The number of new filings for unemployment benefits in the US fell last week, delivering another encouraging round of numbers for the economy, according to this morning’s release from the US Labor Dept. The news follows upbeat data for the labor market overall in August. Considering all the numbers to date reaffirms the view that business cycle risk remains low.

Continue reading

Calls To Delay Fed Rate Hike As 2-Year Yield Rises

The World Bank and two influential economists–Larry Summers and Paul Krugman–have joined the do-not-raise-rates club of doves. The Treasury market, however, is still expecting that the Federal Reserve will tighten monetary policy at next week’s meeting, according to the rate-sensitive 2-year maturity, which ticked up to a seven-week high of 0.75% yesterday (Sep. 9) via daily data from Treasury.gov.

Continue reading

Initial Guidance | 10 September 2015

US Recession Risk Is Still Low Based On August Labor Market Data

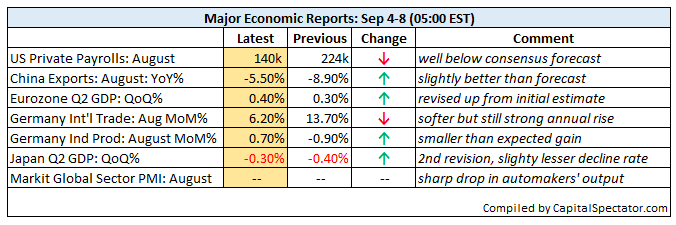

The pace of growth for US private payrolls stumbled in August, but last month’s deceleration doesn’t translate into a warning sign for the business cycle. That’s the message in yesterday’s monthly update of the Federal Reserve’s Labor Market Index (LMCI), a multi-factor benchmark that’s designed as a comprehensive measure of the broad trend for job-market indicators. Expectations for low recession risk also finds support in initial jobless claims numbers and a markets-based proxy for estimating business cycle conditions.

Continue reading

Initial Guidance | 9 September 2015

Skewed By Randomness: Testing Arbitrary Rebalancing Dates

How much influence do investors have over their portfolios? Perhaps it’s less than commonly assumed. The notion that randomness plays a role in money management has been widely studied in finance–Nassim Taleb’s popular treatment in Fooled by Randomness: The Hidden Role of Chance in Life and in the Markets is one example. The concept is a staple in the money game, although it’s easily overlooked, even ignored in some cases. Consider a simple rebalancing strategy. Does it matter which dates you choose to return a portfolio mix back to the target weights? Maybe, but the details matter quite a lot in terms of the answer. For instance, crunching the numbers on an 11-fund portfolio with a Dec. 31, 2003 start date shows that randomly choosing rebalancing dates tends to perform as well if not better than a consistent year-end remix and a buy-and-hold strategy (based on daily data).

Continue reading

Initial Guidance | 8 September 2015

● Fed’s Williams sees rate hike this year… maybe | MarketWatch

● US bond market gives green light for rate hike | Bloomberg

● China commodity imports slump on weak demand | Reuters

Labor Market Conditions Index: August 2015 Preview

The Federal Reserve’s Labor Market Conditions Index is expected to tick lower to 1.0 in tomorrow’s update for August vs. the previous month, based on The Capital Spectator’s average point forecast for several econometric estimates. The prediction suggests that labor market conditions weakened slightly in August vs. July.

Continue reading

Book Bits | 5 September 2015

● Playing the Long Game: How to Save the West from Short-Termism

By Laurie Fitzjohn-Sykes

Summary via publisher (Imprint Academic)

We obsess about what our politicians are doing, but ignore that our companies are no longer investing, instead they are focusing on next quarter’s profits in order to justify ever higher executive compensation. This is in turn accelerating the West’s economic decline versus the East. While the short-term focus of business is becoming widely acknowledged, we are not doing enough to reverse this. Looking at the less known history of companies shows us the choices we can no longer afford to ignore. Some current reforms need to go further and some areas that need reform are currently being ignored. Encouraging our businesses to invest again is one of the most important issues of our time.

Continue reading

US Job Growth Stumbles In August

Private payrolls in the US grew at a surprisingly slow pace in August, according to this morning’s monthly employment update from the US Labor Dept. Companies created 140,000 new jobs last month—well below expectations for 200,000-plus. The disappointing news raises new questions about the strength of economic growth–and the timing of the Federal Reserve’s interest-rate hike.

Continue reading