* Russia launches yet another massive missile barrage across Ukraine

* US requires negative Covid test for travelers from China

* Forecasts of a global recession may be premature

* Consumers have been key to economic growth this year. Can it last?

* European natural gas prices fall to pre-Ukraine war levels

* Investors expect that the US dollar’s strength has peaked

* ExxonMobil sues EU to block new energy windfall tax on oil companies

* US pending home sales in November fall to second-lowest level on record:

2022 Review: US Equity Risk Factors

Investing in US stocks by way of risk factors has been a humbling experience this year. Short of a miraculous rally between now and Friday’s close, this realm of financial engineering is on track to dispense black eyes all around, based on a set of proxy ETFs.

Macro Briefing: 28 December 2022

* Supreme Court rules that US can not halt the expulsion of migrants

* US holiday sales up 7.6% despite inflation, credit card data show

* Attacks on US energy infrastructure in 2022 highest since 2012

* Russia bans sale of its oil to countries imposing price cap

* Hardline positions by Ukraine and Russia suggest peace talks are far off

* Economist expects decade of slow growth for global economy

* Dallas Fed Mfg Index rebounds in December

* Growth rate for US home prices continues to decelerate in October:

2022 Review: Major Asset Classes

Dismissing asset allocation as ineffective has become popular in some circles in recent years, but the charge is demonstrably false. The evidence to the contrary is especially conspicuous in 2022, which is on track to dispense an unusually wide range of returns for the calendar year’s that nearly run out of road. The implication: opportunity has been unusually high within the realm of asset allocation.

Macro Briefing: 27 December 2022

* China takes step toward reopening by ending quarantine for foreign travelers

* Russian foreign minister announces ultimatum for Ukraine

* Ukraine’s foreign minister aims for February peace summit

* Will a faster slide in inflation prevent a recession?

* Inflation changes “safe” withdrawal rate for investment portfolios

* Semiconductor supplies swell as consumer demand for electronics wanes

* Hedge funds had a good year in 2022

* Cash holdings at pension funds drop to 15-year low

* US 10-year Treasury yield enters trading week at highest level in a month:

Merry Christmas, One And All!

Best Of Book Bits 2022: Part I

The year that’s nearly over has taken the world on one heck of a ride, quite often for the wrong reasons. The good news is that the publishing world has continued to mint great books, including several in the finance and economics category that have appeared in CapitalSpectator.com’s weekly Book Bits column. Before we bid adieu to 2022, let’s review some of the highlights on these pages. Here are ten books from the year’s archives – titles that for one reason or another caught your editor’s eye. Five today, followed by another five on December 31. Happy reading!

●

Nomad Century: How Climate Migration Will Reshape Our World

Gaia Vince

Review via Datebook

In “Nomad Century: How Climate Migration Will Reshape Our World,” science writer Gaia Vince (“Transcendence” and “Adventures in the Anthropocene”) addresses how the climate chaos of the coming century will influence where and how we live. The essence of her thesis is simple: “People will have to move to survive.”

The complexity arises in the details: Vince suggests that of the roughly 8 billion people on the planet today, around 3.5 billion will be forced to move north within the next 50 years because “hotter temperatures combined with more intense humidity” will have made their environment unlivable. Which brings us to the thorniest question in this scenario: How? The sheer complexity of such a move is staggering.

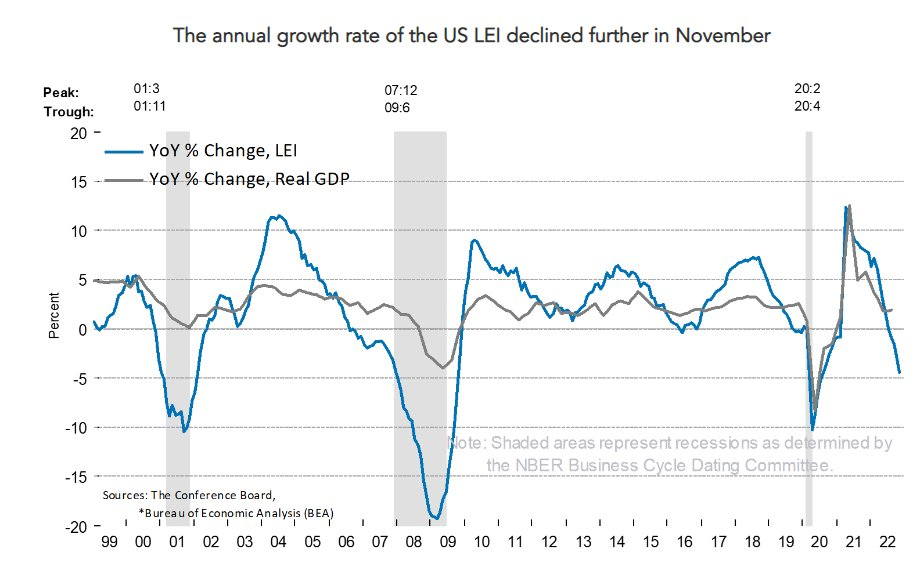

The US Economy Is Resilient, Unless It’s Not

The US economy appears resilient and vulnerable at the same time. There’s always uncertainty about the economy’s near-term path, but rarely has the data presented such a striking contrast in possibilities.

Macro Briefing: 23 December 2022

* Senate passes funding bill that keeps government open through September

* Global supply chains are normal again after Covid disruption, but…

* A new CNBC survey of logistics managers suggests problems will persist

* US economy remains surprisingly strong, even if it’s not obvious

* Mortgage rates drop for sixth straight week

* US population rises 0.4% this year, close to slowest increase on record

* US economy in Q3 grew faster than previously estimated

* Low US jobless claims still highlight tight labor market conditions

* US Leading Economic Index continues to signal elevated recession risk:

Modest GDP Growth Expected In Q4 As Recession Risk Lurks

Economic output appears on track to post a second quarterly increase, based on the median nowcast for a set of estimates compiled by CapitalSpectator.com. At the same time, recession risk is elevated, according to several estimates of business-cycle activity. The conflicting signals suggest the potential for relatively sharp upside or downside surprises in economic updates in the weeks ahead.