* Biden close to passing laws that will bring major shift in social policy

* New round of Russia-linked computer-hacking operations identified

* Big tech earnings reports in focus this week

* Treasury Sec. Yellen expects high inflation through mid-2022

* Short-term gov’t bond yields, sensitive to rate expectations, are rising

* Federal Reserve prepares to wind down bond-buying program in November

* Sudan’s prime minister arrested amid reports of a coup

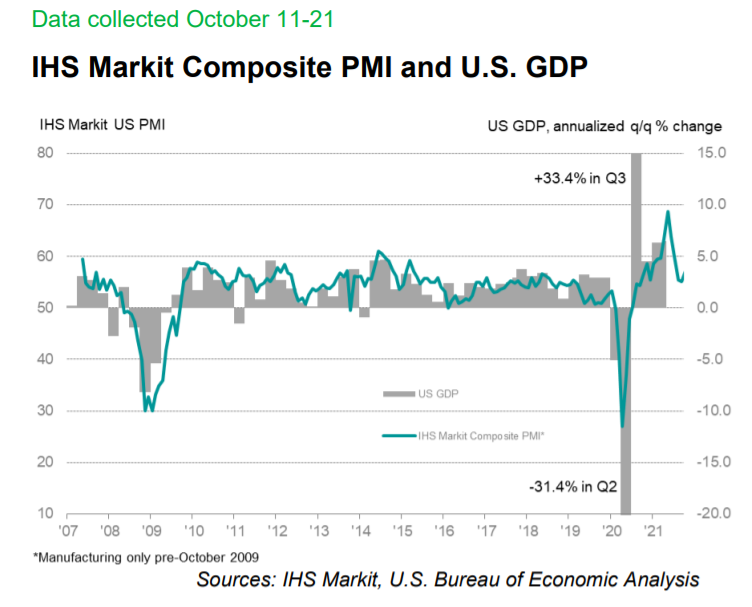

* US economic growth strengthened in October, according to PMI survey data:

Monthly Archives: October 2021

Book Bits: 23 October 2021

Jonathan E. Hillman

Summary via publisher (Harper Business)

From the ocean floor to outer space, China’s Digital Silk Road aims to wire the world and rewrite the global order. Taking readers on a journey inside China’s surveillance state, rural America, and Africa’s megacities, Jonathan Hillman reveals what China’s expanding digital footprint looks like on the ground and explores the economic and strategic consequences of a future in which all routers lead to Beijing. If China becomes the world’s chief network operator, it could reap a commercial and strategic windfall, including many advantages currently enjoyed by the United States.

Comparing This Year’s Inflation Surge With History

The sharp rise in US inflation in 2021 may or may not be transitory, but history reminds that the numbers to date aren’t unusual.

Macro Briefing: 22 October 2021

* US government agency warns that climate change poses risk to financial system

* China Evergrande makes debt payment, avoids default, according to state media

* Eurozone growth slows to 6-month low in Oct as prices accelerate

* US inflation expected to linger via 10-year Treasury breakeven rate

* Fed Chairman Powell’s reappointment remains uncertain

* Global bond market may be headed for worst year since 2005

* US Leading Economic Index continued rising in September

* US existing home sales surged in September, reaching 8-month high

* Philly Fed Mfg Index: sector continues to grow at strong pace in October

* US jobless continued falling last week, dipping to new pandemic low:

Will Slowing Economic Growth Delay Fed’s Tapering?

Federal Reserve officials have recently been talking up the case for starting the process of tapering the central bank’s asset purchases. This baby step towards a more hawkish policy stance could begin as early as next month.

Macro Briefing: 21 October 2021

* Senate Democrats consider abandoning planned tax-rate hikes

* European Union set to rebuke Poland for challenging primacy of EU laws

* UK’s energy crisis could force 20 power suppliers into bankruptcy

* China Evergrande’s shares plunge after asset-purchase deal falls apart

* Fed’s Beige Book: slower growth amid higher inflation in early autumn

* Bitcoin futures ETF reaches $1 billion in assets after record-breaking debut

* Inflation worries are driving investment flows into bitcoin, says JP Morgan

* Six reasons why Americans are reluctant to return to work

* US stock market (S&P 500) closed just below a record high on Wednesday:

The ETF Portfolio Strategist: 20 Oct 2021

Does your bond allocation need more diversification? The question comes to mind in a year when many of the usual suspects in fixed income are nursing losses.

