* Victory still not imminent on inflation war, advise economists

* Teamsters president asks White House not to intervene in looming UPS strike

* JP Morgan and Goldman Sachs lower US recession odds

* Slower China growth not a first-order risk for America, according to US officials

* Russia steps up economic war on West by seizing assets of two companies

* CNN Money Fear and Greed index stays in “Extreme Greed” zone on Monday

* US housing market recession appears to be fading

* US chip industry presses Biden to refrain from additional China curbs

Monthly Archives: July 2023

Strong Gains Lift Most Major Asset Classes This Year

Across-the-board rallies in all the major asset classes last week strengthened year-to-date performances in markets around the world, based on a set of ETFs. The downside outlier: a broad measure of commodities, which continues to post a moderate loss so far in 2023 as of Friday’s close (July 14).

Macro Briefing: 17 July 2023

* Market’s high weights in big stocks suggest investors uncertain on economy

* China GDP growth for Q2 rises substantially less than forecast

* Analysts cut China growth outlook after disappointing Q2 data

* Russia suspends grain deal that allowed Ukraine exports to world

* As the demographics of aging unfold, it will reshape the global economy

* Markets cautiously optimistic that inflation will continue to ease

* Equity strategists lift S&P 500 earnings forecasts

* US stocks (S&P 500) on Friday closed at highest weekly high since March 2022:

Book Bits: 15 July 2023

● The Paradox of Debt: A New Path to Prosperity Without Crisis

Richard Vague

Summary via publisher (U. of Pennsylvania Press)

When we talk about debt and its impact on our economy, we almost always mean “government debt.” However, this is only a small part of the picture: individuals, private firms, and households owe trillions, and these private debts are vital to understanding the economy. Author Richard Vague examines the assets, liabilities, and incomes of the entire country, private and public sector, to reveal its net worth. His holistic analysis shows that the real factor that drives both financial crises and spiraling inequality—but also, paradoxically, economic growth—is ever rising private debt. The paradox is that while debt is essential and our economy relies on it, it also brings instability unless it is periodically deleveraged—and that is very hard to do. It can, however, be carefully managed, and Vague ends the book by showing how to do so in policy areas ranging from trade and housing to financial policy and student debt.

Has The Fed’s Rate-Hiking Cycle Peaked?

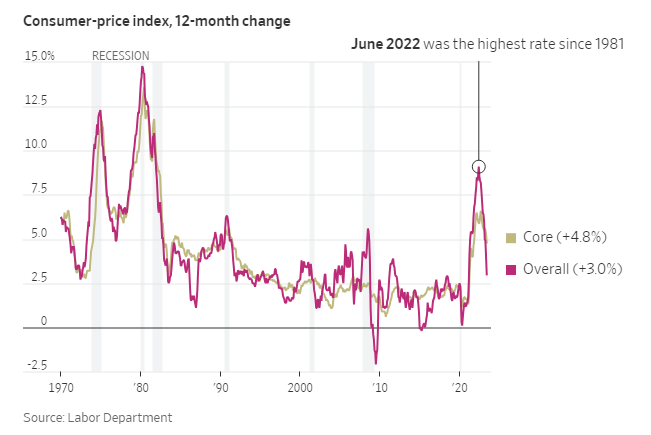

This week’s news on consumer inflation supports the case for expecting that the Federal Reserve’s interest rate hikes are approaching the end game. The basic calculus is that are disinflation persists, the odds rise that the central bank will pause its policy of tightening monetary policy.

Macro Briefing: 14 July 2023

* Falling US dollar is boost for risk assets across the globe

* US federal deficit surges in first nine months of fiscal year

* Soft landing odds rise for US economy after release of inflation data for June

* Wholesale inflation barely rose in June vs. year-ago level

* Too early to declare victory on inflation, says SF Fed president

* US jobless claims tick down, holding near multi-decade low:

10-Year US Treasury Yield ‘Fair Value’ Estimate: 13 July 2023

The 10-year Treasury yield looks elevated relative to CapitalSpectator.com’s fair-value modeling. But after yesterday’s news that US consumer inflation fell more than expected in June, the relatively wide spread will likely narrow in the months ahead.

Macro Briefing: 13 July 2023

* Will new US investment restrictions on China derail latest diplomatic outreach?

* China exports fell the most in three years in June

* IEA cuts global oil demand forecast for 2023

* US economic activity increased slightly since late May: Fed Beige Book

* Business inflation expectations unchanged at 2.8% in July: Atlanta Fed survey

* Elon Must announces new company focused on artificial intelligence

* US junk bond market shrinks sharply after rate hikes

* “Inflation story is history,” predicts Johns Hopkins University Steve Hanke

* US consumer inflation slows to softest pace in more than two years:

Macro Briefing: 12 July 2023

* More rate hikes expected no matter what today’s US inflation data reveals

* Possible UPS strike would be “disruptive” for US economy

* Auto industry prepares for contentious talks with unions

* Demand for lithium and other critical minerals is surging, IEA says

* Housing market may be near inflection point as prices look set to spike

* Variations for measuring inflation stir debate on which metrics are best

* World expected to consume more oil than it produces in 2023

* US Dollar Index trades near lowest level in over a year:

US Recession Risk Is Still Low, Defying Recent Forecasts

New York Fed President John Williams says “I don’t have a recession in my forecast.” Neither does CapitalSpectator.com. That’s not blind adherence to a central banker’s prognostications. Rather, the view on these pages is based on the data. Not a single indicator, but a broad sweep of the numbers.