Trump defers to Pelosi and agrees to delay SOTU speech: Politico

Upcoming Senate votes on reopening gov’t expected to fail: Bloomberg

Aviation workers: gov’t shutdown poses rising risk for air travel: NY Times

Venezuela’s opposition leader claims presidency, receives US support: Reuters

American business leaders remain upbeat on economic outlook: NY Times

Poll: US growth will slow in Q1 due to gov’t shutdown: Reuters

Eurozone economy close to stalling in Jan via PMI survey: IHS Markit

Global gov’t debt rose to $66 trillion at 2018-end–double year-ago level: Fitch

US FHFA House Price Index increased 5.7% in Oct vs year-ago level: HousingWire

Richmond Fed: mfg activity was ‘soft’ in Jan in the bank’s district: Richmond Fed

Earnings sentiment (ERR) is weakest since mid-2016: BlackRock

It (Still) Looks Like A Bear Market For US Stocks

On Christmas Eve, the US stock market appeared to be caught in a bear-market, based on econometric analysis via a Hidden Markov model (HMM). Since then, we’ve seen a strong rally in the new year. But the regime shift to the dark remains intact and in fact has strengthened.

Continue reading

Macro Briefing: 23 January 2019

Congress set to vote on bills to end partial gov’t shutdown: Politico

US national intelligence director warns of increasing threats: NY Times

UK trade minister see ‘good chance’ for a Brexit deal: CNBC

Ex-US Marine, held in Russia on spying charges, is denied bail: Newsweek

Three men and teen arrested in alleged plot to bomb muslims in upstate NY: CNN

LA teachers end week-long strike: USA Today

Brazil’s Bolsonaro gives pro-business speech at Davos: Reuters

Existing homes sales fell 10.3% in Dec vs. year-ago level: MW

US Economic Policy Uncertainty Index spiked to 2-1/2 yr high on Tues: FRED

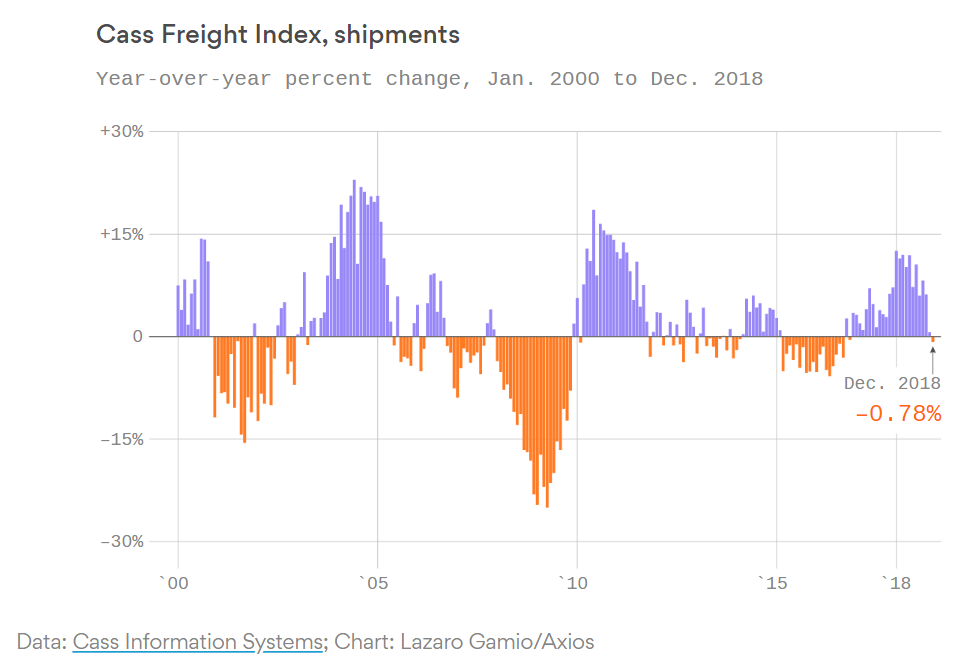

US truck shipments fell in year-over-year terms in Dec — first loss in 2 years: Axios

Value In The Lead For US Equity Factor Returns So Far In 2019

Trading is set to resume today for the US stock market with value firmly in the lead for year-to-date performance for the major equity factors, based on a set of exchange-traded funds. In fact, a positive bias prevails across the board for stocks so far in 2019. Headwinds may be brewing via several areas of concern, including softer global growth and the ongoing partial government shutdown. But as the crowd returns to work after a long weekend, value enjoys a sizable performance edge in the new year.

