● A World Safe for Commerce: American Foreign Policy from the Revolution to the Rise of China

● A World Safe for Commerce: American Foreign Policy from the Revolution to the Rise of China

Dale C. Copeland

Review via The Wall Street Journal

There is therefore a historical irony that comes in Mr. Copeland’s important final chapter, for the story here, as he puts it, is of “the great geopolitical struggle” of the 21st century “between a seemingly declining United States wanting to maintain a semblance of preeminence and a rising China seeking to establish itself as a dominant, if not the dominant, state in its region and perhaps the world.” Here, for the first time in more than a century, there exists another nation with a GDP almost as large as America’s, a nation that sells far more to the U.S. than it purchases, a nation that seems impervious to American pressure. All this suggests to Mr. Copeland that there is a trade war in which America seems to be losing, not winning. “A World Safe for Commerce” thus ends with the author’s recommendations for robust policies to preserve America’s world order, which may be another reason for paying attention to this work.

Research Review | 9 February 2024 | Cross Market Analytics

A Changing Stock-Bond Correlation: Explaining Short-term Fluctuations

Garth Flannery (BlueCove) and Daniel Bergstresser (Brandeis Intl Business School)

December 2023

This paper builds on a framework that uses macroeconomic drivers to explain long-term variation in the correlation between stocks and bonds. The existing work focuses on the relative volatility of growth and inflation and the correlation between them and explains about 70 percent of the variation in rolling 10-year stock-bond correlation. We focus on forecasting short-term variation in stock-bond correlation with measures that capture the extent to which individual forecasters’ predictions about those markets have the same sign or opposing signs. Our framework enhances stock-bond correlation forecasting at tactical horizons, which we define here as the next three months.

Macro Briefing: 9 February 2024

* OpenAI’s Sam Altman seeks to raise trillions of dollars to reshape chip industry

* China’s real estate crisis is starting to spill across borders

* Economists debate outlook for China’s economy

* Emerging markets have been surprisingly resilient despite rising interest rates

* Nuclear fusion project achieves world record in generating energy

* US jobless claims remain near lowest level in decades:

Interest Rates Are Still Biggest Short-Term Risk: Nobel Economist

It’s hardly the first time that the sharp rise in interest rates over the previous two years has prompted warnings about the business cycle outlook from an economist. Yet the forecast still resonates when it comes from a Nobel laureate, even in the wake of the latest upbeat US economic news.

Macro Briefing: 8 February 2024

* Fed officials offer cautious outlook on expectations for rate cuts

* China deflation deepens in January–prices fall at fastest rate in 15 years

* US trade deficit narrowed in 2023 by the most since 2009

* CBO projects US federal budget deficit at 6.1% of GDP for 2025 vs 2024’s 5.6%

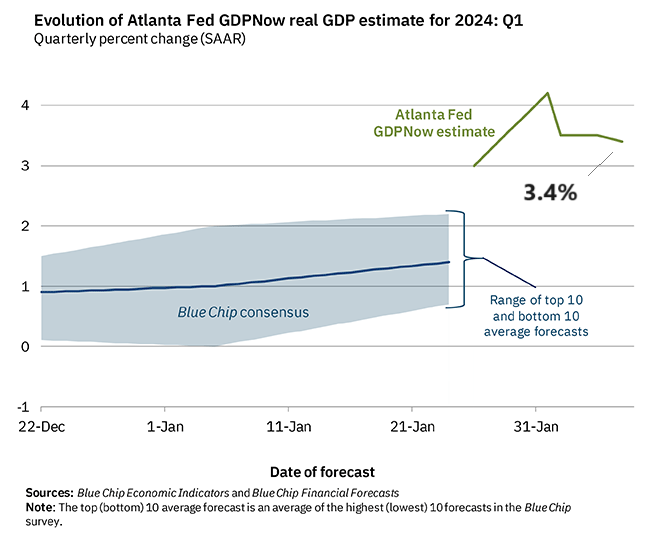

* US GDP Q1 nowcast via Atlanta Fed’s GDPNow model in line with Q4’s increase:

US Stocks Remain Upside Outlier For Major Asset Classes In 2024

It’s lonely at the top. American shares are posting strong year-to-date results in 2024. Granted, it’s only early February. But the striking distance between the gain in US stocks vs. the rest of the major asset classes is still striking, based on ETF proxies through Tuesday’s close (Feb. 6).

Macro Briefing: 7 February 2024

* US bills on border security, Ukraine and Israel aid falters amid GOP dysfunction

* S&P 500 Q4 earnings reported to date (about 2/3 of firms) beat expectations

* Credit card debt in US rises to new high in Q4 as delinquencies surge

* BP reports 2nd highest profit in decade, joining strong results for oil majors

* World’s largest chipmaker will build a second factory in Japan

* NY Community Bancorp downgraded to junk, sparking fears for regional banks:

US Treasury Market Misjudges Timing On First Rate Cut… Again

We’ve been here before. In the spring of 2023, the bond market rallied sharply, effectively forecasting a rate cut by the Federal Reserve. But the punt turned to tears as the Federal Reserve continued raising interest rates, causing bond prices to sink and yields to spike.

Macro Briefing: 6 February 2024

* Fed can delay rate cuts due to strong economy: Minneapolis Fed President

* Global growth edges up to 7-month high in January via PMI survey data

* Are China’s efforts to curb stock market rout too little too late?

* US Treasury officials head to China to discuss policy

* US bond yield looks unattractive relative to stock market’s earning yield

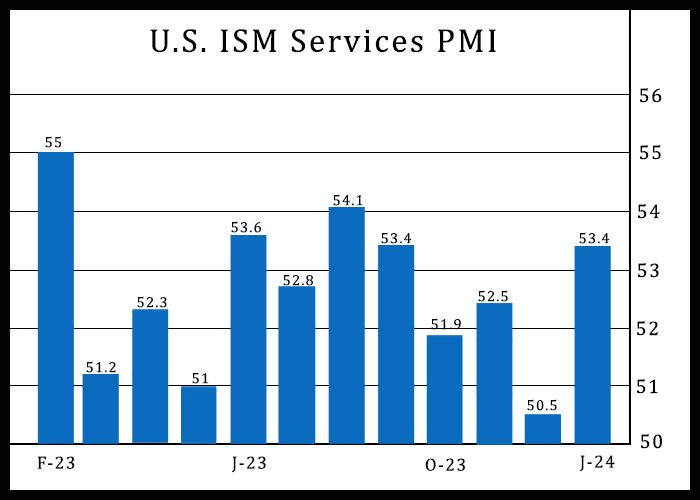

* ISM Services Index rebounds more than expected in January:

American Stocks Continue To Lead Global Equities ex-US In 2024

Betting on the demise of the long-running leadership of US shares over foreign markets has been a losing proposition for some time and the early going in 2024 suggests the trend persists. It’s only February and so the new year is still ripe with opportunity, risk and surprise. But judging by year-to-date results, old history is repeating, again, in terms of relative performance for US stocks, based on a set of ETFs through Friday’s close (Feb. 2).