US Q3 Growth Nowcast Falls Ahead Of Next Week’s GDP Report

The recent slowdown in the outlook for third-quarter growth deepened recently, based on a set of nowcasts. The Oct. 28 release from the Bureau of Economic Analysis is still on track to post a moderate gain, but today’s update for the nowcast reflects a steep downgrade from the previous estimate.

Macro Briefing: 20 October 2021

* Fed Chair Powell’s inflation metrics raise doubts about transitory forecast

* US 10-year Treasury yield rises to 1.67% on Tuesday — highest since May

* Has China become uninvestable? Milken conference guests debate the question

* UN report expected to forecast that fossil fuel producers set to ramp up output

* Can carbon-sucking fans help the world reach net-zero emissions?

* Multiple factors driving labor shortage that’s slowing US recovery

* German producer prices increase at fastest annual pace in more than 46 years

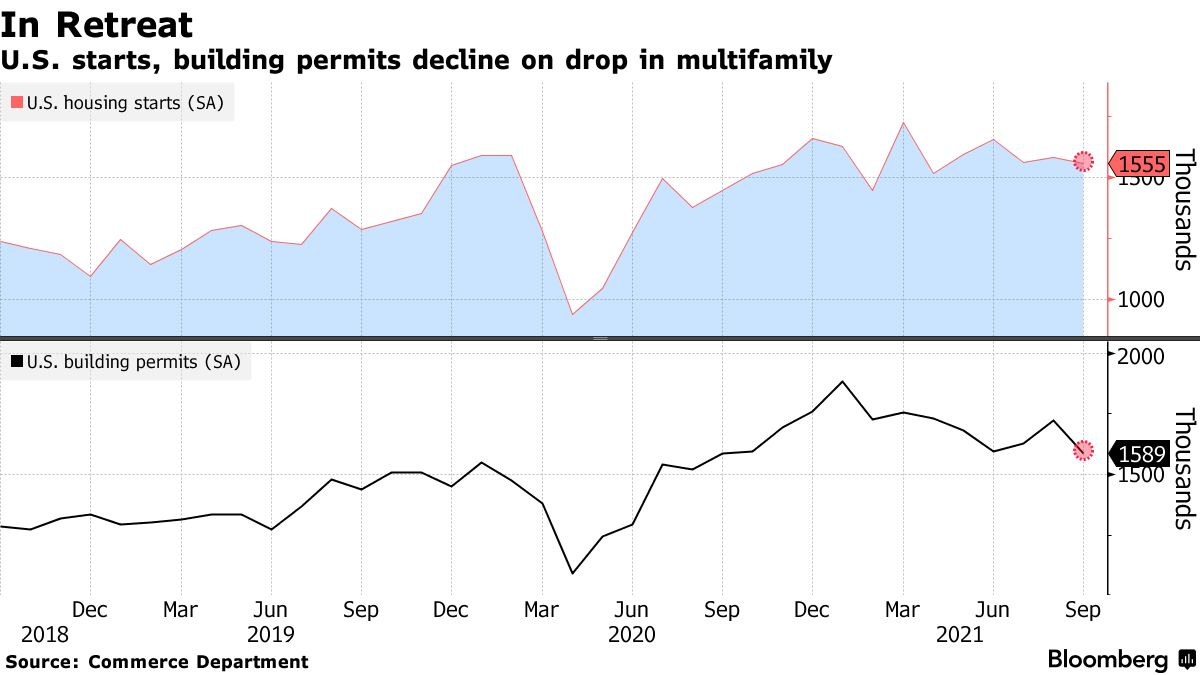

* US housing starts fell in September vs. expectations for moderate rise:

Is Weak US Industrial Output Flashing A Warning Sign?

Industrial production in US was surprisingly weak in September, falling a hefty 1.3% vs. the previous month – far below Econoday.com’s consensus point forecast for a moderate 0.2% rise. That’s worrisome, but monthly data is noisy and so it’s premature to read too much into one monthly update.