The case for categorizing commodities as one asset class has always been a shaky affair based on convenience rather than logic. The economic factors driving prices of specific types of raw materials varies widely and so a more nuanced view from an asset allocation perspective is compelling. Recent market trends tell the story.

Macro Briefing: 27 September 2024

US initial jobless claims fell again last week, dropping to the lowest level since mid-May. The current level of new filings for unemployment benefits remains near a multi-decade low and suggests that the labor market’s outlook remains healthy for the near term.

Markets Lean Into Another ½-Point Rate Cut By The Fed

Markets are highly confident that the Federal Reserve will announce another cut in interest rates at the next policy meeting on Nov. 7, two days after the election. The uncertainty is whether the cut will be 25 or 50 basis points.

Macro Briefing: 26 September 2024

Congress passed a funding bill Wednesday to avert a government shutdown next week. If signed by President Biden, which is expected, the bill will fund the government through Dec. 20, setting up another spending fight just before the holidays.

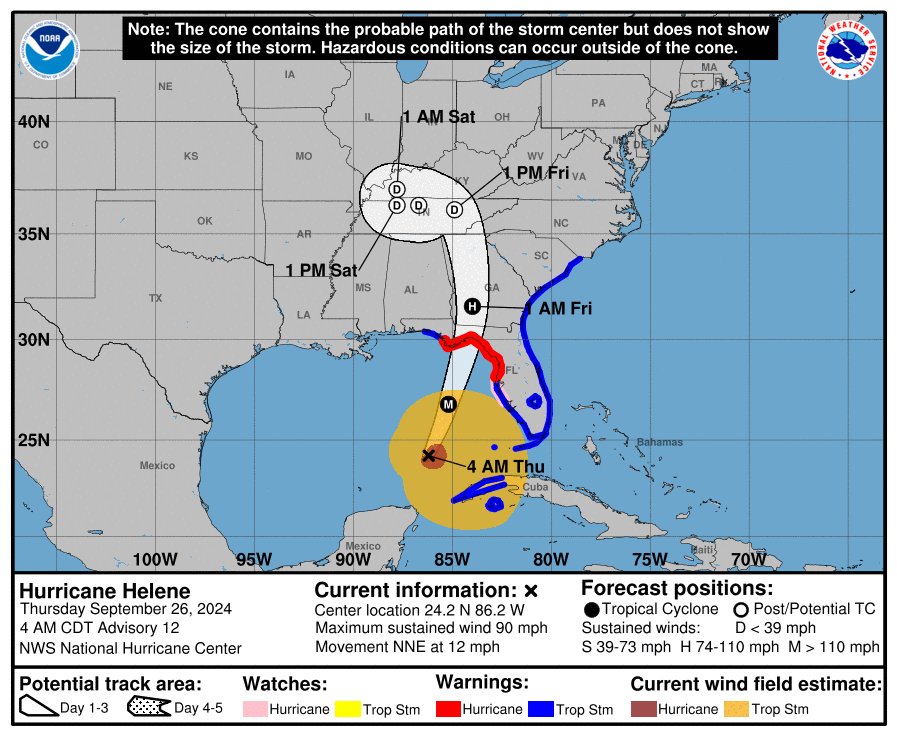

Florida’s upper west coast braces for Hurricane Helene for a Thursday evening or early Friday morning landfall. The National Weather Service warns: “A catastrophic and deadly storm surge is likely along portions of the Florida Big Bend coast, where inundation could reach as high as 20 feet above ground level, along with destructive waves.

Continue reading

US Still On Track To Avoid Recession In Q3

The odds continue to look favorable that the US will dodge an NBER-defined recession through the end of the third quarter. Q4 still looks more challenging, but that’s guesswork at this point. By contrast, the case for expecting an positive trend to endure in Q3 reflects a rising set of published economic data to date.

Macro Briefing: 25 September 2024

US housing prices rose to another all-time high in July, based on the S&P CoreLogic Case-Shiller Index, which rose 5% year over year. The July increase marks the 14th consecutive month of a record high for the National Index component. “Overall, the indices continue to grow at a rate that exceeds long-run averages after accounting for inflation,” says Brian Luke, an analyst at S&P Dow Jones Indices.

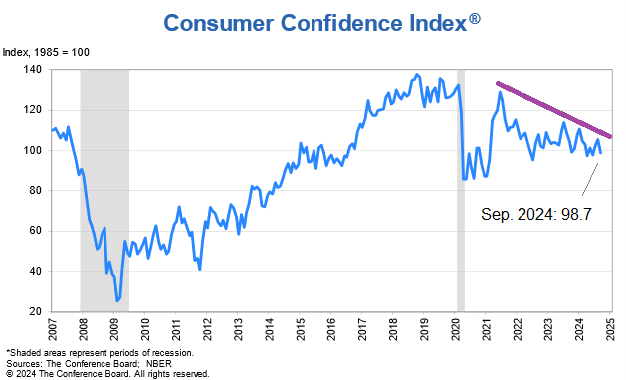

US Consumer Confidence Index fell to a 3-month low in September. The decline highlights an ongoing slide in the index over the past two years. “September’s decline was the largest since August 2021 and all five components of the Index deteriorated,” notes Dana Peterson, chief economist at The Conference Board. “Consumers’ assessments of current business conditions turned negative while views of the current labor market situation softened further.”

Broad-Based Gains For Global Equities Persist In 2024

You might think that war in the Middle East, heightened geopolitical risk elsewhere, and the potential for turmoil in the upcoming US election would spell trouble for world stock markets. But a review of year-to-date results through Monday’s close (Sep. 23), based on a set of ETFs, suggests otherwise.

Macro Briefing: 24 September 2024

US business activity remains “robust” in September, according to the Composite PMI, a GDP proxy. The services sector is the main driver, posting a “solid pace” of growth, reports S&P Global Market Intelligence. By contrast, the manufacturing sector’s output fell for a second month. “The early survey indicators for September point to an economy that continues to grow at a solid pace, albeit with a weakened manufacturing sector and intensifying political uncertainty acting as substantial headwinds,” writes Chris Williamson, chief business economist at S&P Global.

Continue reading

Gold Is Enjoying A Banner Year Despite Softer Inflation

Everyone’s favorite precious metal is red hot this year, rising nearly 27% through Friday’s close (Sep. 23). Gold’s rally beats the strong runup in US stocks as well as rallies in the major asset classes, based on a set of ETFs.

Macro Briefing: 23 September 2024

The House will vote on a new three-month stopgap funding bill to avoid a partial US government shutdown that would start Oct. 1 without Congressional action. Even if the bill is enacted, the short time frame set up another high-stakes battle just ahead of the holidays.

The latest escalation in the conflict between Israel and Lebanon’s Hezbollah raises the risk of an all-out war over the Lebanese-Israeli border. “With the region on the brink of an imminent catastrophe, it cannot be overstated enough: there is NO military solution that will make either side safer,” United Nations’ special coordinator for Lebanon, Jeanine Hennis-Plasschaert wrote on X yesterday.

Gold prices rose to a new record high on Friday, closing at $2646 an ounce: