Last week’s no-hike Fed decision raises questions about the outlook for the US economy, but another delay in tightening monetary policy revived demand for interest-rate sensitive assets. US real estate investment trusts (REITs) gained more than 3% for the week through Sep. 18, based on the total return for the Vanguard REIT ETF (VNQ). That’s the best weekly performance by far for the week just passed among our standard set of proxies for monitoring an the major asset classes.

Continue reading

Initial Guidance | 21 September 2015

Book Bits | 19 September 2015

● Charlie Munger: The Complete Investor

By Tren Griffin

Q&A with author via The Wall Street Journal

WSJ: Mr. Munger has unique views on investing, particularly about the choice between index investing and what he calls “focus investing.” Do you agree with his approach?

MR. GRIFFIN: Munger says the best option for what he calls the “know-nothing investor” with a long-term time horizon is a diversified portfolio of low-cost index funds or ETFs. He also points out that despite the fact that more than 90% of investors are “know-nothing investors,” way more than 10% will conclude “I’m in the 10%.”

Continue reading

Negative US Interest Rates: A Primer (Just In Case)

The crowd is buzzing over the possibility that the Federal Reserve may be considering negative interest rates. Where did that notion come from? Well, from the horse’s mouth. As noted earlier, an unnamed FOMC member recommended—for the first time in Fed history in terms of a formal, public document—that the central bank’s policy rate be set slightly below zero for this year and in 2016, as per two dots in yesterday’s dot plot (see chart below). It’s an idea that seems to be catching on… again. The Bank of England’s Andy Haldane just outlined the case for going negative in the UK.

Continue reading

Will The Fed’s No-Hike Decision Trigger More QE In Europe?

Yesterday’s verdict by the Federal Reserve to leave its policy rate unchanged at the zero-to-0.25% target–a policy that’s been in place for six years–has inspired speculation that the European Central Bank (ECB) will be forced to up its game with monetary stimulus. The crowd certainly appears to be making bets in that direction–Bloomberg reports that European bond prices surged today in reaction to yesterday’s announcement in Washington. Why? Laurence Mutkin, global head of Group-of-10 rates strategy at BNP Paribas, advises that the Fed’s dovish decision has ramifications for the ECB. “We think during the fourth quarter [the ECB’s] going to announce an extension of QE,” he explains.

Continue reading

US Business Cycle Risk Report | 18 September 2015

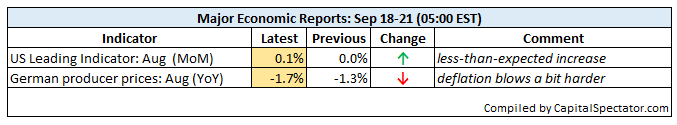

Economic reports in recent weeks suggest that the growth trend for the US has decelerated, but the softer numbers in the aggregate still fall short of reflecting substantially higher recession risk. The outlook is moderately darker from the vantage of financial and commodities markets, but for the moment there’s no clear sign that a downturn is imminent via the economic numbers overall.

Continue reading

Zero Is (Still) The New Normal For Fed Policy

The Fed punted on raising rates yesterday, but that didn’t stop it from raising its estimate of GDP growth for 2015… slightly. The median projection for this year has been tweaked up to +2.1% from +1.9% in the June outlook. The modest increase in projected growth looks a bit odd in the context of leaving the target rate for Fed funds unchanged at zero-to-0.25%. But all becomes clear when we review the Fed’s assumptions for 2016.

Continue reading

Initial Guidance | 18 September 2015

Upbeat US Data Ahead Of Today’s Fed Decision

Today’s updates on US economic activity—housing starts and jobless claims–offer a fresh round of encouragement for expecting moderate growth in the near term. The numbers are a net positive for monetary hawks who argue that the Federal Reserve should announce a rate hike today. The counterpoint is that economic growth has been sluggish lately, raising concerns that it’s still too early to start tightening policy. Nonetheless, the data du jour provide some support for the view that the US economy is still on a path of moderate growth.

Continue reading

Rationalizing The Case For A Rate Hike With Models

The Federal Reserve may or may not raise interest rates today—the mystery will be solved when today’s policy announcement hits the streets at 2:00 pm eastern. Meanwhile, what’s the case for squeezing liquidity, if only slightly? US economic growth, after all, has been sluggish lately, which inspires Goldman Sachs CEO Lloyd Blankfein (among others) to recommend that the central bank delay the first hike in over a decade. The economic data “is not compelling to raise interest rates right now,” he says. An open-and-shut case? Not quite, which explains the recent obsession with analyzing/forecasting the Fed’s decision that’s finally upon us. So, how might the monetary mavens rationalize raising rates today? By focusing on the specific data points that support a hike. Although Blankfein suggests otherwise, there are some indicators that suggest that tighter policy is appropriate. To be precise, certain models are a hawk’s best friend for arguing that it’s time to pull the trigger.

Continue reading