* European Central Bank expected to announce rate cut this week

* Opec announces extension of oil-production cuts into next year

* Eurozone factory output close to stabilizing in May via PMI survey data

* China manufacturing activity surges in May, survey data show

* Chicago PMI plunges to 4-year low in May

* US PCE inflation held steady at 2.7% year-over-year pace in April

* US consumer spending and income growth slow in April:

Book Bits: 1 June 2024

● The Hamilton Scheme: An Epic Tale of Money and Power in the American Founding

● The Hamilton Scheme: An Epic Tale of Money and Power in the American Founding

William Hogeland

Summary via publisher (Macmillan)

Forgotten founder” no more, Alexander Hamilton has become a global celebrity. Millions know his name. Millions imagine knowing the man. But what did he really want for the country? What risks did he run in pursuing those vaulting ambitions? Who tried to stop him? How did they fight? It’s ironic that the Hamilton revival has obscured the man’s most dramatic battles and hardest-won achievements—as well as downplaying unsettling aspects of his legacy. Thrilling to the romance of becoming the one-man inventor of a modern nation, our first Treasury secretary fostered growth by engineering an ingenious dynamo—banking, public debt, manufacturing—for concentrating national wealth in the hands of a government-connected elite. Seeking American prosperity, he built American oligarchy. Hence his animus and mutual sense of betrayal with Jefferson and Madison—and his career-long fight to suppress a rowdy egalitarian movement little remembered today: the eighteenth-century white working class.

US Q1 GDP Revised Down, But Q2 Nowcasts See Firmer Growth

US economic growth rose a modest 1.3% in the first quarter, a softer increase vs. the government’s initial 1.6% estimate. The revised data reflects a sluggish pace of growth and the second straight quarterly downshift. But the current nowcast for Q2 suggests that output will stabilize if not strengthen, based on the median for a set of estimates compiled by CapitalSpectator.com.

Macro Briefing: 31 May 2024

* Opec set to meet amid cartel’s limited influence on oil market

* Senate Democrats call for Big-Oil probe over price fixing

* AI-related data centers may use 9% of US electric supply by 2030, study finds

* Pending home sales in US slump to lowest level since pandemic’s start

* US jobless claims edged up last week but remain low

* US Q1 GDP growth revised down a sluggish 1.3%:

Will Fed’s Preferred Inflation Gauge Tick Lower In Friday’s Update?

Tomorrow’s update on US inflation for April looks set to tick lower, although the odds aren’t trivial that pricing pressure will remains sticky, according to various forecasts and a review of pricing trends published to date. Disinflation is still intact, based on numbers in hand, but the report scheduled for Friday, May 31, will probably show limited progress on taming inflation.

Macro Briefing: 30 May 2024

* US economy continues expanding, Fed’s Beige Book reports

* Extreme heat will slow US growth, San Francisco Fed study predicts

* Lingering inflation pressures are preventing Fed from cutting rates

* German inflation rises more than forecast ahead of ECB rate decision

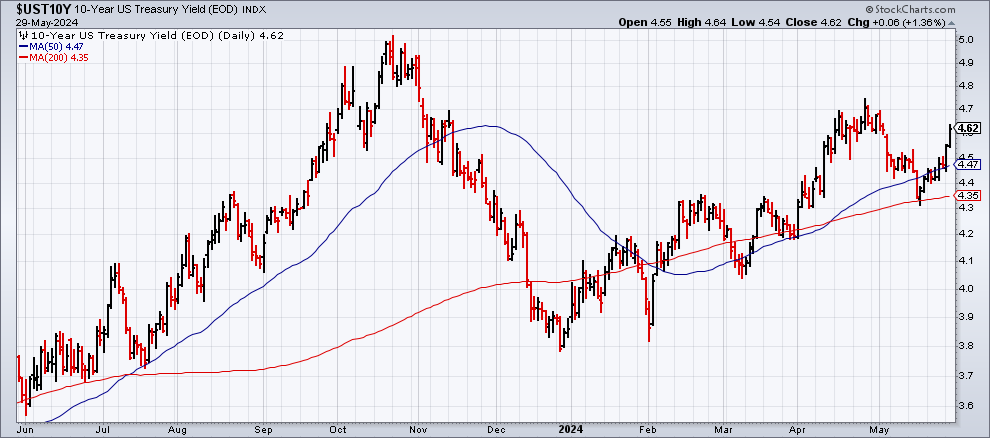

* US 10yr yield rises above 4.6% for first time in over a month:

Africa Stocks Take Lead For Global Equities Market In 2024

After a punishing start to the year, shares in Africa have rebounded and are now the leading performer for the global stock market in 2024, based on a set of ETFs tracking the world’s main regions through yesterday’s close (May 28).

