● Burn Book: A Tech Love Story

● Burn Book: A Tech Love Story

Kara Swisher

Review via AP

Technology is so pervasive and invasive that it’s polarizing people, producing feelings of love and loathing for its devices, online services and the would-be visionaries behind them, according to a longtime Silicon Valley reporter.

Kara Swisher unwraps how we got to this point in her incendiary memoir… Swisher skewers many of the once-idealistic tech moguls who, when she met them as entrepreneurs decades ago, promised to change the world for the better but often chose a path of destructive disruption instead. And along the way, they amassed staggering fortunes that have disconnected them from reality.

Major Asset Classes | February 2024 | Performance Review

Stock markets around the world led returns for the major asset classes in February, topped by US shares, based on a set of ETFs. Bonds, by contrast, declined, in the US and abroad while commodities extended a year-to-date rally and US real estate investment trusts rebounded after falling sharply in January.

Macro Briefing: 1 March 2024

* Immigration is a key reason for US economic recovery from the pandemic

* China’s factory activity contracts for fifth straight month in February

* India is ‘easily’ the fastest growing economy in the world: IMF executive

* US jobless claims rose last week but remain historically low

* US pending home sales in January fall the most since August

* US inflation picked up as real consumer spending slowed in January:

Risk-On Momentum Prevails As February Winds Down

The premise of the momentum factor draws on an empirical fact: price trends persist… until they don’t. The latter point is the tricky part and so it’s never quite clear when the party will end and a trend reverses. But based on the numbers through yesterday’s close (Feb. 28), it’s fair to stay that the crowd’s appetite for risk endured for another month in February, extending 2024’s upbeat kick-off in January via a set of ETF pairs that serve as risk proxies. Trends have a shelf life, but it’s not yet obvious that the expiration date is today.

Macro Briefing: 29 February 2024

* Congressional leaders reach tentative deal to avoid government shutdown

* Biden administration will investigate Chinese cars as security threat

* Rate cuts will likely start this year, says Boston Fed Bank President Collins

* Dept. of Justice launches antitrust probe into UnitedHealth Group

* Why is bitcoin surging again?

* US economic growth revised down slightly to still-solid 3.2% rise in Q4:

US Recession Risk Stays Low With Moderate Q1 Growth Nowcast

Recent US recession forecasts look set to fail again for the first-quarter economic profile, based on the current lineup of Q1 GDP nowcasts. Output remains on track to slow in the first three months of 2024, but not enough to revive the warnings from some analysts that a new downturn is near as a highly plausible scenario.

Macro Briefing: 28 February 2024

* China’s EVs are going global–and Detroit isn’t ready to compete

* Bitcoin tops $59,000, near a record high

* US home prices increased to record high in December

* US Consumer Confidence Index slips in February–first decline in 3 months

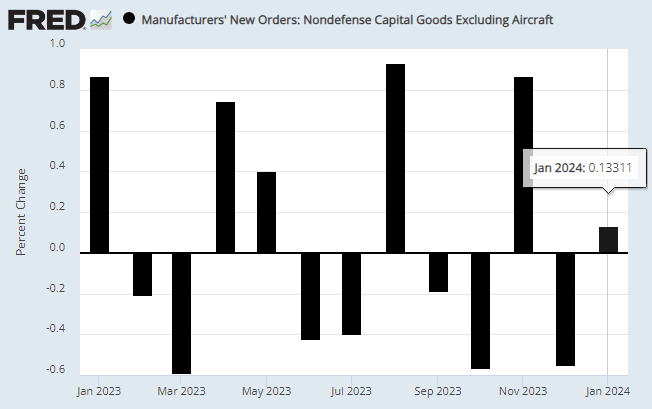

* US durable goods orders fell more than expected in January, but…

* Subset of new orders (a proxy for business investment) rebounded:

Communications, Health Sectors Lead Rally In US Stocks In 2024

The strong year-to-date gain in the US stock market is broad based, led by shares in communications services and health care, based on a set of sector ETFs through Monday’s close (Feb. 26). But the party has yet to spill over into utilities and real estate, which remain downside outliers this year.

Macro Briefing: 27 February 2024

* US government remains headed for partial shutdown on March 1, but…

* April 30 may be more consequential for government shutdown risk

* Fed wants more “certainty” on inflation before rate cuts: Moody’s Analytics’ Zandi

* Hedge funds turn cautious on outlook for tech stocks

* Texas factory activity stabilizes in February

* New US home sales edged higher for a second month in January:

Looking Ahead To US Economic Data For February

The Federal Reserve remains data dependent, as the central bank’s chairman Jerome Powell likes to say, and perhaps that’s especially true now as policy makers weigh the prospects for when (or if) to start cutting interest rates this year.