility Have Spiked

Designing and managing portfolios that maximize diversification is challenging in the best of circumstances. In the wake of this year’s coronavirus pandemic, the task has become even tougher.

Macro Briefing: 29 December 2020

* House passes bill to raise stimulus checks to $2,000

* Debate over $2,000 Covid-19 aid checks shifts to Senate

* House overrides Trump’s veto of a $740.5 billion defense policy bill

* New York lawmakers pass bill that bans most evictions

* Manufacturing activity expanded for 7th month in Texas in December

* US stock market (S&P 500) jumped to record high on Monday:

Commodities Rallied And Emerging Markets Tanked Last Week

The year’s penultimate trading week was short but it didn’t lack for drama. A broadly defined, equal-weighted measure of commodities led a mixed run for the major asset classes while stocks and bonds in emerging markets posted the deepest losses, based on a set of exchange traded funds at the close of last week’s trading (Dec. 24).

Continue reading

Macro Briefing: 28 December 2020

* Trump signs pandemic relief bill, averts government shutdown

* Suspect in Nashville explosion died in blast, policy say

* Risks continue to lurk for global economy at year’s end

* UK headed for ‘bumpy period’ in Brexit transition period

* Bitcoin on track for third monthly gain in December–longest streak in over a year

* Is the worst yet to come for pandemic blowback in the US?

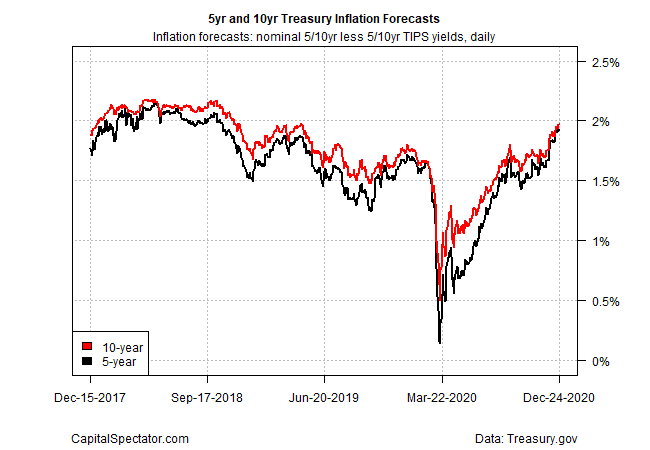

* 10yr Treasury market’s inflation forecast holds at 1.97%–highest since April 2019:

The ETF Portfolio Strategist: 26 Dec 2020

In this issue:

- US small-cap stocks continue to rally

- It’s Been A Good Year For Global Asset Allocation Strategy Benchmarks

- Managed Volatility Still Running Hot This Year

Best Of Books Bits 2020: Part I

As 2020, annus horribilus, crawls to a close, let’s look back on one of the bright corners of the year – book publishing. In matters economic and finance, the last 12 months delivered an extraordinary run of fascinating new titles. As usual in this year-end review, we’ll highlight ten that appeared in The Capital Spectator’s weekly Book Bits column over the course of 2020. Choosing only ten is difficult, and more than slightly subjective, but let’s give a whirl. As usual, the short list will be carved into two equally digestible servings, starting with five today, followed with the balance next week. Happy reading!

Holiday Schedule

The holidays have snuck up on your editor once more and so it’s time to temporarily shutter the doors at the world headquarters of The Capital Spectator. We’ll be celebrating (with masks and social distancing, of course) for the rest of the week, returning with a Best of Book Bits on Saturday, Dec. 26, followed by the usual routine on Monday, Dec. 28. Stay safe, be merry and watch out for beta coefficients masquerading as cherries in your holiday punch. Happy Christmas!

The holidays have snuck up on your editor once more and so it’s time to temporarily shutter the doors at the world headquarters of The Capital Spectator. We’ll be celebrating (with masks and social distancing, of course) for the rest of the week, returning with a Best of Book Bits on Saturday, Dec. 26, followed by the usual routine on Monday, Dec. 28. Stay safe, be merry and watch out for beta coefficients masquerading as cherries in your holiday punch. Happy Christmas!