Macro Briefing: 29 May 2024

* Robust earnings outlook is a key factor for stock market optimism

* IMF lifts China economic forecast to 5%, up from 4.6%

* US consumer confidence index rises in May–first increase in four months

* Low stock market volatility may be underpricing risk

* Texas manufacturing activity weakens slightly in May

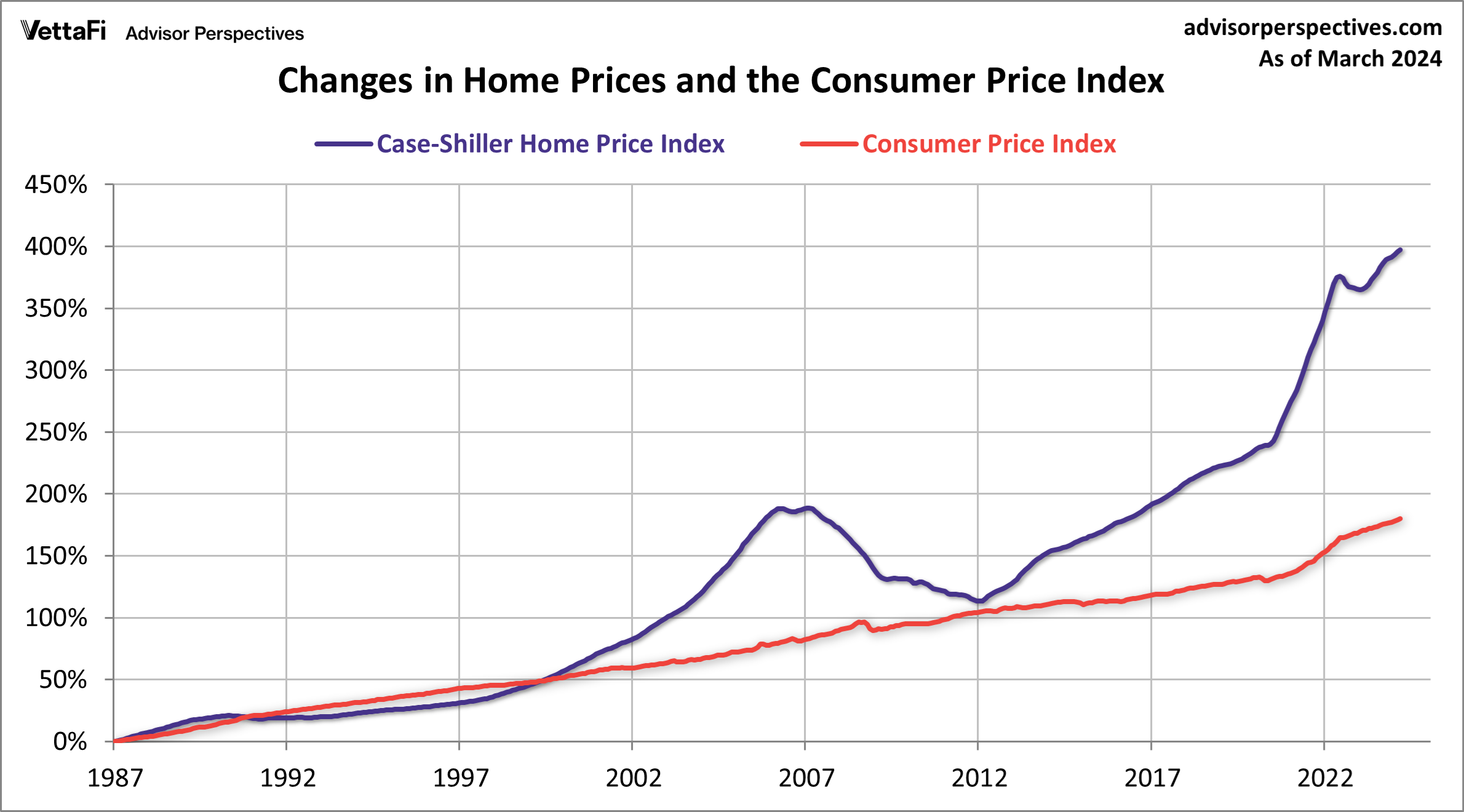

* US home prices rise to a new record high in March:

US Economic Data Still Reflect Low Recession Risk — Will It Last?

A broad set of US economic indicators continue to show that the odds are low that an NBER-defined recession has started or is imminent. This profile upends the dark narrative favored in some quarters. There are possible warning signs brewing on the horizon, but the case for expecting trouble is still weak, according to the numbers.

Macro Briefing: 28 May 2024

* US stock market was far more concentrated in the 1950s and 1960s vs today

* Global debt nears 100% of global GDP–highest since the Napoleonic Wars

* European Central Bank signals it’s likely to cut interest rates on June 6

* China is a tough act to match in the West for achieving parity in manufacturing

* Fed’s Kashkari wants ‘many more months’ of good inflation data before rate cut

* US durable goods orders stagnate for 1-year trend through April: