The pickings remain slim for yield-seeking investors when sifting through the global markets. But cheer up: relative to inflation, the current payouts look reasonable and arguably attractive.

Macro Briefing: 23 December 2020

* Trump raises doubts about Covid relief bill by asking for changes

* US hospitals struggling with rise of Covid-19 patients

* New Covid-19 strain in UK may have spread to Europe and US

* WHO chief scientist: herd immunity unlikely until late-2021

* EU-China investment deal hits snag after tweet by Biden aide

* Israel gov’t collapses, triggering new election–fourth in two years

* Record gain for US GDP in Q3 revised up slightly

* US existing home sales fell for first time in 5 months in November

* Cryptocurrency XRP tumbles 25% after SEC lawsuit against XRP-linked Ripple

* Manufacturing growth in mid-Atlantic states strengthened in December

* US Consumer Confidence Index drops to four-month low in December

Deep-Value ETF Report: 22 December 2020

Widespread rallies across the major asset classes in recent history have left few opportunities for bargains in the waning days of 2020. The main exception: energy and certain slices of the commodities markets. Otherwise, the catch from deep-value fishing is light, based on 140-plus exchange-traded funds covering stocks, bonds, property shares and commodities on a global basis.

Continue reading

Macro Briefing: 22 December 2020

* Congress passes $892 billion Covid-19 relief package

* US Treasury Sec: stimulus checks will start arriving as early as next week

* Despite virus warnings, US passenger totals rise above 1 million at airports

* Google, Facebook agreed to cooperate on possible antitrust action via lawsuit

* UK Q3 GDP growth revised up to 16.0%

* US economic growth slowed in November via Chicago Fed Nat’l Activity Index

US Stocks Led Global Rally In Asset Classes Last Week

Shares of American companies rebounded last week, forging into record territory before edging back by the close of the trading week on Friday, Dec. 18. When then dust cleared, US stocks led most of the world’s major asset classes, which posted solid gains, based on a set of exchange traded funds. The outlier: a fractional loss for US investment-grade bonds.

Continue reading

Macro Briefing: 21 December 2020

* Congressional leaders reach deal $900 billion Covid-19 aid package

* House and Senate will vote today on Covid-19 relief bill

* UK isolated in Europe after reporting highly infectious new strain of the virus

* Cyberattack on the US government is much worse than initially fearred

* 2020 has been a year of whipsawed economic forecasts

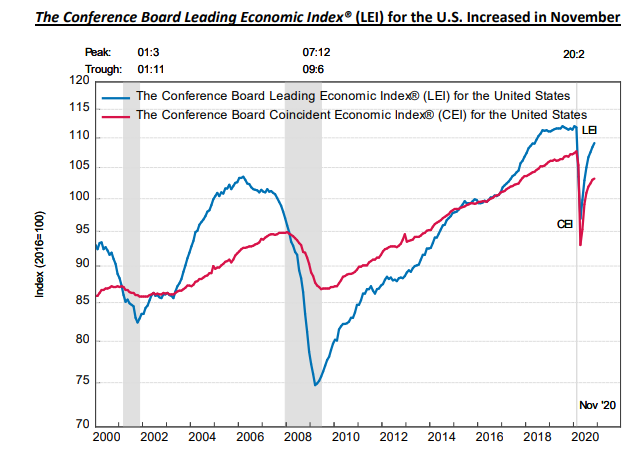

* US Leading Economic Index continued rebounding in November:

Book Bits: 19 December 2020

● Money Mammoth: Unlocking the secrets of financial psychology to break from the herd and avoid extinction

● Money Mammoth: Unlocking the secrets of financial psychology to break from the herd and avoid extinction

Brad Klontz, et al.

Summary via publisher (Wiley)

When it comes to our relationship with money, we are in the Stone Age. Despite the relentless barrage of information and warnings from financial experts, the average American is in terrible financial shape. It turns out that human beings are just not wired to do the right things around money—such as saving and not overspending.

The ETF Portfolio Strategist: 18 Dec 2020

Latin America’s Winning Streak Continues: Stocks in Latin America extended their bull run for a seventh straight week through today’s close (Dec. 18). The iShares Latin America 40 (ILF) added 2.5% in this week’s session. Although the fund pulled back on Friday, the selling still leaves ILF close to a 10-month high.

China Leads World’s Major Equity Regions So Far In 2020

China’s stock market is posting the strongest gain among the world’s main equity regions in 2020 as the year’s final trading sessions come into view, based on a set of publicly traded proxies through yesterday’s close (Dec. 17).

Macro Briefing: 18 December 2020

* Second coronavirus vaccine moves closer to approval in US

* Congress still haggling over coronavirus stimulus as gov’t shutdown nears

* Google facing three major antitrust lawsuits

* US set to add dozens of Chinese firms to a trade blacklist

* Deflation deepens in Japan as consumer prices fall at fastest rate in a decade

* Philly Fed Mfg Index continues to reflect solid growth in December

* US housing starts rose in November–third monthly gain

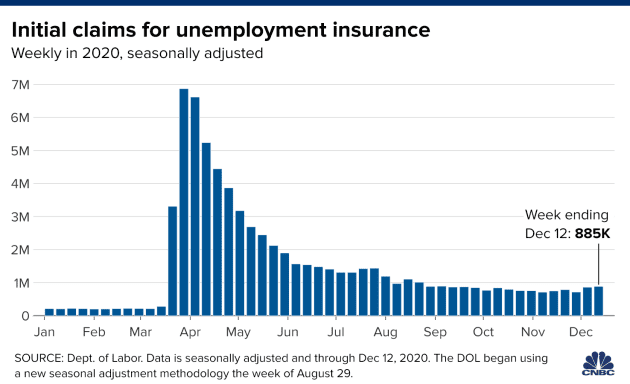

* US jobless claims continue to rise, reaching highest level in over 3 months: