Financial markets have had a bumpy ride lately, inspiring fresh concerns that this year’s rebound from 2022’s sharp loss has run its course. It’s premature to dismiss that possibility, but a review of several sets of ETF pairs for markets still leave room for debate, based on prices through yesterday’s close (Sep. 5).

Macro Briefing: 6 September 2023

* Federal Reserve expected raise its US economic forecast this month

* Saudi Arabia extends oil output cut through end of the year

* China economic slowdown is a “top risk” for US, advise EY economists

* China bans iPhones and other foreign devices from use in government offices

* US consumer spending will slow but remain solid, predicts Goldman Sachs

* US factory orders fell sharply in July, first monthly decline since February:

Total Return Forecasts: Major Asset Classes | 5 September 2023

The expected return for the Global Market Index (GMI) ticked up in August from the previous month. Today’s revised long-run forecast for this benchmark — a market-value-weighted portfolio that holds all the major asset classes (except cash) via a set of ETF proxies — edged up to an annualized 6.6% return, the highest so far in 2023.

Macro Briefing: 5 September 2023

* Will a strong job market immunize the US from recession? Maybe not

* China Composite PMI, a GDP proxy, indicates Aug growth slowest since Jan

* China’s Country Garden, a property developer, avoids default–again

* Eurozone economy contracts at faster pace in August via PMI survey data

* Modest global mfg contraction continued in August via PMI survey data

* US manufacturing activity contracted for 10th straight month in August

* US payrolls rose more than forecast in August

* Economists expect US economic growth will slow in 2024:

Labor Day Weekend 2023

The Capital Spectator never argues with long holiday weekends, and this Labor Day is no exception. The wheels for the machinery start turning again on Tuesday, Sep. 5. Meanwhile, Sophocles comes to mind: “Without labor nothing prospers.”

The Capital Spectator never argues with long holiday weekends, and this Labor Day is no exception. The wheels for the machinery start turning again on Tuesday, Sep. 5. Meanwhile, Sophocles comes to mind: “Without labor nothing prospers.”

Major Asset Classes | August 2023 | Performance Review

Cash led the performance race in August for the major asset classes, based on a set of proxy ETFs. In fact, most markets posted losses last month. The handful of winners, in addition to cash: a broad measure of commodities and US junk bonds.

Macro Briefing: 1 September 2023

* US consumer spending accelerated in July

* Slowing sales at Dollar General suggest softer US consumer spending ahead

* Eurozone manufacturing PMI reflects “steepening downturn in August”

* China’s economic headwinds may be linked to the ‘paradox of thrift’

* China Manufacturing PMI shows stronger operating conditions in August

* US mortgage rates ease after 5 weeks of climbing

* US jobless claims eased last week, remaining near multi-decade low

* Chicago PMI survey data continues to indicate contracting mfg activity in August

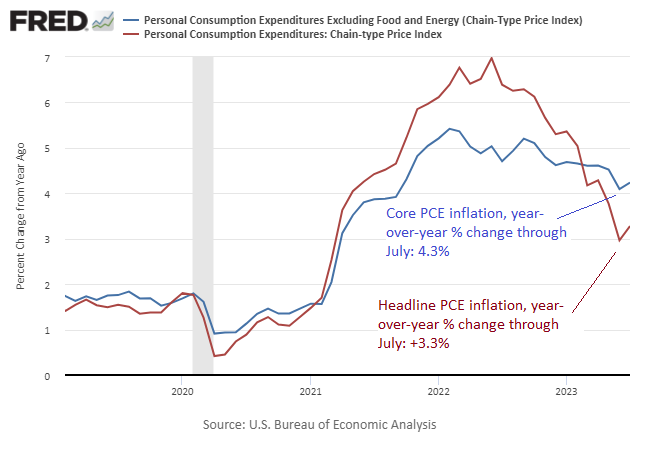

* US PCE inflation edges up for 1-year change through July:

Research Review | 31 August 2023 | Financial Crises

Predicting Financial Crises: The Role of Asset Prices

Tristan Hennig (International Monetary Fund), et al.

August 2023

We explore the early warning properties of a composite indicator which summarizes signals from a range of asset price growth and asset price volatility indicators to capture mispricing of risk in asset markets. Using a quarterly panel of 108 advanced and emerging economies over 1995-2017, we show that the combination of rapid asset price growth and low asset price volatility is a good predictor of future financial crises. Elevated levels of our indicator significantly increase the probability of entering a crisis within the next three years relative to normal times when the indicator is not elevated. The indicator outperforms credit-based early warning metrics, a result robust to prediction horizons, methodological choices, and income groups. Our results are consistent with the idea that measures based on asset prices can offer critical information about systemic risk levels to policymakers.

Macro Briefing: 31 August 2023

* US GDP for Q2 revised down to +2.1% from +2.4%

* China manufacturing sector contracts 5th month in August via PMI survey

* One of China’s biggest property developers warns of possible default on debt

* Eurozone inflation is higher than expected in August

* US pending home sales in July post gain for second straight month

* Hiring by US companies slows sharply in August via ADP data:

Is US Economic Resilience Peaking?

Nothing lasts forever, as any student of the business cycle knows. But recognizing that the economy is dynamic, and constantly shape shifting, doesn’t make it any easier to spot trend changes in real time.