Market Risk Premium Expectation: Combining Option Theory with Traditional Predictors

Hong Liu (Washington University in St. Louis), et al.

December 2022

In general, the slackness between the Martin lower bound (solely based on option prices) and the market risk premium depends on economic state variables. Empirically, we find that combining information from option prices and economic state variables yields forecasts of the market risk premium with greater out-of-sample performance compared to forecasts using option prices alone or economic state variables alone. Additionally, these combination-based forecasts can significantly increase investors’ utility by improving their portfolios’ Sharpe ratios. Our findings suggest the importance of combining information from option prices and economic state variables.

Macro Briefing: 8 March 2024

* Fed’s Powell says central bank “not far” from cutting rates, but…

* Powell also says “there will be bank failures” due to commercial property losses

* US consumer borrowing rose more than expected in January

* US trade deficit widens in January to largest gap in nine months

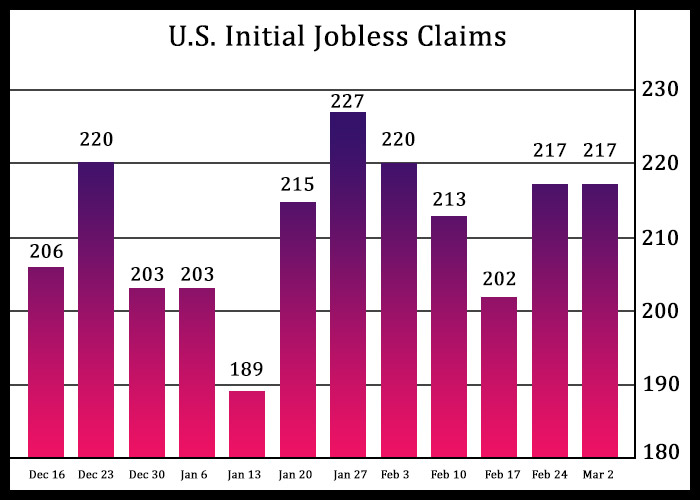

* US jobless claims were unchanged last week, holding at a low level:

US Growth Expected To Slow In Next Month’s Q1 GDP Report

Economic activity remains on a path to slow in the next month’s release of first-quarter GDP data, according to the median nowcast via a set of estimates compiled by CapitalSpectator.com.

Macro Briefing: 7 March 2024

* House approves first step to avert partial government shutdown

* Fed’s Powell says he expects rate cuts this year in House testimony, but…

* Powell also says he needs “see a little bit more data” before moving on rates

* China’s exports and imports beat estimates, suggest improving demand

* China could flood US electric-vehicle market with its cars, says Energy Secretary

* US companies hired more workers in February vs. January, ADP estimates

* US economy accelerated slightly in early 2024: Fed Beige Book

* US job openings are steady at elevated level in January:

Will Powell’s House Testimony Today Shift Rate-Cut Expectations?

Fed Chair Jerome Powell is scheduled to testify in the House today (Wed., Mar. 6) and markets will be all ears on topics that offer guidance on the outlook for interest-rate cuts.

Macro Briefing: 6 March 2024

* Red Sea cables cut, affecting data traffic flow between Asia and Europe

* Biden and Trump secure respective parties’ nominations after Tue’s vote

* Global economic growth picks up to eight-month high in February: PMI survey

* Strong US economy fuels bets that Fed will delay interest rate cuts

* US factory orders decline more than expected in January

* US ISM Services Index dips in February but still signals modest growth:

Bubble Watch: S&P 500 Edition | 05 March 2024

You can almost set your watch to it. When the stock market enjoys a strong bull run, the bubble warnings come out of the woodwork. That’s not to disparage a healthy discussion about overbought and oversold conditions. Markets go to extremes, of course, and so keeping an eye on the outlier events can be productive because current conditions provide context for estimating expected return. But obsessing over bubble talk can also lead to temporary insanity. Finding the sweet spot is the trick.

Macro Briefing: 5 March 2024

* Rebound in economic sentiment isn’t translating into stronger support for Biden

* China services sector continues to expand at moderate rate in February

* China stocks rally to 3-month highs as Beijing targets 5% GDP growth

* Inflows into Bitcoin ETFs surge, helping drive price near a record high

* Gold rises to record high above $2,100/oz on Monday:

Total Return Forecasts: Major Asset Classes | 4 March 2024

The long-term return estimate for the Global Market Index (GMI) edged up in February, rising from January’s estimate — the first increase in three months. Today’s revised forecast (based on three models defined below) points to a 6.8% annualized return for the unmanaged benchmark, which holds all the major asset classes (except cash) based on market weights via a set of ETF proxies.

Macro Briefing: 4 March 2024

* New concerns for regional banks after NY Community Bancorp rating cut to junk

* Rising tide of new laws reshape how Big Tech operates around the world

* Japan’s stock market rally persists: Nikkei 225 index tops 40,000 for first time

* Several OPEC+ countries extend voluntary oil-supply cuts

* US economic strength inspires some to argue no rates cuts are likely in 2024

* ISM manufacturing index in February shows sector contraction continues: