The partial government shutdown could be a slow-moving train wreck for the US economy, but for the moment the crowd’s inclined to reprice the major equity sectors higher in the new year following 2018’s haircut. With the exception of utilities, year-to-date returns are positive across the board through yesterday’s close (Jan. 16), based on a set of sector ETFs.

Continue reading

Macro Briefing: 17 January 2019

Pelosi urges Trump to delay State of the Union address: WSJ

UK’s May survives no-confidence vote: BBC

Jack Bogle, who launched index fund revolution, dies at age 89: CNBC

ISIS attack on US forces in Syria refocuses attention on US withdrawal: CNBC

US economy is ‘flying blind’ due to partial gov’t shutdown: Brookings

Half of debt in investment-grade bond funds are rated just above junk: WM

Business inflation expectations fell to 8mo low of 2.0% in Jan: Atlanta Fed

Import prices for US fell in Dec–largest drop since 2016: CNBC

Fed’s Beige Book: Concern among US businesses rising: WSJ

US homebuilder sentiment rises in Jan following 3-year low: MW

The Shutdown Begins To Weigh On The Economic Outlook

Will the US government’s stalemate over budget negotiations trigger a recession? In “normal” times this question would be dismissed as absurd. But the times they are a changin’.

Continue reading

Macro Briefing: 16 January 2019

UK’s May faces confidence vote after crushing Brexit defeat: BBC

Economic headwinds increasing for US as gov’t shutdown drags on: NY Times

China injects record amount of money into economy to support growth: CNBC

Death from opiods more likely than dying in car crash in US: USA Today

Antarctica losing ice at an increasingly rapid rate, threatening coastlines: Axios

Henry Kissinger: US-China trade dispute will likely be resolved: KraneShares

US wholesale inflation fell in Dec but annual pace steady at +2.5%: MW

NY Fed Mfg Index: mfg sector posted sharply softer growth in Dec: Reuters

US GDP Growth Remains Set For Moderate Slowdown in Q4

Economic output is still on track to decelerate to a moderately slower pace in the government’s fourth-quarter report on gross domestic product (GDP) due later this month, based on based on the median estimate for a set of nowcasts compiled by The Capital Spectator. Today’s update reflects a slightly firmer gain vs. the previous estimate published two weeks ago.

Continue reading

Macro Briefing: 15 January 2019

Polls suggest Trump is losing public support for gov’t shutdown: Fox

Officials preparing for nightmare scenarios if shutdown continues: Bloomberg

Goldman Sachs: US growth will slow but avoid recession in 2019: CNBC

Prime Minister May faces crushing defeat on Brexit vote: Bloomberg

German economic growth slowed to 5-year low in 2018: BBC

China set for more stimulus to counter economic slowdown: Reuters

The Chinese investment boom into US has nearly vanished: CNN

US GDP growth for Q4:2018 on track to slow to 2.6%, according to survey: WSJ

Consumer outlook for inflation in Dec for year ahead was steady at 3%: NY Fed

US Real Estate Investment Trusts Topped Last Week’s Gains

Securitized real estate shares in the US led markets for the broad-based gains in the major asset classes last week, based on a set of exchange-traded products.

Continue reading

Macro Briefing: 14 January 2019

Republican Senator Graham: Trump shoud support re-opening gov’t: Reuters

China’s exports in December fell the most in 2 years: Reuters

China’s trade surplus with US expands to record high: CNBC

Eurozone industrial output fell sharply in Nov–biggest slide since 2016: Reuters

UK Prime Minister May set for last-ditch effort in support of Brexit deal: BBC

Trump threatens Turkey with economic devastation over Kurds: Politico

Investors focus on softer forecasts for corporate earnings growth: WSJ

The collapse of sedan demand is weighing on US auto industry: Bloomberg

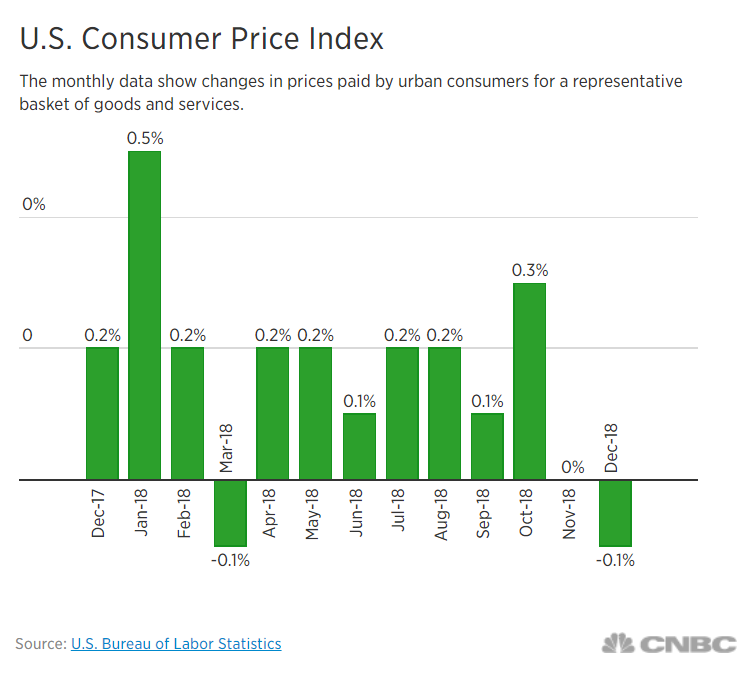

US consumer inflation in Dec fell for first time in 9 months: CNBC

Book Bits | 12 January 2019

● Broken Bargain: Bankers, Bailouts, and the Struggle to Tame Wall Street

By Kathleen Day

Review via Kirkus Review

Following the financial meltdown of 2008, writes former business journalist Day (Business Administration/Johns Hopkins Business School; S&L Hell: The People and the Politics Behind the $1 Trillion Savings and Loan Scandal, 1993), Queen Elizabeth II asked faculty at the London School of Economics why no one had noticed. It was, they said, “principally a failure of the collective imagination of many bright people.” As the author clearly shows, national and international economic systems involve many bright people, but the experts often fail—and, “given the political landscape, they will again.” Day ably documents a succession of crises that ought to have imparted essential lessons but that instead fueled further crises—e.g., tariffs or Andrew Jackson’s undoing of Alexander Hamilton’s national bank system, Jackson being the predecessor Donald Trump seems most to admire. Much of the author’s story concerns efforts to separate banking and investment, which Franklin Roosevelt characterized as “speculation with other people’s money”; every time the two are separated, of course, politicians join them together anew only to usher in another crisis.

Continue reading

It’s Been A Good Year So Far

Seven trading days don’t tell us much about price trends, but if we plead temporary insanity and restrict our view of performance to the 2019 calendar the numbers look encouraging. What can we do with this information? Not much, but as financial entertainment goes it’s amusing. Let’s throw caution to the wind and consider how some key markets are shaping up so far this year, if only as a brief distraction from the chaos unfolding in Washington and its shutdown soap opera.

Continue reading