Continue reading

Macro Briefing: 22 January 2019

Senate unlikely to approve Trump’s plan to reopen gov’t: WSJ

Taliban attack on military base in Afghanistan kills dozens: NBC

Report finds a new previously undisclosed missile base in N. Korea: USA Today

China warns US and Canada on extradition of Huawei exec: SCMP

UK’s Labour Party moves closer to securing 2nd Brexit referendum: Reuters

US recession worries are on the rise: CNN

Americans’ outlook for economy has soured in the past 2 months: Gallup

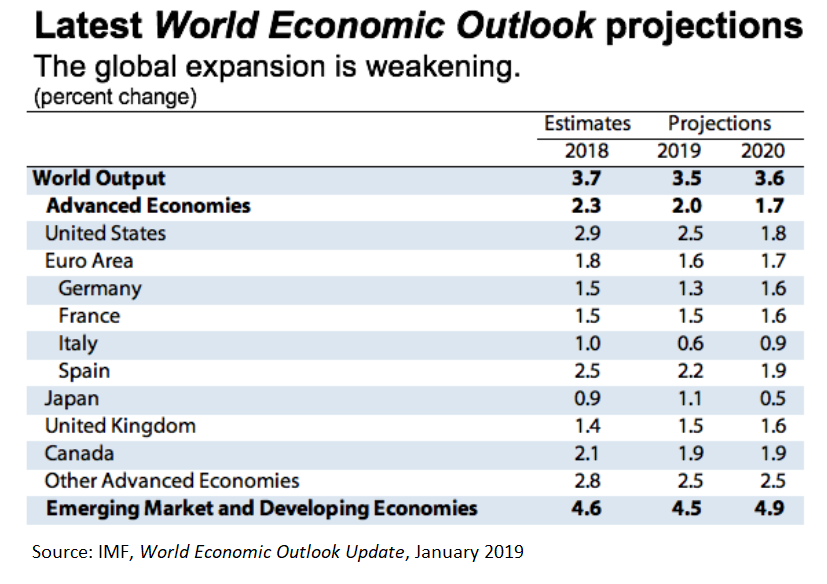

IMF trims 2019 growth estimates for global economy: IMF

US Stocks Led Last Week’s Rebound

Global equities, real estate and commodities posted solid gains last week, offsetting losses in bonds. Overall, it was a mixed week for the major asset classes, but an upside bias clearly dominated.

Continue reading

Macro Briefing: 21 January 2019

China’s economic growth decelerated to 28-year low in 2018: CNBC

Israel attacked Iranian forces in Syria: NBC

Is the Fed the source of this year’s rebound in stocks? NY Times

Senate GOP leader to introduce bill this week to reopen gov’t: Politico

Trump-Pelosi battle rages on over gov’t shutdown: WaPo

Missing US economic data due to shutdown leaves hole for macro analysis: MW

The rich have become richer since the financial crisis: Bloomberg

Consumer sentiment in US fell sharply in January: MW

US industrial output rebounded in Dec, but annual pace eased to 4.0%: CNBC

Book Bits | 19 January 2019

● The Age of Surveillance Capitalism: The Fight for a Human Future at the New Frontier of Power

By Shoshana Zuboff

Review via Los Angeles Review of Books

Silicon Valley’s Phoenix-like resurrection is a story of ingenuity and initiative. It is also a story of callousness, predation, and deceit. Harvard Business School professor emerita Shoshana Zuboff argues in her new book that the Valley’s wealth and power are predicated on an insidious, essentially pathological form of private enterprise — what she calls “surveillance capitalism.” Pioneered by Google, perfected by Facebook, and now spreading throughout the economy, surveillance capitalism uses human life as its raw material. Our everyday experiences, distilled into data, have become a privately owned business asset used to predict and mold our behavior, whether we’re shopping or socializing, working or voting.

Zuboff’s fierce indictment of the big internet firms goes beyond the usual condemnations of privacy violations and monopolistic practices. To her, such criticisms are sideshows, distractions that blind us to a graver danger: By reengineering the economy and society to their own benefit, Google and Facebook are perverting capitalism in a way that undermines personal freedom and corrodes democracy.

Continue reading

US Business Cycle Risk Report | 18 January 2019

The odds are still low that a new US recession has started, but economic momentum continues to slow. The headwinds remain moderate so far, but the potential for trouble later in the year is rising, in part due to the partial government shutdown.

Continue reading

Macro Briefing: 18 January 2019

Trump blocks Pelosi’s overseas trip, citing gov’t shutdown: WSJ

Trump-Pelosi feud dims prospects for quick end to gov’t shutdown: Bloomberg

Key dates to watch for monitoring partial gov’t shutdown: CNBC

N. Korea and US planning to discuss possibility of 2nd Trump-Kim summit: Reuters

Signs of progress on US-China trade dispute support global stock markets: Reuters

BuildFax data suggests US housing starts fell in Dec: MW

US jobless claims fell more than expected last week: CNBC

Philly Fed Mfg index strengthens in January: MW

Global Economic Policy Uncertainty Index surged in 2018: Axios