House impeaches Trump: Reuters

Pelosi may delay sending impeachment articles to Senate: Politico

Impeachment doesn’t worry investors: MW

Is North Korea preparing to test a long-range missile? CNBC

India detains thousands for defying ban on protests over citizenship act: BBC

Sweden’s Riksbank is first central bank to exit negative rates: RTE

Economists expect US expansion to continue in 2020 via new survey: WSJ

UK retail sales fell in Nov, 4th monthly decline–weakest run since 1996: BBG

10yr/2yr Treasury yld curve spread (via daily data) rises to 29bps, a 6mo high:

US Business Cycle Risk Report | 18 December 2019

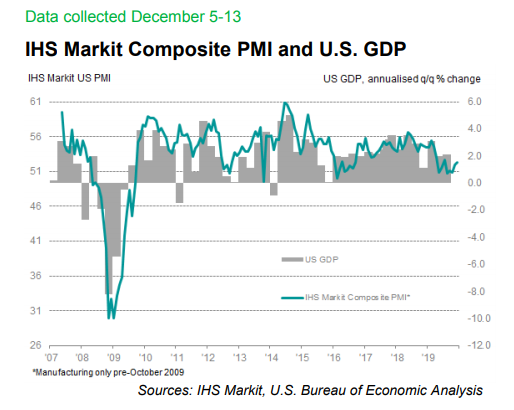

The US economy continues to reflect signs of stabilizing after a months-long period of downshifting. The possibility of a firmer expansion can’t be ruled out, but there are few convincing signs at this point. What is clear: recession risk remains low, as it has been all along (unless you cherry picked an indicator or two). As outlined below, reviewing a broad-minded data set still shows that output is increasing at a moderate pace and near-term projections for the US macro trend point to more of the same.

Continue reading

Macro Briefing | 18 December 2019

House set to vote on impeachment articles against Trump today: The Hill

Pondering Trump’s policy priorities if he’s re-elected: CNBC

German business sentiment improves in December: Ifo

Atlanta Fed’s Q4 GDP growth nowcast revised up to +2.3%: AF

US job openings rebounded in October after reaching 18-month low: Reuters

Industrial output in US rebounded sharply in November: MW

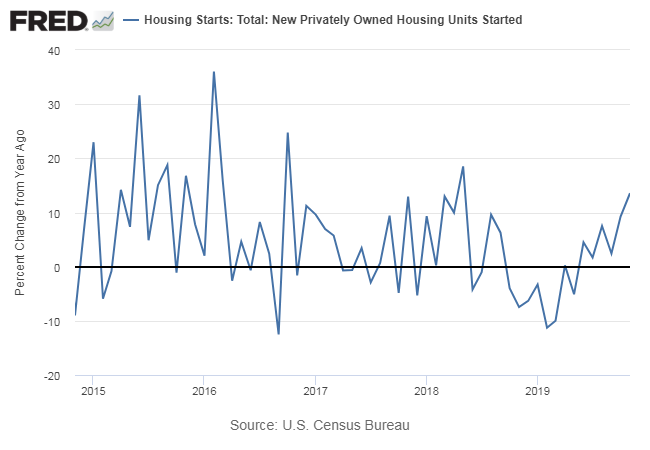

US housing starts’ 1-year gain accelerated to 1-1/2 year high in Nov: CNBC

Is The Treasury Market Transitioning For Reflation In 2020?

Amid signs that 2019’s slowdown in the US economy may be stabilizing, the US Treasury market appears to be flirting with firmer inflation expectations. It’s too early to know if the latest dance with reflation is noise or a preliminary signal, but the recent U-turns in the market’s implied inflation estimates deserve close monitoring in the weeks ahead.

Macro Briefing | 17 December 2019

Boeing will halt 737 Max production in January: CNBC

China and Russia seek to ease UN sanctions on N. Korea: Reuters

US budget proposal rises to $1.4 trillion: The Hill

Will slow job growth in Midwest threaten Trump’s re-election? NY Times

Is the US stock market poised for a ‘melt-up’ rally? MW

US homebuilder confidence jumps to 20-year high in December: CNBC

NY Fed Mfg Index continues to reflect soft growth in December: MW

US economy shows signs of strengthening in December: IHS Markit

Emerging Markets Stocks Continued To Rebound Last Week

The recent bounce in emerging markets shares accelerated last week, delivering the strongest gain for the major asset classes over the five trading days through Dec. 13, based on a set of US-listed exchange-traded funds.

