* Markets will focus on today’s speech by Fed Chairman Powell at Jackson Hole

* US existing home sales rise in July–first monthly gain in 5 months

* Canada government ends rail strike, ordering arbitration for labor dispute

* July economic output slowed: Chicago Fed Nat’l Activity Index

* US jobless claims up slightly, remain middling vs. recent history

* US economic activity eases in August but still points to 2%-plus growth: PMI

Two Rounds Of Key Economic Reports To Go Ahead Of US Election

The economy isn’t always decisive in US presidential elections, except when it is. Think Herbert Hoover in 1932 and George H.W. Bush in 1992. Each lost the presidency to a challenger primarily because of the economy. Current conditions are far less extreme, of course. In fact, by a number of metrics, the economy looks relatively solid. But there are also plenty of challenges brewing and so it’s debatable how much the economy will influence the results of Nov. 5 and which candidate will benefit the most.

Macro Briefing: 22 August 2024

* Fed minutes highlight a “likely” rate cut in September

* Fannie Mae economists lower expectations for 2024 home sales

* Business inflation expectations fall to 2.2% in August: Atlanta Fed survey

* Eurozone business activity rises at faster pace in August: PMI survey

* US payrolls growth revised down by 818,000 for year through March 2024:

Bond Market Momentum Firmly Bullish Ahead Of Fed Conference

Fixed income as an asset class is looking bullish as Fed Chairman Powell prepares to give a widely anticipated speech this Friday (Aug. 23). The central banker is expected to drop clues about the outlook for monetary policy for the rest of the year — clues that are forecast to favor higher bond prices and lower yields.

Macro Briefing: 21 August 2024

* Markets prepare for today’s revision of US employment statistics

* Slowing US jobs market will be topical for central bankers at Jackson Hole

* FAA orders inspections of Boeing 787s after midair dive

* Berkshire Hathaway reduces stake in Bank of America

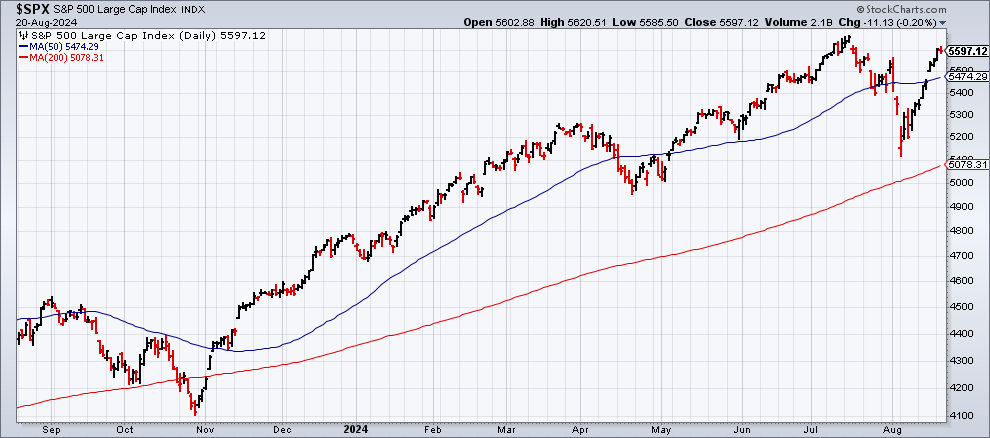

* US stocks slip on Tuesday, breaking 8-day winning streak:

Are Utilities The New Must-Own Equity Sector?

Recent stock market turbulence has left two equity sectors outperforming this year: communications services and utilities, based on set of ETFs through Monday’s close (Aug. 19). The remaining sectors are trailing the broad market, albeit with positive results.

The top performer in 2024: Communication Services ETF (XLC), which is up 20.7%, moderately ahead of the 18.5% rise for US shares overall via SPDR S&P 500 (SPY).

Macro Briefing: 20 August 2024

* Canadian rail strike could have economic ripple effects for US

* AI hype is fading as investors worry about profits for the technology

* China leaves key lending benchmark interest rates unchanged

* US consumer inflation expectations fall sharply at medium-term horizon, but…

* NY Fed survey also finds workers increasingly worried about losing their jobs

* US Leading Economic Index continues to slide in July:

Will Last Week’s Upbeat Economic Data Delay Rate Cuts?

US recession risk appeared to ease in the wake of last week’s encouraging updates for retail sales and jobless claims. Will the better-than-expected numbers delay the widely expected rate cut that markets are pricing in for the Federal Reserve’s Sep. 18 policy meeting?

Macro Briefing: 19 August 2024

* Federal Reserve’s Jackson Hole Symposium in focus this week for markets

* Goldman Sachs cuts odds of US recession to 20% after upbeat economic data

* Start-up business failures rise 60% in US vs year-ago level

* Gold trades at record high and analysts expect the rally to continue

* Trump’s plans for raising tariffs is a key uncertainty factor for markets

* US consumer sentiment “essentially unchanged” for fourth month in August:

Book Bits: 17 August 2024

● On The Edge: The Art of Risking Everything

● On The Edge: The Art of Risking Everything

Nate Silver

Review via AP

By the time you finish Nate Silver’s new book, you’ll probably want to do something risky.

Not for the sake of adrenaline or to the point of being reckless, but because you might be convinced that the occasional gamble — more than most people are comfortable with — is worth it.

In “On the Edge: The Art of Risking Everything,” Silver compellingly theorizes that humans are in general too risk averse, and that those who can discerningly fight that impulse often benefit greatly in life.