Macro Briefing | 16 December 2019

Key details remain unclear on US-China trade deal: CNBC

Violent protests spread across India over new citizenship law: CNN

Why did economists misread the past decade? WSJ

Eurozone economy continues to stagnate in December: IHS Markit

No sign of recovery for Germany’s factory recession: Bloomberg

UK economy contracted again in December, PMI survey data shows: IHS Markit

US business inventories rose in Oct, boosting outlook for Q4 growth: Reuters

Oil lifted US import-price inflation in November: MW

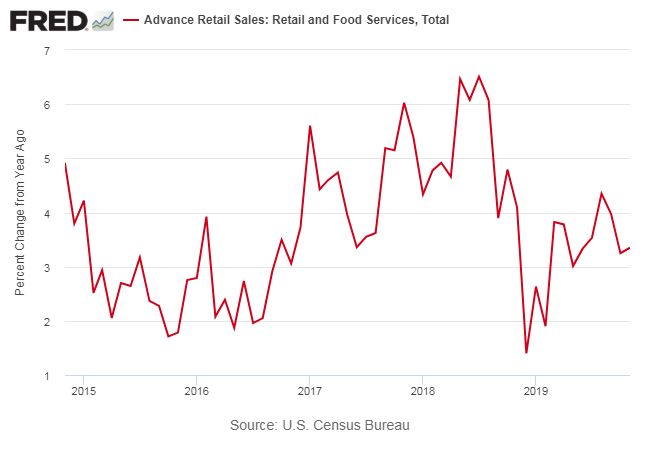

US retail spending growth slowed in Nov but 1-year trend ticked up:

Book Bits | 14 December 2019

● Advances in Active Portfolio Management: New Developments in Quantitative Investing

By Richard C. Grinold and Ronald N. Kahn

Summary via publisher (McGraw-Hill Education)

From the leading authorities in their field—the newest, most effective tools for avoiding common pitfalls while maximizing profits through active portfolio management. Whether you’re a portfolio managers, financial adviser, or student of investing, this follow-up to the authors’ classic work on the subject delivers everything you need to master the concepts and practices of active portfolio management. Advances in Active Portfolio Management brings you up to date on the issues, trends, and challenges in the world of active management and shows how advances in the authors’ approach can solve current problems.

Continue reading

Lessons Learned From The Recent Recession Scare

Earlier this year a number of economic analysts were convinced that a US recession was imminent. So far, however, the economy has continued to expand, albeit at a slowing pace as the year unfolded. The breathless warnings have, once again, come to naught — par for the course in recent years. The culprit, as usual: misguided business-cycle analytics.

Macro Briefing | 13 December 2019

Trump OKs partial trade deal with China: WSJ

China’s foreign ministry backs trade deal… sort of: SCMP

Vote on impeachment articles abruptly postponed: The Hill

UK’s Johnson wins big majority, lifting odds for Brexit: BBC

Will the Fed starting cutting rates again in 2020? CNN

Today’s US retail sales report for Nov expected to show slightly firmer 1-year trend

Soft US wholesale inflation in Nov points to weak pricing pressure: CNBC

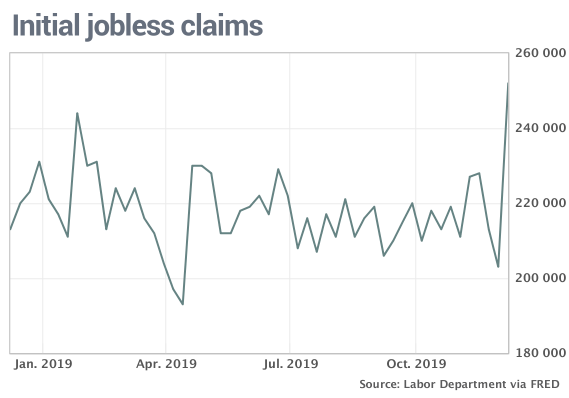

US jobless claims spiked last week to a 2-year high: MW